When getting started with investing, it's best to use an index investing approach. What exactly does...

Catherine Emerson

8 August 2019

Successful investing is simple and mostly common sense, but that doesn’t mean it is easy.

As investors we can refer to decades of research, historical performance and of course, hindsight. So, what does this tell us about how investing can be ‘successful’?

As we will explore further below, the most successful strategy is to simply own your share of a range of publicly held businesses to share in their success, at a very low cost. How do you do this? Through an index fund.

An index fund is simply a basket of shares that are designed to mimic the performance of the market, or a part of the market (such as the commercial property sector). By owning an index fund, you eliminate the risk of picking individual stocks or the risk of picking an active manager who will typically underperform.

Simply, companies are priced according to their potential future, so rather than trying to assess which are going to do better, you invest according to a broader characteristic such a country, a sector or grouping like infrastructure or a theme like Clean Energy.

This leaves you only with the risk of the market, which in the long term consistently rewards the patient investor. And it’s important to remember that falls/corrections in the market have happened consistently since the dawn of the stock market. These falls have always been caused by a different trigger, but one thing has always held true – they recover.

Successful investors ignore these short-term events and may in fact take advantage of them to start investing more, but are focused on their long-term investment horizon. They’re not short-term speculators trading on the headlines trying to beat the market; they know that interfering with their portfolio adds transaction cost and ignores that it is time in the market not timing the market that matters.

Successful investors understand the value of diversification and the power of compounding, which over the years has generated truly astonishing wealth thanks to the ongoing growth in productivity and innovation.

On average, countless academic studies and past performance returns have shown that most stock picking investors and actively managed funds underperform the return of the market. There is a simple mathematical reason as to why we should expect this referred to as “The zero-sum game”. Warren Buffett gives a great demonstration of the nature of the zero-sum game and his bet against hedge funds in this clip from one of his 2016 Annual General Meeting.

Collectively as a group, all investors own the stock market and will get the average return of the entire market. Therefore, for each percentage point of extra return above the market someone earns, other investors must underperform the market by the equivalent. This is before the deduction of the costs of investing, and hence known as the zero-sum game.

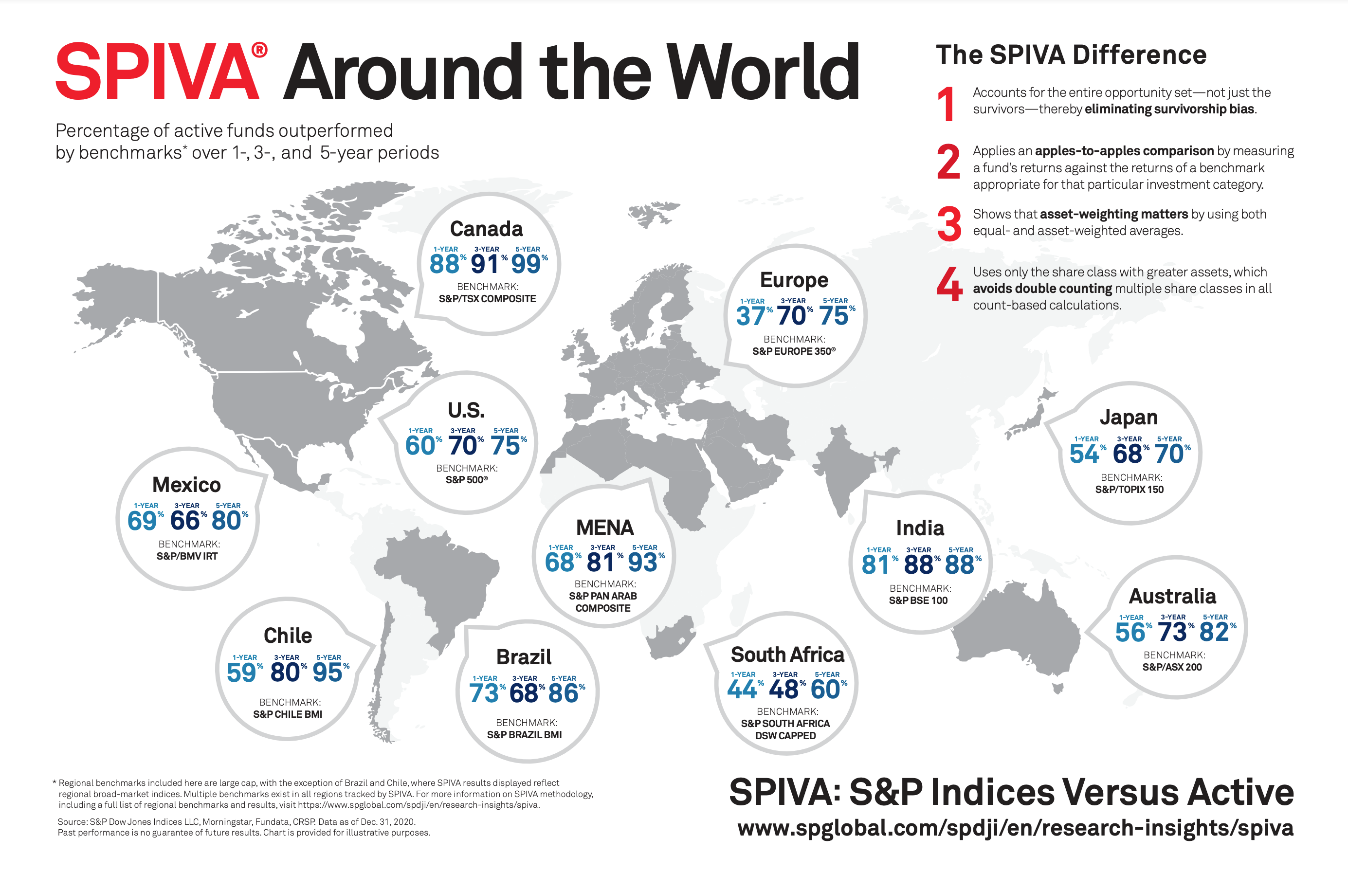

The majority of the market is controlled by professional fund managers and institutions. When adding in fund fees and the other costs of investing, we see a far higher percentage of active funds underperforming the market. If you’re interested to see how poor active managers perform, take a look at the S&P Dow Jones annual S&P Indices vs Active (SPIVA) report card, shown below.

As you can see, on average active managers have underperformed the market over the past decade in markets around the world. Further studies show those winners are not consistent, last year’s top funds are no more likely to outperform again and actually most likely to move from top quartile to bottom quartile. Meanwhile the investors have ultimately paid higher fees to underperform the market. The winner is the active manager who has collected these higher fees on the billions of dollars that they manage.

Conversely the lack of those higher fees and lack of oscillation around the market benchmark return, means that the index fund rise from the middle to the top over time, just like cream rising to the top of undisturbed milk. By the way, this underperformance by active managers isn’t a new phenomenon or confined to recent history, it has been consistently demonstrated across time periods, all the way back to the 1970’s.

The first is you can try and pick one of the very few funds that may beat the market Alternatively, you can remove yourself from the game and simply receive your share of the market return at a low cost through an index fund.

This investment strategy is simple, can be implemented with as little as $100 and is backed by unrefutably arithmetic and decades of research. The hard part is keeping disciplined through the short-term excitement of the market and focusing on your long-term investment strategy. As The Economist puts it:

“The truth is that, for the most part, fund managers have offered extremely poor value for money. Their records of outperformance are almost always followed by stretches of underperformance. Over long periods of time, hardly any fund managers have beaten the market averages…And all the while they charge their clients big fees for the privilege of losing their money…you will almost never find a fund manager who can repeatedly beat the market. It is better to invest in an indexed fund that promises a market return but with significantly lower fees.”

Interested to know more about Kernel’s index funds? Check out the link below.

When getting started with investing, it's best to use an index investing approach. What exactly does...

Catherine Emerson

8 August 2019

The future of investing is sustainable

Today more investors are adopting sustainable investing, looking at both the financial outcome and i...

Dean Anderson

11 May 2021

How to Start Investing: Part One

Successful investing isn’t as hard as you think. In this blog we walk you through key concepts and h...

Dean Anderson

13 August 2020

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices