Since 2018, increasing demand for sustainable investing has seen ESG (Environmental, Social, Governance) funds grow 10-fold. Investors are not only interested in the financial outcome of an investment decision, but also the impact it has in shaping the world. ESG funds encompass these forms of non-financial metrics when considering an investment decision.

There are three driving ‘forces’ that play a role behind the acceleration towards sustainable investments:

1. Investor demand

Today consumers are ‘voting with their dollar’, demanding more sustainable products with a willingness to pay a premium for them. We see this with the likes of sustainable packaging, plant-based food and eco-friendly fashion (hello Allbirds). And companies are responding, altering what they sell and how it is produced and distributed. This same voting is now being seen with how we invest and grow our hard earned dollars.

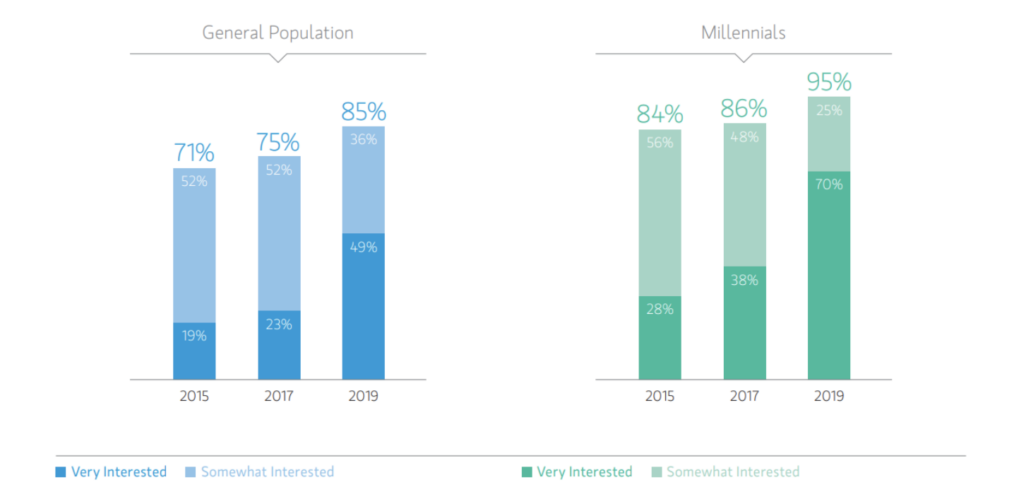

A Morgan Stanley survey found that 85% of the general population and 95% of millennials are interested in sustainable investing.

Importantly, we are now seeing an investment in sustainable funds as a way to enhance and protect long term returns. Gone are the days of an assumed sacrifice of returns in exchange for your moral conscience.

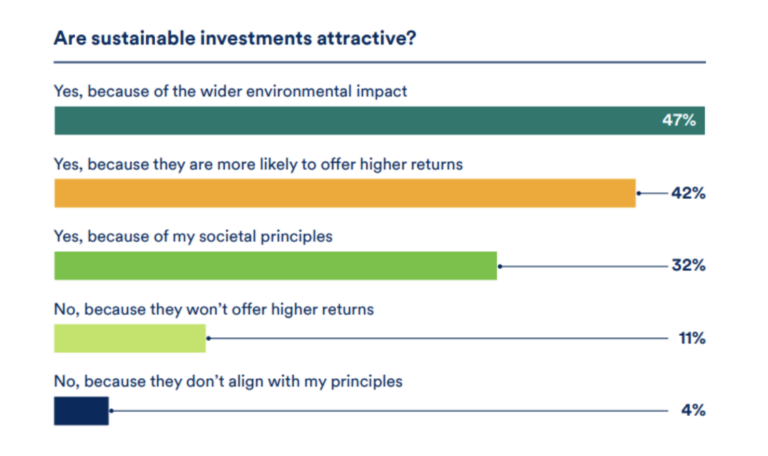

A 2020 survey by Schroders, of over 23,000 investors globally, found that environmental impact and higher returns are the main attraction to sustainable funds. While almost half surveyed selected sustainable investment for their environmental impact, another 42% made the decision as they are more likely to offer higher returns.

This is a critical tipping point.

It is easy to respond to surveys saying we will invest ethically. However, when it comes to investing your hard-earned dollar, the attraction of the product itself still needs to deliver.

Looking at the electric vehicle (EV) sector we see the importance of product design in fuelling demand. A mere decade ago, the idea of shifting to an entirely electrified vehicle fleet seemed far-fetched. However, in the last few years, every leading vehicle manufacturer has released or is releasing a pure EV vehicle line. This has also meant increased performance, lower prices and attractive design has seen EV sales reach new heights.

Did you know: In New Zealand new car sales in September ’21 showed the Tesla Model 3 outsold the iconic Toyota Hilux, accounting for 9% sales.

But what better example of changing consumer demand than looking at the Ford F-Series. Ford’s gas guzzling F-150 and its larger siblings was America’s top-selling pickup for 39 straight years. Next year the F-series goes full electric, with the release of the F-150 Lighting. Early interest, including a much-publicised test drive by President Biden, has seen Ford double its planned production by 2024.

“For both Ford and the American auto industry, F-150 Lightning represents a defining moment as we progress toward a zero-emissions, digitally connected future…Now we are revolutionizing it for a new generation.”

– Bill Ford, Ford Chairman

With investors now selecting sustainable investments due to the product itself and their potential of higher performance, we are at the tipping point where high survey responses start to result in real world action.

2. Data & Insights

As investor demand for sustainable investment options grow, the demand for ESG data providers has also grown exponentially. Data from both business and ESG research has paved a way for navigating the ESG investment landscape.

The key word is ‘scale‘. What used to be the domain of individual man hours has now transformed into data processed by machine learning and AI to create ESG benchmarks. This means investors can now readily access transparent ESG investment options through low-cost index funds, increasing the investor pool.

Each company is measured across the three ESG dimensions (for example a company’s “E” score), using up to 1000 data points to measure factors such as greenhouse gas emission, water use, and workplace diversity. A total score between 0-100 is then calculated, with 100 representing best performance. The better the score, the greater weighting in the index the company may receive (index providers like S&P DJI have index investment committees to regulate individual scenarios that need further moderation).

The first ESG index for NZ

Three years after the launch of the S&P 500 ESG index, New Zealand received its first ESG index, the S&P/NZX 50 Portfolio ESG Tilted. No longer are low cost index investment options limited to simplistic sector and industry exclusions. Now, they can use multiple data sources for a complete framework that upweights and downweights companies based on their individual ESG score. These data sources include:

Vote with your dollar and as a shareholder

Technology has also helped fund managers in enabling investors to vote at companies’ annual general meetings. This month, the world’s largest asset manager Blackrock announced that from next year, nearly half of the assets across its index funds will be enabled for investors to cast a direct vote. Gone are the days when we accept things for how they are, the power is now in the hands of the investor to address environmental and social issues.

3. Regulatory impacts

Government and regulatory support have also driven a shift towards sustainable investing. The increasing regulatory interventions are designed to accelerate our shift to a low carbon economy.

Germany announced plans to end the use of coal-powered energy by 2038;

Norway has banned the sale of fossil fuel cars by 2025; and

At home in New Zealand, the government has committed to producing 100% renewable electricity generation by 2030.

With this impending revolution, we can expect to see companies considering their social responsibility and acting before regulations are enforced.

One key sector experiencing the regulatory movement is financial services. Recently, New Zealand became the first country to introduce legislation that will require banks, insurers, investment managers, and companies listed on the NZX (New Zealand stock exchange) to make disclosures reporting the impacts of climate change, including how they would manage climate-related risks and opportunities.

From December onwards, an exclusion on fossil fuels will also be added to default KiwiSaver schemes, following a similar exclusion on investments in companies involved in illegal weapons. Whether or not government intervention in investment options are aligned with your political views, there is no ignoring the weight this has in setting the direction of sustainable investment.

So where does this lead us to?

It’s undeniable the impact that we as consumers and investors are able to have through the investment decisions we make. Our ability to shake up demand, innovate and challenge the status quo means it is no longer a question of whether sustainable investing is here to stay. The real question truly lies on the journey ahead: “What are the opportunities and challenges for further growth?”