Why do investors make poor decisions in down markets?

Investors make much worse decisions in down markets than increasing markets. Read about the common i...

Catherine Emerson

1 May 2020

Have you ever thought about changing things up in your investment portfolio? Wondered if you should be taking more or less risk based on your age, stage or life events? If yes, you’re not alone. Most investors like to take stock of their portfolio from time to time and make changes where needed. This is common amongst both DIY investors as well as large financial institutions and in the world of investing is known as portfolio rebalancing.

In this blog, we aim to break down what portfolio rebalancing is, what the costs and benefits of doing so are and why you would do it in the first place.

Portfolio rebalancing is a strategy used by investors to readjust their portfolio allocations due to performance and/or changes in their personal circumstances or risk tolerances. This can be done by returning them to their target weights or to alter asset allocations to a new mix of investments.

It’s important to consider rebalancing your portfolio periodically to ensure you maintain your desired level of risk and asset allocation. The primary benefit of rebalancing is to realign for your time horizon and risk profile.

For example, if the value of equity investments in a portfolio continues to increase due to favourable market conditions, the asset allocation towards equities will be larger, increasing the overall risk profile of the portfolio. Consequently, if markets fall losses will be larger and may not have time to recover before the money is needed for a goal.

Rebalancing instils discipline within investors to maintain their target asset allocations and take a long-term approach to wealth creation.

Before thinking about rebalancing your portfolio, it’s important to know and understand what portfolio monitoring is, as this is what drives whether to rebalance or not.

In essence, portfolio monitoring is being mindful of changing economic and personal circumstances that may affect your portfolio. It can be done on a periodic basis to understand the impact of any material changes influenced by these factors, say quarterly monitoring. The economic circumstances considered are where looking forward you believe interest rates or inflation will impact the attractiveness of types of investments, but care should be taken with such predicting. The risk or challenge for some is monitoring too frequently and then reacting to short term performance.

As mentioned, portfolio monitoring goes hand-in-hand with portfolio rebalancing, because without monitoring how are you going to know when to rebalance? In particular, monitoring ensures that any consequences arising from a change in personal circumstance are addressed in a timely and efficient manner.

For example, you might have a growth portfolio comprising of an 80/20 asset allocation to equities and term deposits/cash. But you’ve decided that you would like to buy your first home. You’re speaking with agents and are getting close to when the deposit is required. To suit this, you would potentially change your asset allocation to a conservative portfolio of 100% term deposits/cash. This change will mean that you can protect yourself to a certain degree against any short term market volatility.

Rebalancing a portfolio can be tricky and get complicated, fast. It comes with additional costs (more on this later) and can prove to be time consuming. Factors such as timing trades and market liquidity play an important part too.

The key here is to set target asset allocations which meet your specific risk profile but provide a certain degree of flexibility when it comes to deviations from the target weights. To overlay disciplined behaviour, investors can then choose one or both of two primary types of portfolio rebalancing methodologies – calendar rebalancing or percentage-of-portfolio rebalancing.

A calendar rebalance methodology is used to rebalance an investment portfolio at pre-set times through the year. This method is mostly followed by investors who receive external financial advice. Common calendar rebalance frequencies are annually or twice annually.

In this method, the investor would review their portfolio allocations to see how far their asset allocations have deviated from their target allocations, then they either buy or sell assets as required to bring those allocations back in line. The advantage of a calendar rebalance is that it provides discipline to investors without the need to frequently monitor their allocations between rebalance dates.

The disadvantage however, is that the portfolio could significantly drift from target allocations between rebalance dates. For investors with longer time horizons and lower liquidity requirements, calendar rebalancing could be a suitable option.

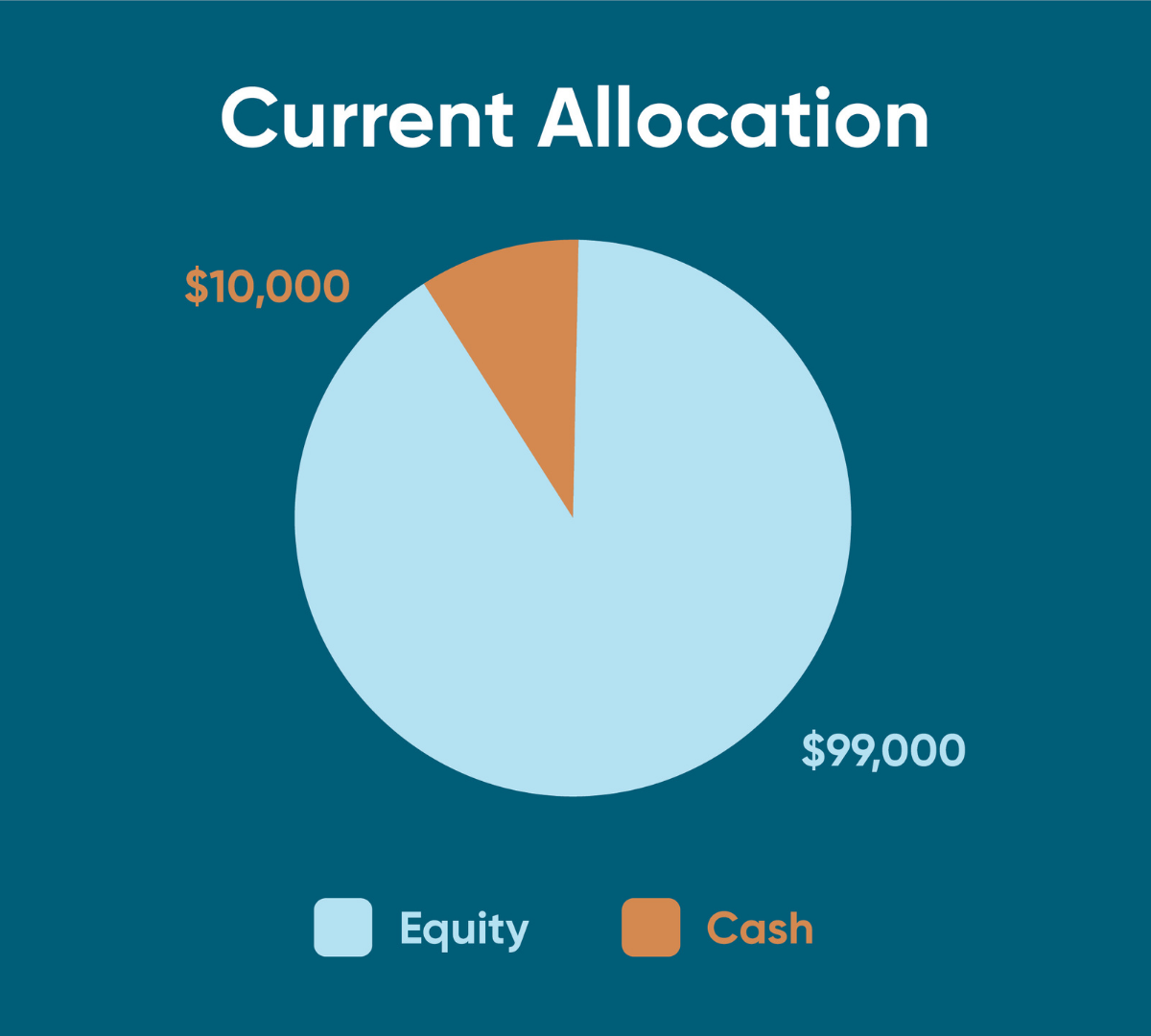

Say you currently have a portfolio worth $100,000 with an allocation of 90% equity assets and 10% cash, a high growth portfolio.

You start out at the beginning of the year with a minimum investment horizon of 5 years. Towards the end of the year a couple of things have happened, you’ve met your partner and have decided to buy your first home together within a year’s time. The share markets have performed well and the equity portion of your portfolio is up 10%.

As a result, your total portfolio value is now $109,000 (Original $90,000 invested x 10% + $10,000 cash). It also pushes the allocation of equities to around 91% and cash to around 9%. Considering the value of the portfolio this minor change doesn’t warrant a rebalance as the costs would possibly outweigh the benefits. However, the change in personal circumstance does mean a rebalance could be appropriate.

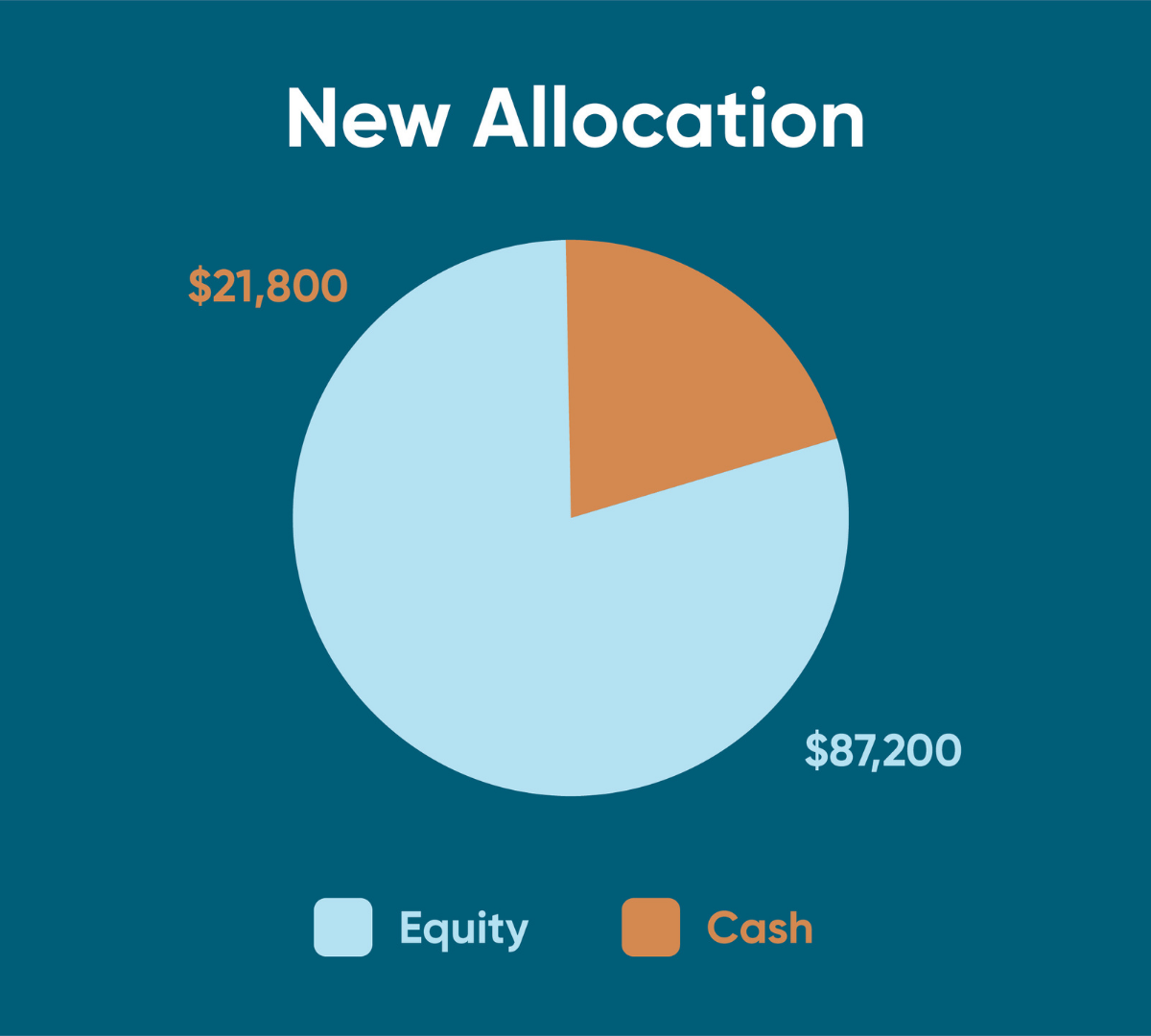

If we assume you will be using some or all of these funds to buy your new home, it’s advisable to change your asset allocations to a more conservative mix, say 80% cash and 20% equities. This will essentially involve selling ~71% of your investments and rebalancing to the new mix, which would look like this:

Assets | Current Allocation | % of Portfolio | Assets | New Allocation | % of Portfolio |

|---|---|---|---|---|---|

Equity | $99,000 | 91% | Equity | $21,800 | 20% |

Cash | $10,000 | 9% | Cash | $87,200 | 80% |

Total | $109,000 | 100% | Total | $109,000 | 100% |

It’s important to note that with this method we are putting a much higher weight on the passage of time rather than market volatility. This therefore “de-risks” the portfolio from downward (and upward) movements. As mentioned earlier, this encourages investors to follow a more disciplined approach rather than focus on short term noise in the markets. If the investment horizon is more flexible, a greater proportion could be left to the ebb and flow of equity markets.

A lot of investors will be making regular contributions to their investment portfolio, for example weekly, fortnightly or monthly. Cash flow rebalancing means they can use these contributions to rebalance their portfolios as and when required.

Not sure what we mean? Let’s look at an example.

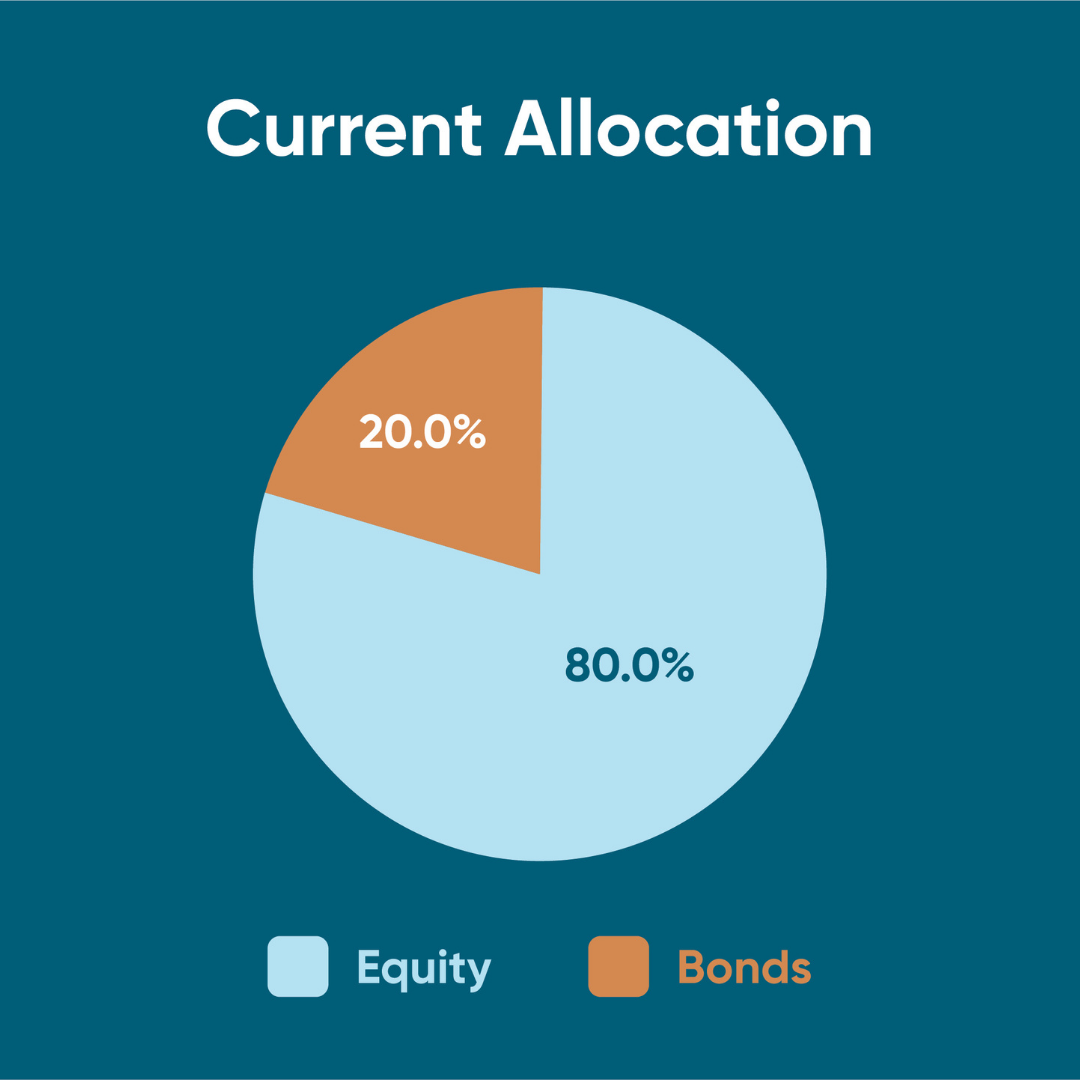

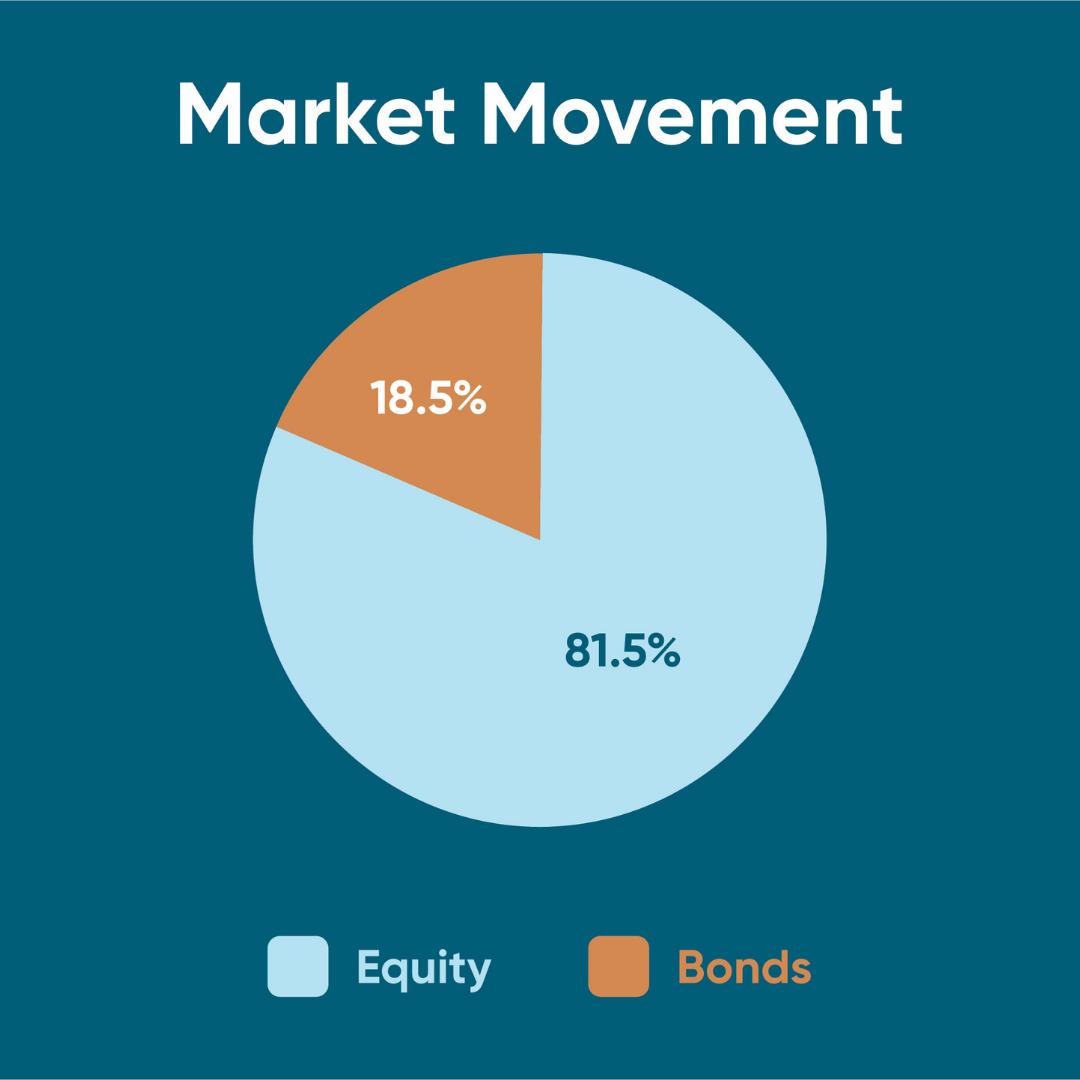

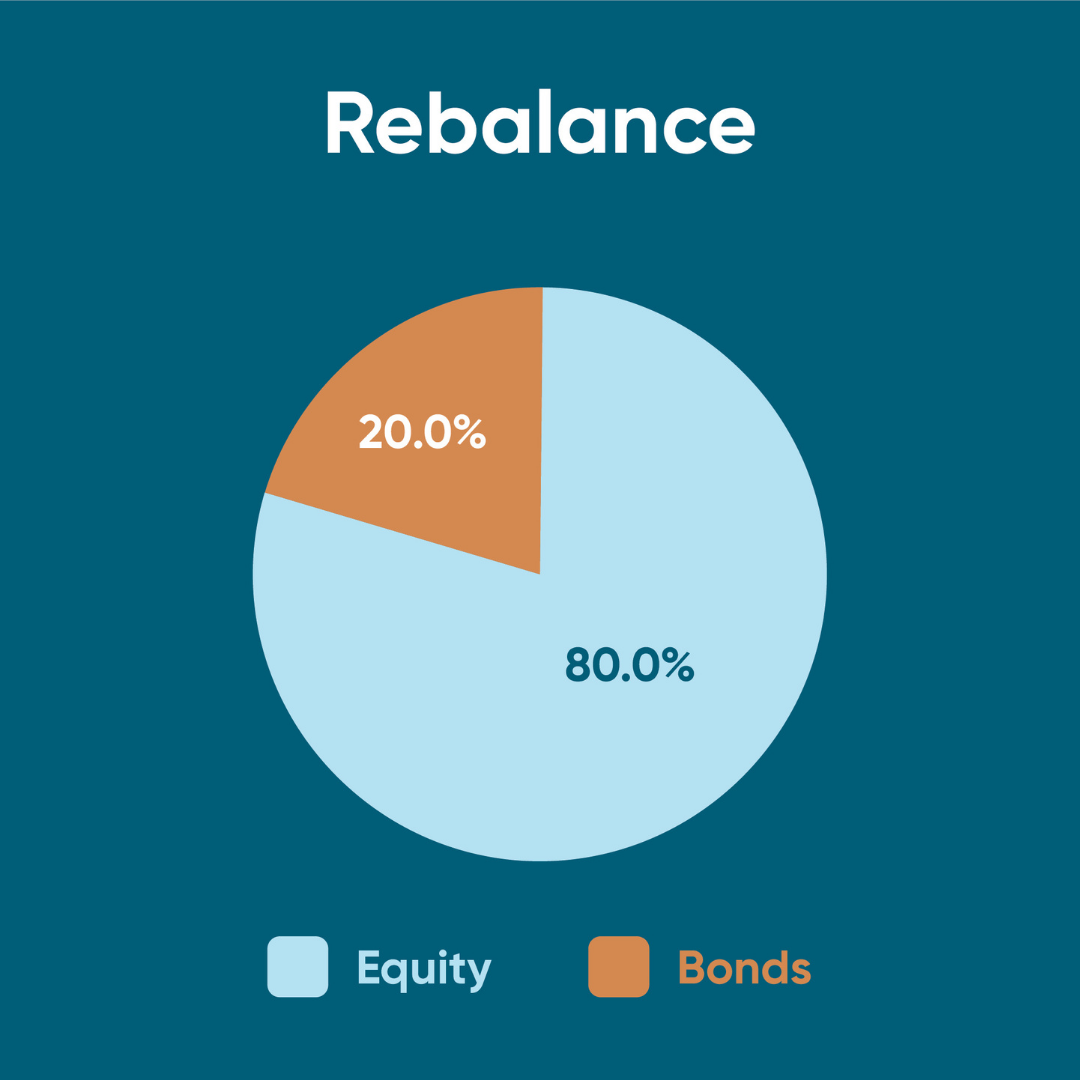

Say you have an investment portfolio of $50,000, with a 80/20 split towards equities and bonds. Recent positive market movement has seen your equity allocation increase by 10%. This would mean your total portfolio is now worth $54,000 and the equity allocation would be worth $44,000 (81.5%). You make monthly contributions of $1,000. In order to bring your portfolio allocation back to the target mix of 80/20, you would use the next monthly contribution of $1,000 to purchase bonds.

Assets | Current Allocation | % of Portfolio | Assets | New Allocation | % of Portfolio |

|---|---|---|---|---|---|

Equity | $40,000 | 80% | Equity | $44,000 | 81.5% |

Bonds | $10,000 | 20% | Bonds | $10,000 | 18.5% |

Total | $50,000 | 100% | Total | $50,000 | 100% |

The PPR method involves setting a ‘deviation range’ from the portfolio’s target allocations and rebalancing when those ranges are breached.

For example, if the equity allocation of the portfolio is 50% the deviation range could be ±5%. This means that if the allocation drifted outside 45% and 55% respectively, then assets would need to be bought and sold to bring the portfolio back to the target allocations.

This method is effective to maintain target allocations with greater accuracy. However, a considerable amount of time and effort is required to stay on top of the game, and it can taper strong periods of performance (or under performance), not to mention the additional costs and other factors to consider as per below.

There are two ways of thinking of this, which may be occurring simultaneously. Elements of the portfolio that have underperformed, you are going to shift money towards. Elements of the portfolio that have overperformed, you are going to shift money away from. This fits the concept of mean reversion.

Assume a portfolio of 1 stock and 1 bond. If the stock has outperformed the bond over a period, it means trimming the winning stock and taking profits, meanwhile the opposite for the losing bond. That said, past performance is no indicator of future performance and the trend might continue as much as it inverts, for better or worse.

Whilst we have highlighted just two portfolio rebalancing methods, there are other more complex rebalancing options available such as algorithmic rebalancing etc. These are seldom used by even the most sophisticated investors. We need to apply a practical lens around managing an investment portfolio and weigh in the costs and benefits before making any changes. As you will note in the next section, sometimes these costs can be higher than the potential benefits.

Rebalancing is also not always asset class specific. Investors could also look to rebalance based on sector exposures or country exposures. For example, they could have a global equities allocation with a 5% cap on NZ equities, which would mean that they would consider a rebalance if the NZ allocation deviated materially from the 5% target.

The primary costs of rebalancing a portfolio are brokerage fees and foreign exchange (FX) costs for individual stocks, bonds and exchange traded funds (ETF)s. There are also buy/sell spreads for some managed funds. Thankfully Kernel’s funds don’t have any of these costs!

Another factor that can increases costs is taxes. In some jurisdictions, such as Australia, capital gains are taxed, hence selling equity positions for rebalancing purposes can result in additional tax liabilities.

Factors such as market liquidity are also an important consideration when rebalancing. If markets are illiquid or specific securities are trading at lower liquidity levels, asset prices may need to be sold at a discount, resulting in reduced benefits from rebalancing.

It’s difficult to estimate the true transaction costs of rebalancing, but we can be certain that there will be costs, which as we mention can often exceed the benefits of rebalancing in the first place.

You have another option! If your investment horizon is long, i.e. 10 -15 years, you do have the ability to buy and hold assets without rebalancing or with doing so very infrequently.

If an investor’s time horizon is long and they have resulting overall positive returns, this would mean investors would be willing to take more risk and rebalance less. Meaning, if the value of stocks in their portfolio increases they would leave this as is, not rebalance and let the portfolio grow over the years. This is because they focus on the starting amount in each asset or asset class rather than the current valuation.

The above can also be the most cost effective and tax efficient option. Of course, this approach is more risky and not suitable for investors with shorter time horizons or who seek greater capital protection. For DIY investors, the time and effort required to follow some of the above strategies should also be a key consideration.

Portfolio rebalancing comes with a number of costs and benefits and it’s important to weigh these up before committing to regularly rebalancing. Each investor has different appetites for risk and personal circumstances, so there isn’t a “one size fits all” when it comes to adjusting one’s portfolio asset allocation. Perhaps it’s helpful to seek external financial advice to help guide you through whether to rebalance or not, and how is the best for your unique needs.

Rebalancing is a decision that all investors should be conscious of whether undertaking it or not. Ultimately any combination of investment will perform uniquely over time and it is at what point or trigger the investor chooses to intervene that should be considered to alter the risk profile back towards the desired or intended. The temptation as noted is too frequent rebalancing rather than too infrequent, which starts to look like an attempt to time the market, something as discussed before is fraught with dangers.

Why do investors make poor decisions in down markets?

Investors make much worse decisions in down markets than increasing markets. Read about the common i...

Catherine Emerson

1 May 2020

Market Correction, Crashes, Bear Markets and Recession: Kernel Explains

Kernel explains what actually happens in a market correction, a crash and how investors should appro...

Stephen Upton

26 February 2020

All You Need to Know About Investment Performance & Returns

Are my investments making money? An important question to know the answer to. We explain the nuances...

Catherine Emerson

14 May 2020

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices