One question we often get asked is why should I invest in the NZ 20 Fund instead of the NZ 50 Fund?

Whether you’re bench marking active fund managers, or looking to invest in an index fund, selecting the right index is critical. While the S&P/NZX 50 index has long been considered the benchmark for NZ equities, the data supports the S&P/NZX 20 index as the true S&P 500 equivalent of NZ.

Here’s why…

When investing in an index fund, the choice of index itself is more important than the fees the fund charges. Ultimately, it’s the index design and structure that will determine what sort of performance you can expect.

It’s important that investors understand what the index invests in, how it invests and how you can use it in your portfolio. That’s where Kernel comes in – our philosophy is to bring you international best practice, research and innovation so that you have access to better investment solutions.

Here’s what we found

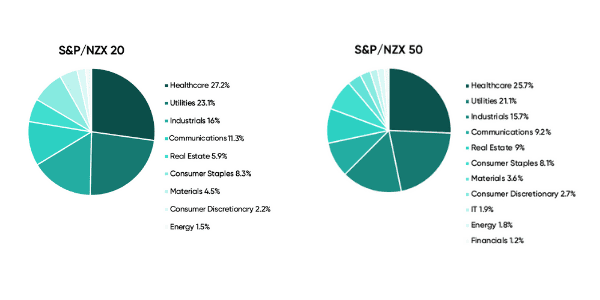

One of the most important factors of the S&P/NZX 20 index is that the sector composition (think the split between power companies, transport, ports and healthcare) closely reflects the composition of the S&P/NZX 50 index. This has meant over time, the correlation (how closely they move in sync) of these two indices has been high.

The sector composition of the S&P/NZX 20 compared to the S&P/NZX 50 as at 31 Dec 2020

However, one of the critical differences is the number of companies in the S&P/NZX 20 index… 20. The number of companies in proportion to the size of the NZ market meant that underperforming sectors and companies were dropped quickly. On the flip side, they were also added quickly when performance improved. The index still maintained diversification and broad sector alignment with the wider market.

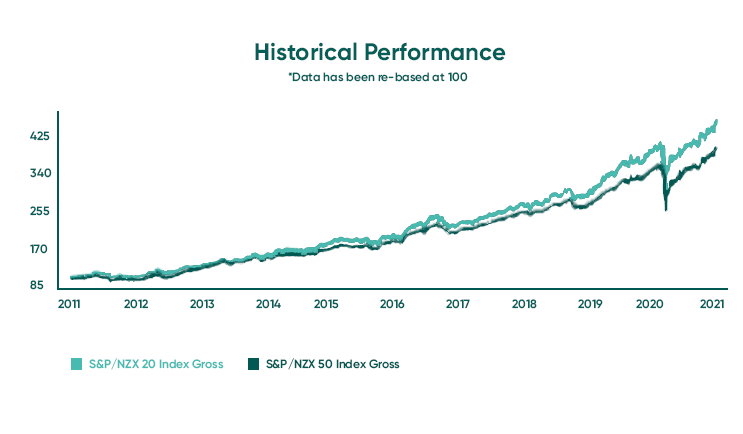

This has resulted in the S&P/NZX 20 index outperforming the S&P/NZX 50 over 1, 3, 5 and 10 year periods by well… A LOT! Over the past 11 years it outperformed by 1.58% per annum!

What does that mean for you as an investor?

If you had access to our NZ 20 Fund 11 years ago (so in 2010) and invested $10,000, you would have been $1,575 better off than investing in an S&P/NZX 50 Fund. This is a 15.75% better return!

And before you accuse us of cherry-picking “good dates”, let’s look at some of the supporting data. All data below as at 31 Dec 2020.

Key stats of the S&P/NZX 20 index vs S&P/NZX 50 index

11-year outperformance by the S&P/NZX 20 Index of 1.58% p.a.

Higher annualised risk-adjusted returns of 1.63% vs 1.49%.

The value of the 20 companies in the S&P/NZX 20 index is 80% of the entire freely available NZ share market. That’s right, these top 20 companies combined are over 80% of the total value of New Zealand listed companies that you could invest in!

When we look at calendar years, the S&P/NZX 20 performs with greater consistency, outperforming the S&P/NZX 50 index in 8 out of 11 years.

Over the last 11 calendar years, the average outperformance of the S&P/NZX 20 index has been 2.55% p.a. Whereas the average underperformance in those three calendar years was 1.28% p.a.

Why long term matters

As an investor, you should not make decisions based on short term results. Instead, focus on the long-term data to support your decision making. If you took a short-term view and changed your investment strategy after one of those three years that underperformed, how would you have done? Well by switching to the NZ 50 Fund, you would have missed out on the following annualised out-performance:

1 year 2.63%

3 years 2.74%

5 years 1.78%

10 years 1.58%

The world’s view of NZ

In addition to the research we undertook, it is important to note a key dynamic of the New Zealand market. Many of the top 20 companies are well covered by foreign analysts and meet investment criteria for offshore wholesale investors.

Therefore, the Top 20 attract more foreign investment and the S&P/NZX 20 index is a stronger view of New Zealand’s attractiveness in the world, without the additional cost and effect of holding the other 30 companies. This splits the NZ market into two clear segments. First, the larger entities who attract more foreign investment. Second, those outside of the 20 who are reliant on domestic investment and fluctuate with the domestic business cycle. That’s why we also launched the Small & Mid Cap Opportunities Fund, to give direct access to this second segment.

Source: S&P Dow Jones Indices

How can you use the NZ 20 fund?

The NZ 20 fund can be used in a variety of investment plans. We think it is a great core building block for investors wanting to invest in blue-chip New Zealand companies.