What’s Your Investment Horizon?

When starting to invest, there's one key question you need to consider and it helps determine your i...

Catherine Emerson

29 August 2019

What is financial independence? Ultimately it means having the freedom to make choices that aren’t dictated by money or time.

For you, financial independence might mean being able to spend more time with your family, changing careers, travelling or just feeling secure and sorted. Hey, it could even mean quitting your job and joining Cirque Du Soleil. Whatever you’re trying to achieve the secret to getting there is prioritising what’s important and taking action today.

To help you get started and achieve financial independence faster we’ve put together an easy guide to prioritising your financial goals.

Having both high-interest debt and no emergency fund can leave you financially vulnerable. Luckily you can pay off that debt and build up your emergency fund by following a few simple steps.

Your first priority should be to get rid of high-interest debt as soon as possible. We’re talking about:

This type of debt makes it harder to build wealth because it does the opposite of what good investments do; interest compounds and grows over time, but instead of earning this, you are paying it, limiting your ability to put money aside.

Start with the debt with the highest interest rate and pay down as much as you can every payday. Setting up an automatic payment might make it easier - but you should do whatever works for you.

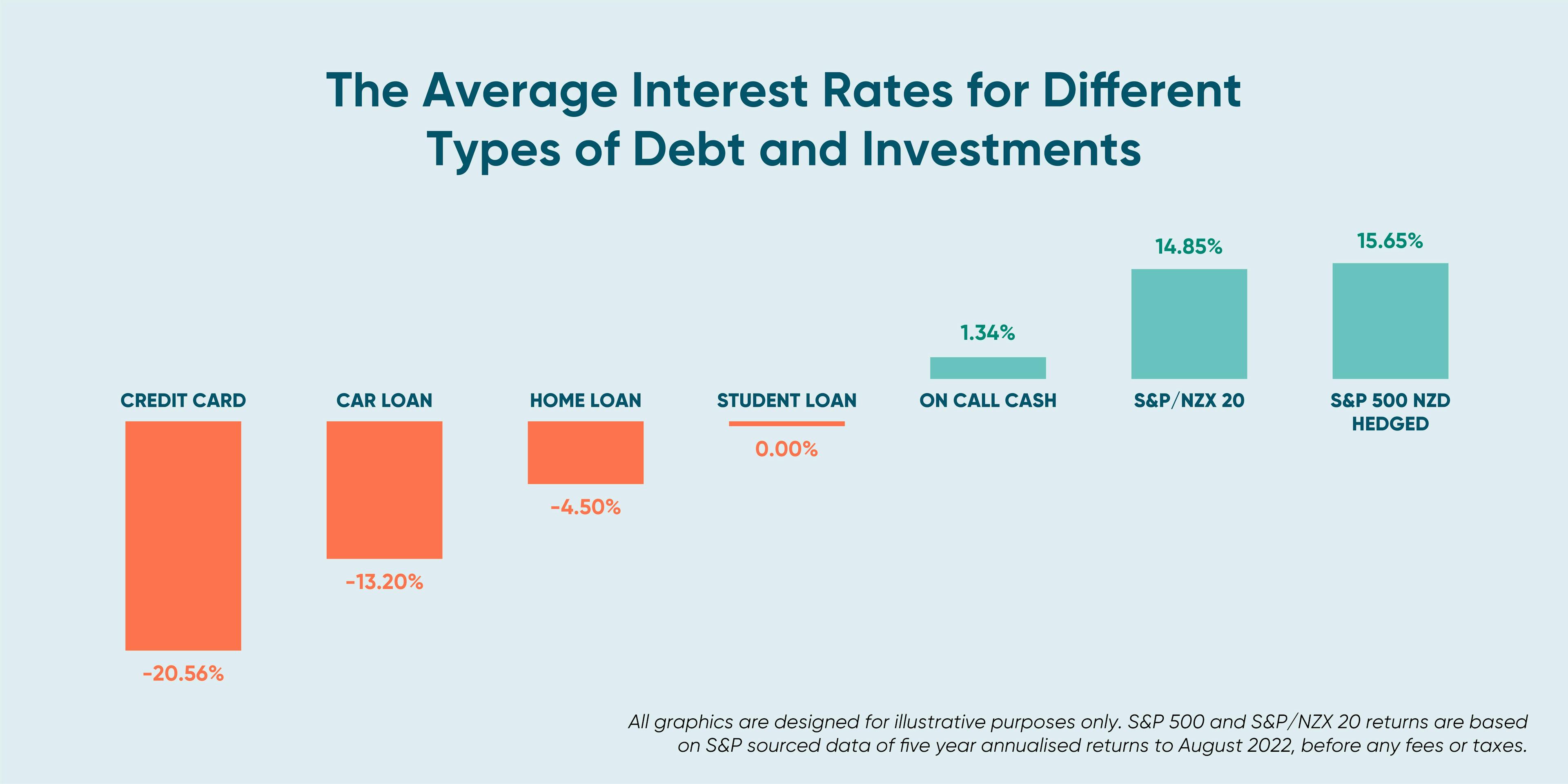

With all that said, not all debt is bad and paying off some debt doesn’t always need to be prioritised above investing. In fact, if the potential returns on your investments are much higher than the interest rates on your debt, it could be a good idea in some cases to prioritise investing. For example, based on the interest rates and historic returns below you may, over time, be better off investing in a diversified fund like the NZ 20 fund than paying off your student loan.

On the day you pay off your high-interest debt, celebrate! It’s important to enjoy your financial and life achievements (as long as those celebrations don’t send you back into debt!).

After congratulating yourself it’s time to take your next step toward financial independence and build up an emergency fund. This is a chunk of money which you can access in case you lose your job, become unwell, get into an accident or are otherwise unable to work. The idea is that you can live off your emergency fund until you’ve either found a new job or found other arrangements that work for you.

A good rule of thumb is to aim for at least three months worth of expenses including rent or mortgage, food, bills and all the other stuff needed to keep you and your family going. This will be more if you’ve got a big mortgage and a family and a bit less if you’re single and flatting.

Others suggest at least three months of loan repayments and/or rent plus bare minimum living expenses like food and transport, or a minimum of $5,000 for a single and $10,000 for a couple.

Save this amount the same way you paid down your debt, by simply transferring whatever you can into your emergency fund on payday. This account could be separate from your normal accounts so it’s not easy to spend - something like the Kernel Wealth Save account could be perfect for a portion of your emergency fund (just remember to keep some of your fund in a transaction account so that you can use it right away if need be). This nifty account helps you reach your short-term goals sooner thanks to typically higher interest rates compared to a standard transaction bank account. Plus, it’s free to use.

Being debt free and having an emergency fund is like a financial superpower. You’ll feel lighter, more secure and like you can achieve anything. While you’re enjoying that buzz, think about what you want out of life and start setting some short, medium and long-term goals.

Short-term goals might be stuff like, buying yourself something small or saving up for a short holiday, mid-term goals could include buying a car, travelling or getting married, while your long-term goals might be saving for retirement or buying a home.

Whatever your goals are, you'll need to do the same thing you did when paying off your high-interest debt and saving your emergency fund; put money aside every month on payday to go toward helping you achieve your financial goals.

The way you do this will depend on you, your circumstances, your goals and how you prefer to save and invest. For example, Christine Jensen, Marketing Manager at Kernel says she and her partner save in completely different ways:

“My partner prefers to chip away at all goals at once and divide his weekly savings up into short/medium/long-term goals, whereas I mentally need to add to one big chunk so that I feel like I am making progress -- both have pros and cons to them.”

Once you’ve got your goals set it’s time to start getting it done! Here are a few pointers to get you started.

Generally speaking, it’s best to save for short-term goals using cash. A term deposit or high-interest savings account could be a good idea. Kernel’s Save account could be perfect for your short term goals with an interest rate typically higher interest rates compared to a standard transaction bank account. Plus, there are no fees or minimums.

For your mid-term goals that you plan to achieve in the next 3-5 years, you could use a conservative fund, balanced fund or cash fund.

These funds will have less growth assets (shares) and more income assets (bonds, term deposits), smoothing the ups and downs, meaning you are more likely to have the money when you need it.

If when you need the money is set in stone, then you may still want to look at the likes of a cash or conservative fund. If you have a medium-term goal and the time you need the money is semi-flexible, then you may want to consider a balanced fund. This will fluctuate more than a cash fund, but over time should have higher returns due to having some exposure to growth assets.

Interested in exploring balanced or cash funds? Check out our Cash Plus Fund and Balanced Fund options.

For your long-term financial goals like retirement that are further in the future (7-10+ years), you could use an aggressive growth fund or other investment with potentially higher risk and higher returns. That’s because investments like these tend to go up and down a lot and over a longer term you’ll be better placed to ride this volatility out and enjoy the higher expected returns.

Kernel has many index investment options that can help you reach your goals.

KiwiSaver is another great way to grow your retirement savings or save for your first home.

You can’t withdraw your KiwiSaver at any time though, so whatever money you put in you’ll need to be comfortable not having access to it until you buy your first home or retire at 65.

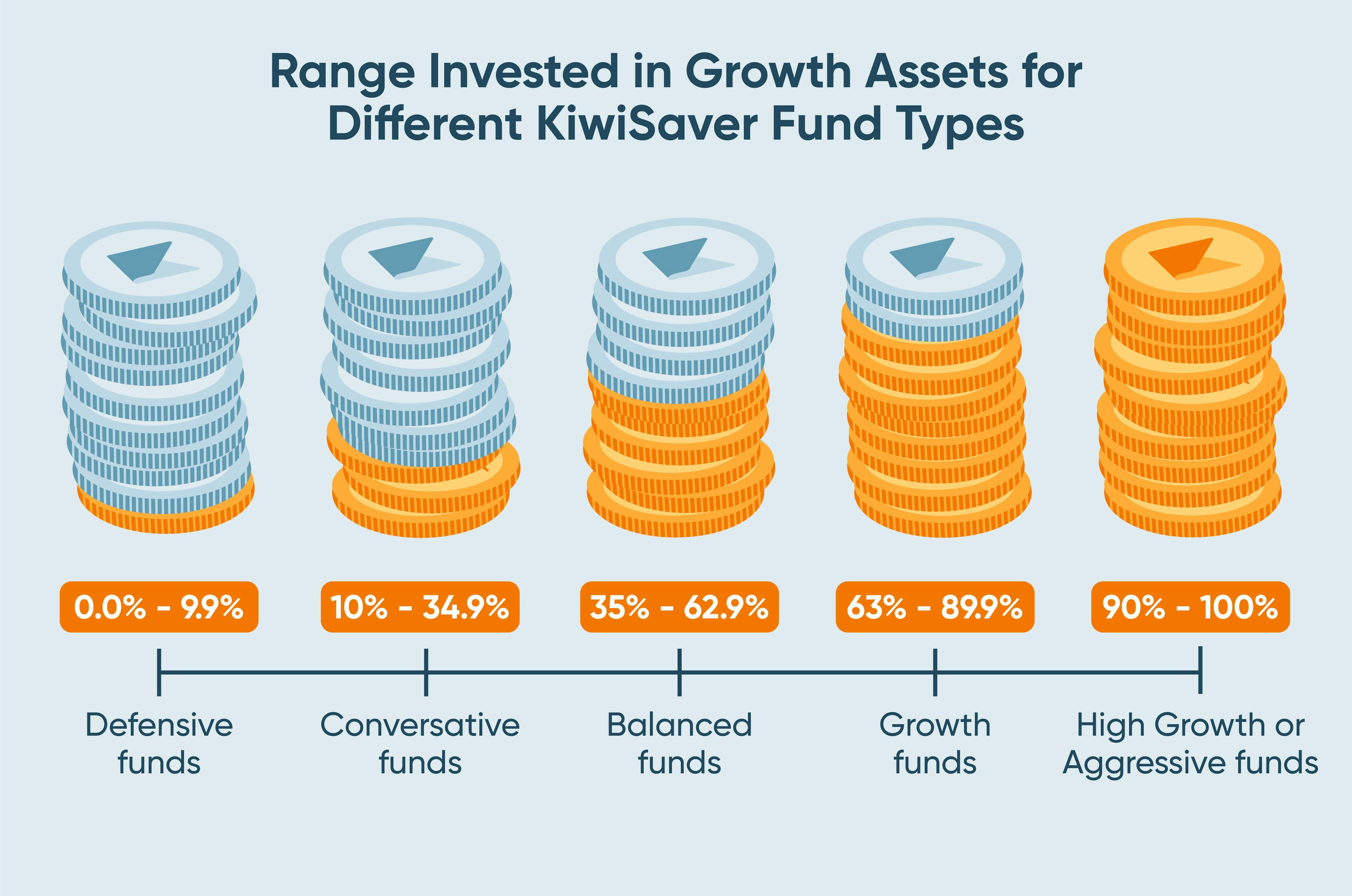

When choosing which KiwiSaver fund to be invested in, remember to make sure you’re in the right risk profile according to your timeline for buying a home or retiring. Meaning, if you’ve already used your KiwiSaver for a home and retirement is 20+ years away, keeping your money in a conservative or balanced fund may cost you significant growth over time.

Equally, many banks only offer Conservative, Balanced, and Growth funds. Most growth funds still have 20-25% in cash, term deposits and bonds. If you have time on your side, this may be a drag on your returns and you may want to look at High Growth options, where 100% is invested in growth assets.

Check out the image below which illustrates specific KiwiSaver fund types and the amount of growth assets they typically have included in them.

Whatever you do, make sure you deposit at least $1042.86 every financial year to receive the $521 government contribution, if you’re eligible.

Keen to supercharge your retirement? Check out the Kernel KiwiSaver Plan, whereby you can choose between our Cash Plus Fund, Balanced Fund, and High Growth Fund or create your own custom KiwiSaver plan with a mix of funds.

Whatever your goals are and however you plan to achieve them, there’s one important thing to remember about achieving financial independence. Saving and investing are all about taking small actions consistently over a long period of time. Try it and you’ll find that those small actions can compound to have a profound impact on your life and financial well-being.

What’s Your Investment Horizon?

When starting to invest, there's one key question you need to consider and it helps determine your i...

Catherine Emerson

29 August 2019

Haven't heard of pay yourself first? Well you should have! We explain how and why this is the best b...

Catherine Emerson

11 January 2020

How to Perfectly Time the Stock Market

Investors tell us they worry about timing the stock market. What if they invest and a crash happens?...

Catherine Emerson

15 February 2026

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices