Who are S&P Dow Jones Indices & what is an index?!

Watch this episode of Ask Kernel where we ask what S&P Dow Jones Indices do for index fund managers ...

Catherine Emerson

December 18, 2019

In the ever-evolving landscape of investment management, various tools and metrics have emerged to evaluate the performance of different investment strategies. One such tool is SPIVA, an acronym for S&P Indices Versus Active Management.

In this blog post, we’ll delve into the concept of SPIVA, explore its purpose, methodology and shed light on how it is used to evaluate the effectiveness of active management strategies.

SPIVA is a research initiative launched by S&P Dow Jones Indices, a leading provider of stock market indices. Its primary goal is to assess the performance of actively managed funds against a relevant benchmark, such as the S&P 500 index, across various asset classes and geographic regions.

SPIVA's methodology involves comparing the returns of active funds to a respective benchmark over specific time periods. The data is collected and analysed on a semi-annual or annual basis, depending on the market segment.

By examining the performance of active funds against a benchmark, SPIVA provides investors with an objective view of the success or failure of active management strategies.

The SPIVA Scorecards present a wealth of information on the performance of active funds. Some key findings and insights derived from SPIVA include:

SPIVA provides a breakdown of the percentage of actively managed funds that outperform a respective benchmark over different time horizons. This information allows investors to gauge the likelihood of selecting a fund that consistently beats the market.

SPIVA also evaluates the persistence of fund performance over multiple periods. It examines whether funds that outperformed in one period continue to do so in subsequent periods or if their success was merely due to chance.

SPIVA covers a wide range of asset classes, including equity, fixed income, real estate, and commodities. It also offers regional breakdowns, allowing investors to compare the performance of active managers across different geographic regions.

SPIVA highlights the importance of considering costs when evaluating active management. It compares the performance of actively managed funds with their benchmark indices, considering the impact of fees and expenses on overall returns.

In today's global financial landscape, the comparison between actively managed funds and their respective benchmarks has garnered widespread attention. Regardless of the region, this comparison reveals intriguing patterns.

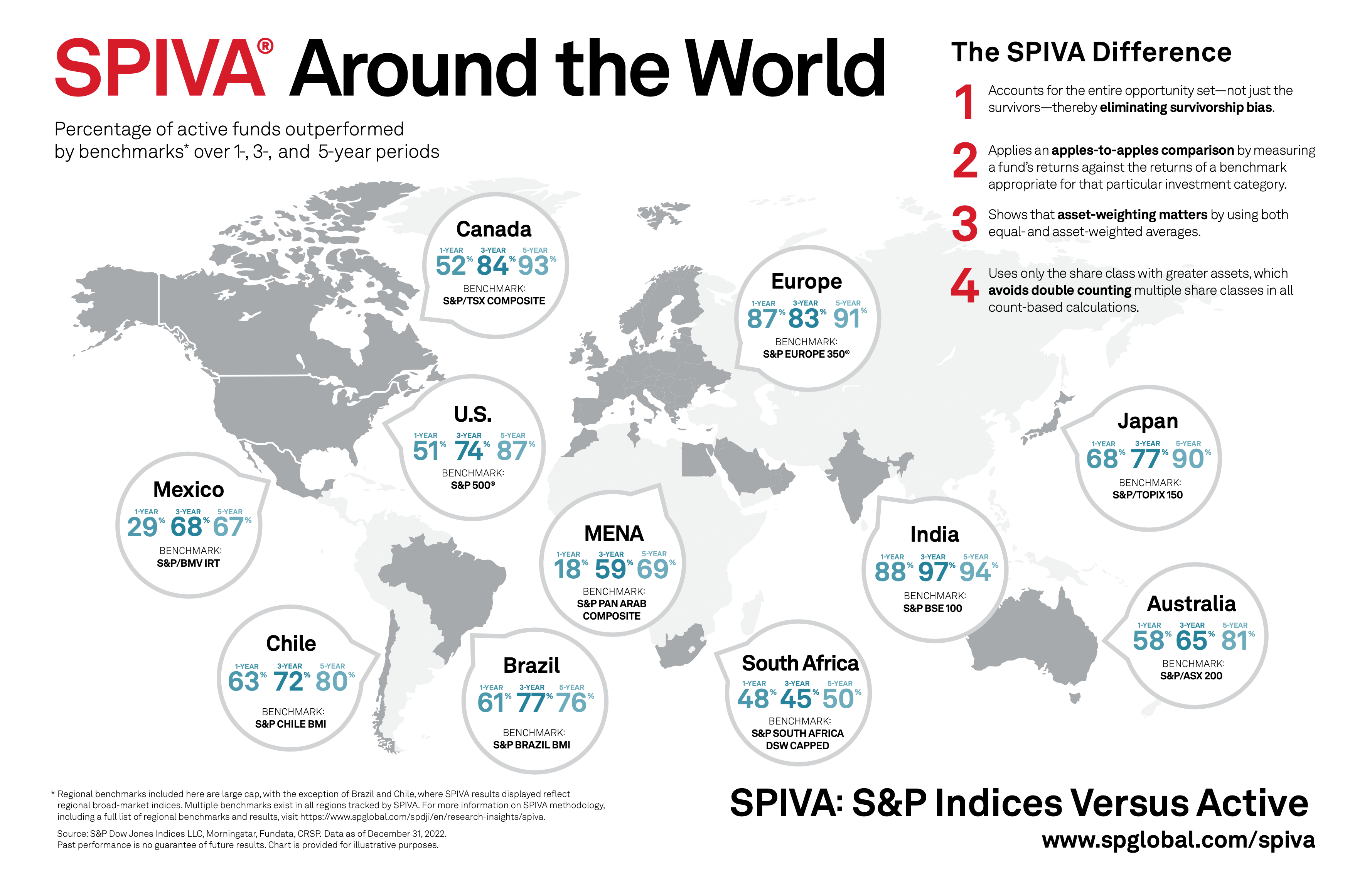

By examining the data map provided below, it becomes evident that over time a significant majority of active funds consistently underperform their benchmarks. The percentage of those that do surpasses 50% across almost all geographical locations.

Different stakeholders in the investment industry will derive varying benefits and applications from SPIVA:

SPIVA reports contribute to investor education by providing objective data on the performance of active management strategies. This information helps investors make informed decisions when selecting investment options.

SPIVA enables investors, fund managers, and financial advisors to evaluate the success of active funds relative to their benchmarks. It provides a benchmark for assessing investment strategies and can inform decisions about fund selection and portfolio construction.

Serving as a valuable resource for industry researchers and academics, the reports’ data can be used to study trends in active management, evaluate the impact of fees on fund performance, and explore other aspects of investment management.

SPIVA has become an essential tool for assessing the performance of actively managed funds in comparison to a respective benchmark. By providing comprehensive data and analysis, SPIVA helps investors and industry professionals gain insights into the effectiveness of active management strategies across different asset classes and geographic regions.

As the investment landscape continues to evolve, SPIVA remains a valuable resource for evaluating the performance of active funds and making informed investment decisions.

Who are S&P Dow Jones Indices & what is an index?!

Watch this episode of Ask Kernel where we ask what S&P Dow Jones Indices do for index fund managers ...

Catherine Emerson

December 18, 2019

Want to know who can beat the market?

Everyone wants to beat the market, be the exception, have above-average returns. But how easy and ac...

Stephen Upton

December 2, 2019

Majority of Actively Managed Funds Continue to Underperform

Time and time again the data shows that actively managed funds result in underperformance compared t...

Dean Anderson

June 23, 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices