The Market has Crashed. Should I Invest Now?

The first part of a rebound is the fastest and you don’t want to be sitting on the side-line for tha...

Catherine Emerson

14 July 2022

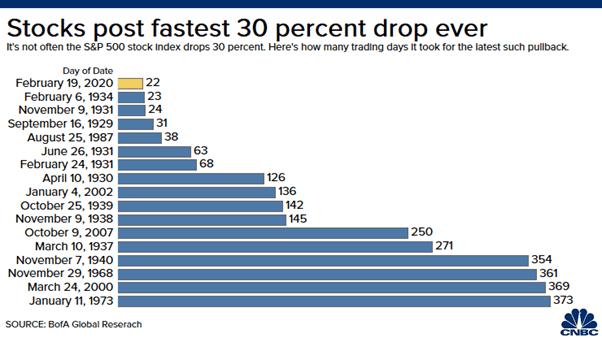

It’s February 19, 2020: within 16 trading days the S&P 500 will fall over 20%. Six trading days later it will set a new record for the fastest 30 percent drop ever, beating the declines of the Great Depression.

Prior to this, there had been 16 bear markets since 1926, averaging once every six years.

Stock market crashes happen and we will continue to see them of varying causes and scales throughout our lifetime – it’s inevitable.

They are often exacerbated by two very human emotions, fear and panic. However, the one consistent fact is that markets have always recovered. The key is to remain patient and to not fall into the frenzy and panic sell.

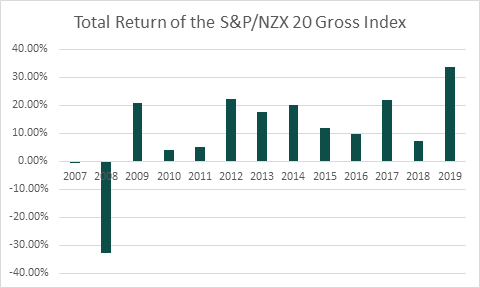

Take the S&P/NZX 20, an index of the 20 largest NZ listed companies. In 2008 the index fell 32.76%. Then in 2009, it bounced back 20.77%. And just last year it returned +33.59%.

Even if you had invested right at the start of 2008, but chose to hold your investment for 10 years, you would have had an annual return of 8.65% (before fees and taxes).

In order to get that return, you would have had to take the good years with the bad ones. That’s not to say all sectors and markets are guaranteed to bounce back. With investing there are no guarantees, but with diversification, time, and compounding, investing will deliver better returns than just stashing away your cash.

One of the best, if perhaps counter intuitive, pieces of advice for surviving a market crash is to simply…do nothing.

Panic-selling is just about the worst thing you could do in a situation like that, because you incur the cost of transacting and the first part of a rebound, as situations and companies’ adaptions becomes clearer, is the fastest.

A great Kiwi example of this is A2 Milk – initially hit very hard as Covid-19 gathered steam and some investors sold to get their cash out at any price. However, to put this in perspective, under 4% of the company’s shares on issue changed hands in the month of March, about double the normal amount, to the sole benefit of the brokers facilitating the trades. Taking a look at the past month share price movement and you can clearly see what we’re talking about with this fast dip, then re-bound.

Source: Google Finance

It also highlights the absurdity of mark-to-market valuation – where the price of the most recent sale is considered the value of every share in the company. On that basis, A2 Milk as a company fluctuated from being worth $12.5billion to $10billion, then back to $12.7billion all within a month. This fluctuation is absurd and the 96% of investors that weren’t selling could see through the panic-sales.

Another great Kiwi example is Serko – a company that specialises in corporate travel and expense software. Naturally, you can see why investors and analysts naively thought the business was doomed with the expansion of Covid-19. As their situation became clearer and they announced that their opportunity remains the same, with their balance sheet strong, there was quite the re-bound in the share price.

Over the course of March 2020, Serko’s share price plummeted from a high of $4.10 to $0.89 and back to a current $2.10 as at 3 April 2020. That’s a 78% drop followed by a 135% increase.

You don’t want to be sitting on the side-line for the rebound.

Sitting tight and not trying to get ahead of the market are your best bets. Let your circumstances and financial needs dictate your investments, not the noise of the news or the market.

The Market has Crashed. Should I Invest Now?

The first part of a rebound is the fastest and you don’t want to be sitting on the side-line for tha...

Catherine Emerson

14 July 2022

How to Perfectly Time the Stock Market

Investors tell us they worry about timing the stock market. What if they invest and a crash happens?...

Catherine Emerson

3 August 2022

Dividends & Distributions Explained: The Case for Reinvesting

Cash out or reinvest your dividends? Find out why it's important for investors to have a plan when i...

Stephen Upton

24 January 2025

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices