We recently announced that we’re launching our first two thematic funds: the Kernel S&P Kensho Moonshots Innovation Fund and the Kernel S&P Kensho Electric Vehicle Innovation Fund.

It’s exciting investing in thematic funds. You get the opportunity to invest in the macroeconomic trends shaping our economic landscape today and tomorrow. But often investors are unsure how, whether or why to include thematic funds in their portfolio. In our previous blog, we touched on how thematic funds would not be a core part of a portfolio.

This blog explores this further, whilst also thinking about how thematic funds are taxed and the role they can play in your investing.

The role of thematic funds

Most financial advisers would recommend that in a traditional investment strategy, a thematic fund is not a core component of a portfolio. A thematic fund would be considered a “satellite” investment; typically making up to 10% of your invested money.

When moving away from a broad market fund, you are concentrating your wealth (or a portion of it) into that sector or theme. You’re making a decision that a specific theme will produce an above-average return, compared to the rest of the share market.

What about tax?

In short, the tax treatment is the same as for any foreign investment fund. We deep-dive into tax on foreign investments here, which explains all you need to know. The most important factor to remember is as Kiwi resident investor there is a ‘tax cost’ to investing in companies listed on international stock exchanges. This cost will vary depending on the amount you have invested and your investment structure (i.e. direct share, ETF or fund).

If you decide to DIY into offshore markets you will need to manage additional trading, foreign exchange and platform costs. Plus the complexity of tax within your tax return, or hire a tax accountant. Alternately, if investing through an unlisted PIE fund like Kernel, we will pay all the tax on your behalf. Less work for you with often better tax results!

Where does Moonshots + EV fit?

Deciding what to invest in or how to split your investment portfolio is ultimately a personal choice. It depends on your time horizon, goals and appetite for risk, among other factors. While we can’t provide recommendations, we can provide examples as to how some investors might approach investing in thematic funds in conjunction with their other Kernel funds.

Portfolio design

Some investors we know are looking to use the thematic funds as a speculative investment. Often, with the vast majority of their portfolio balance. This is because of their youth and high-risk tolerance (for market fluctuations, not permanent loss).

Others are looking to follow the more traditional approach of allocating 5-10% to each fund, to tilt their portfolio towards a belief in these themes.

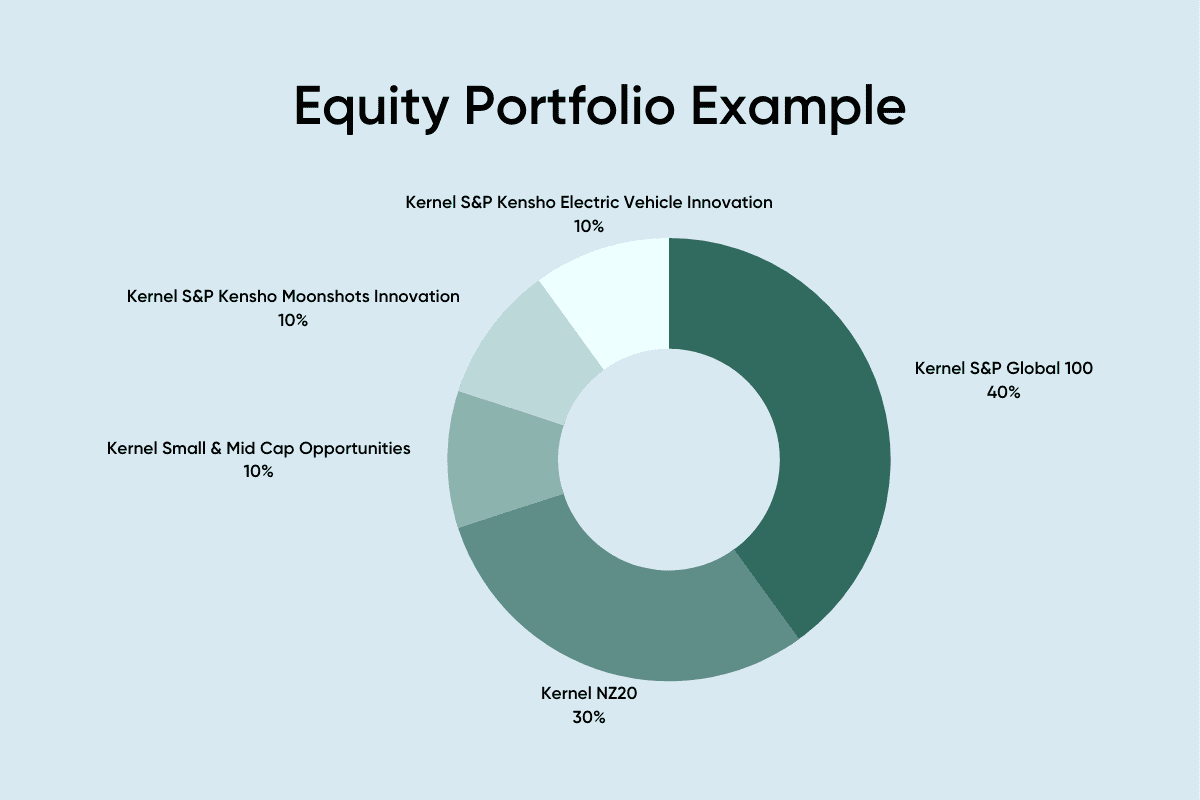

A reasonable equity portfolio for a 40-year-old with no expected short term need for withdrawal might be:

Be aware!..of unintended concentration

Something to be conscious of is unintended concentration. This is particularly relevant if you also have direct investments in individual companies. Unintended concentration is where the fund or other funds also hold a company, so you’re essentially doubling up.

For example, if you owned the S&P 500 (80%), the Kernel S&P Kensho Electric Vehicle Innovation Fund (10%) and Tesla shares directly (10%), you would have a portfolio weighting of over 12% to Tesla. That’s twice as large as your second largest holding (which would be Apple as at January 2021).

With our funds, we try to be as transparent as possible by publishing fund holdings on a monthly basis (you can see these on the individual fund pages). To ensure you don’t fall victim to unintended concentration, we would recommend reading these holdings regularly.

An extra consideration

Other factors to consider would be your domestic vs foreign allocation, and the overall sector balance of your portfolio. It’s important to note that any allocation to equities should have at least a 3 year time horizon. This needs to be even longer for the thematic funds, which should be at least 7 years. This is so short term fluctuations, corrections or world events don’t create a distortion in your wealth accumulation or prevent achievement of your goals.