The Market has Crashed. Should I Invest Now?

The first part of a rebound is the fastest and you don’t want to be sitting on the side-line for tha...

Catherine Emerson

14 July 2022

Kernel is based on the idea that good financial habits and long-term thinking is the most effective way to build wealth. We are also firm believers in technology and progress benefiting mankind overall, that true innovation more likely comes from disrupters and the agile, not the incumbent. We too are a technology company looking to solve problems and improve lives. That’s why the Kensho New Economies align to how we see the future.

Today, we are at the beginning of a Fourth Industrial Revolution. Developments in genetics, artificial intelligence, robotics, nanotechnology, 3D printing and biotechnology, to name just a few, are all building on and amplifying one another. This will lay the foundation for a revolution more comprehensive and all-encompassing than anything we have ever seen.

– World Economic Forum Report 2016

The challenge with new ideas is that estimating their chance of success and projecting their long term adoption and profitability is a very murky area. Normally such investments are privately owned within Venture funds and Private Equity, where a team of consultants or investment bankers at most quarterly, value what a slice is worth.

By comparison, the real-time price discovery that a stock market provides, leads to lots of “news noise”. Where even a single character tweet or clickbait headline can surge or crash a company. It is where those basic concepts of diversification and horizon come into play. A young company is always a gamble, when acceptance of higher risk needs to be compensated by a higher potential reward.

This is why having access to an underlying 50 companies using our Moonshots Fund removes the binary risk of the roulette wheel. It doesn’t, however, remove the sentiment contagion across an industry or economy.

Our Moonshots Innovation and Electric Vehicle Innovation Index funds have the maximum risk indicator of 7, with a minimum suggested timeframe to hold of 7 years.

In 2021 to 18th May, the S&P Kensho Moonshots index has returned 4.33% and the S&P Kensho Electric Vehicles index has provided a return of 2.36%. A return many would be happy with in the current environment, especially when New Zealand markets have been down for the year.

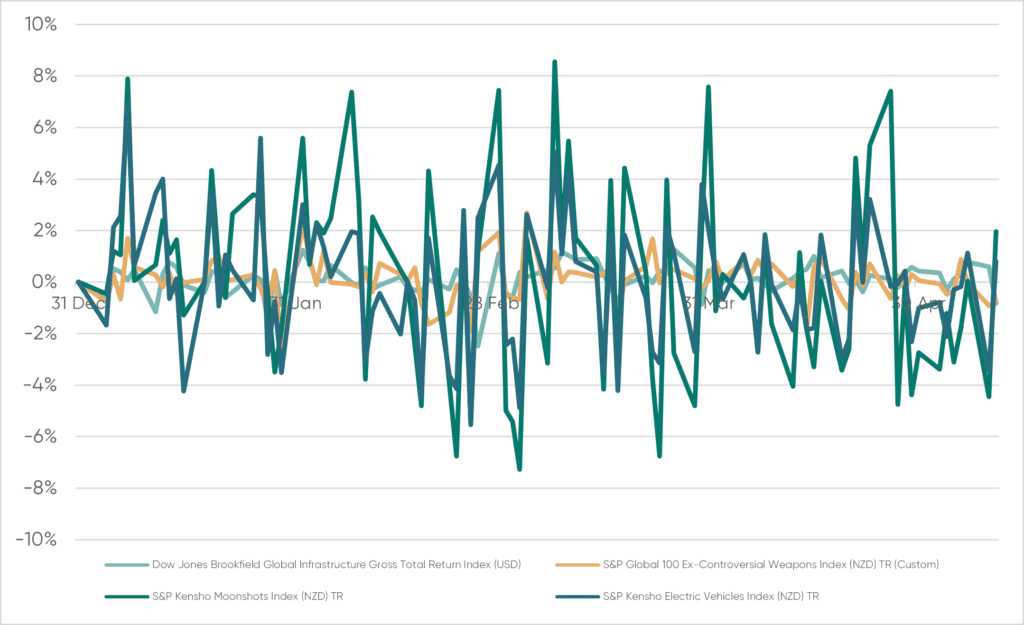

However, that hides much of the story of a wild ride that may have caused palpitations. Even we have been surprised at the volatility of these funds. The below chart compares the daily movement of the index since the beginning of 2021 for two thematic funds compared with our Global 100 and Global Infrastructure funds.

As you can see, the swings are significant and as the theory goes; unpredictable in the short term, so that timing the market is near impossible. The chances of a positive day following a negative day were 49%: so much for buying the dip.

As a result, we have investors in the funds who are up substantially and down substantially depending on their entry point(s). Those who dollar cost average through auto-invest have tended to do the best.

With any amplified risk whether it be these funds, the leveraging of property, accepting lower quality bonds or higher-risk “growth” companies, the emotional brain tends to get involved. However it is the frequent switching and chasing returns that damages your outcome, rather than staying the course of your investment strategy.

If you are saving for your future, the thematics can be a great choice for a small allocation of your portfolio. If you have paid the deposit on a house and are waiting for settlement or thinking about short term money, then they are probably not for you.

The Market has Crashed. Should I Invest Now?

The first part of a rebound is the fastest and you don’t want to be sitting on the side-line for tha...

Catherine Emerson

14 July 2022

What’s Your Investment Horizon?

When starting to invest, there's one key question you need to consider and it helps determine your i...

Catherine Emerson

29 August 2019

How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices