The 101 of Investing in Thematic Funds

Are you the sort of person who dreams about investing in the next big thing? Welcome to investing in...

Stephen Upton

January 26, 2021

In today’s world, technology is changing faster than ever. The speed of technology adoption is also far faster than it was in the 20th century, significantly altering the way consumers, industries, and businesses operate.

As an example, 20 years ago, we had no idea what social media was and how it could become an influential and integrated part of nearly every aspect of our daily lives. So, what is the next big thing that we might have to enjoy in the upcoming decade? Would that be green tech, genetic prediction, nano-robotics, or space exploration?

If you are an investor with a high-risk appetite and a keen interest in these disruptive technologies, you might have already heard about our two thematic funds – the Kernel S&P Kensho Electric Vehicle Innovation Fund, and the Kernel S&P Kensho Moonshots Innovation Fund.

Like typical thematic funds, these two thematic investment opportunities offer an exposure to a particular theme. These are often related to emerging trends that are shaping the Fourth Industrial Revolution, such as robotics, smart city technologies, biotechnology, and autonomous vehicles.

In particular, S&P Kensho Moonshots Innovation tracks the performance of 50 of the most innovative US-listed companies at the forefront of the disruptive technologies spanning across smart transportation, clean power and human revolution. At the same time, S&P Kensho Electric Vehicle Innovation Index offers an exposure to US listed companies involved in the electric vehicle sector and the ecosystem supporting it.

In 2021 to 11 October, the S&P Kensho Moonshots index has returned 2.69% and the S&P Kensho Electric Vehicles index has provided a return of 6.34%. A result many would be happy with in the current low-interest environment. However, it might keep much of the story under wraps.

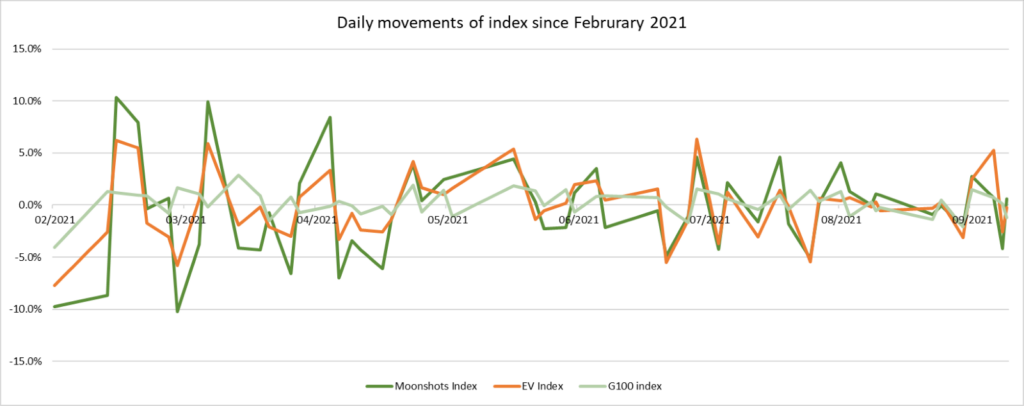

The volatility of these funds can surprise us. The below chart compares the daily movement of these two new funds since opening in February 2021 compared against the Global 100 fund.

As you can see, in the short run, daily price fluctuations of the two thematic indices are substantial and far more random than we could believe. As such, timing the market is nearly impossible. Depending on the entry points, while some investors can experience a significant gain, others might suffer a significant loss.

Thematic funds are more concentrated than broad market funds

Thematic investing is generally risky because your portfolio is restricted within a specific theme and only stocks related to that theme are considered. Put differently, thematic funds are more concentrated than broad market index funds such as the Kernel S&P Global 100 fund.

They are driven by sentiment toward that theme, which for something very future focused can swing around sharply. That’s why our Moonshots and EV funds have the maximum risk indicator of 7, indicating high past volatility with a minimum suggested timeframe to hold of 7 years. Because of their narrow exposure and high-risk profile, these two funds are best used as satellites to our core portfolio holdings and with dollar cost averaging.

Second, the diversification of Moonshots Innovation (and to some extent the Electric Vehicle Innovation Fund) smoothes the often more extreme movements of these early stage high-growth companies. Taking the 3 months to 30 September for example, two companies, LendingClub and Asana, rose 50%+ and two companies, OneConnect Financial Technology and Workhorse Group, fell 50%+.

Looking specifically at each of the Moonshots companies, the 12-month standard deviation of daily returns generally exceeds 3.0% and can be as high as 10.3%. This equates to an annual volatility of 46.6% and 159.4% since the fund inception on 17 February 2021.

By comparison, the Moonshots Innovation Fund, had an annualised volatility of 42.7% since 17 February 2021. In other words, this diversification helps reduce the volatility substantially, from very high to high.

To be included in the S&P Kensho Moonshots index, companies must have high Early-Stage Composite Innovation Scores. This is based on companies’ “allocation to innovation score” and “innovation sentiment score”. While “allocation to innovation score” is ranked based on the ratio of companies’ R&D expenses to revenue compared to peers in the same industry, “innovation sentiment score” is determined by reviewing companies’ regular filings for the previous 12 months for the use of words related to innovation. Each company therefore has the potential to deliver large multiples, but some will also fail on the way.

In comparison, the S&P Kensho Electric Vehicle index comprises of US-listed companies providing services in the electric vehicle industry as well as the companies involved in the supply chain of the industry, and like the Moonshots Innovation fund also subject to a minimum market cap of USD 100 million and a three-month average daily value-traded of USD 1 million.

Both Moonshots and EV are rebalanced twice a year, so new stocks that meet the criteria will enter the index and others that no longer meet the criteria will be out. Compared to Moonshots, EV is less risky as it includes multiple big established names in the car manufacturing industry transitioning to join the electric vehicle race. Tesla, Toyota, General Motors, Ford and Honda are just some of them. In fact, after rebalancing, while new stocks often make up to almost 50% of the Moonshots’ composition, constituents of EV are more likely to stay unchanged.

Fourth, the constituents in thematic funds are often early-stage companies both thriving for innovation and having the potential to revolutionize existing technologies and/or industries. While it’s easy to get excited about evolving technologies such as genetic engineering, smart manufacturing, autonomous vehicle or cyber security, it takes a great deal of time for young companies in these themes to reach their full potential or to be acquired by a larger company.

In summary, it takes a significant amount of time for any theme and emerging sector to reach its peak. Just as it did for Big Tech 15 years ago. If you can stomach volatility, a small allocation of your portfolio to thematic funds can be a great choice.

It’s important to remember that thematic investing is for investors seeking returns in the long term and staying the course of their investment strategy. If you are thinking about short-term money or constantly watching the valuation bounce around, then thematic funds are probably not for you.

The 101 of Investing in Thematic Funds

Are you the sort of person who dreams about investing in the next big thing? Welcome to investing in...

Stephen Upton

January 26, 2021

How Thematic Funds Fit Into Your Investment Portfolio

Thematic funds have a particular place in an investment portfolio, but often investors are unsure ho...

Stephen Upton

February 2, 2021

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

January 19, 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices