With Term Deposits So Low in NZ, How Should You Invest in 2020 and Beyond?

Want to make your money work for you but don't know how when term deposits and savings account rates...

Catherine Emerson

9 September 2020

Originally published on NBR.

Whitecoats are synonymous with professionals in the medical field. We trust them to base their opinions in fact and the scientific method, and not to be swayed by unsubstantiated rumour and quackery.

Our whitecoat experts in the fields of economics, financial markets, financial planning and psychology have combined to address the common misconceptions about investing. Based purely on fact and scientific method; not quackery. So to Part I…

Whether you were harmed by 1987’s wild west, or misplaced trust in a fast-talking-salesman or a newspaper ad promising great guaranteed returns from a finance company prior to 2007, many people have been scared away from the share market.

This fear has forced would-be investors into the low net yield (that’s profit after expenses and taxes) world of residential property. That’s a pity, because the share market is a very safe place to invest if you obey some simple rules.

We welcome your feedback, your experiences, and your contrary emails. For the record, our products at Kernel are not the panacea, we don’t hate property, banks or any type of asset (they all have their place), but we do want to help you understand wealth creation and some of the tricks previously reserved for the rich.

This week we are going to face that fear head on and why thinking you need to pick stocks to invest is a bad use of your time.

The number one mistake that new investors make is that they confuse “trading” with “investing”.

A trader is hardly more than a professional gambler, looking for a short-term profit and ways to tilt the table in their favour. Whether a trader is looking at their portfolio hourly, daily or weekly, the chances of “winning” and justifying the time spent are less than statistically possible.

No matter whether you are researching companies in a fundamental way, a macroeconomic way or a technical way – you would be better to flip a coin or learn how to count cards at the casino.

More simply, there is no get rich quick solution that doesn’t involved high risk, high stakes and a lot of luck.

Investing on the other hand, is buying shares for the long-term, with no expected sale date that is less than a few years. All the noise created by traders disappears and your actual growth in wealth from the share market is always the greatest.

Those front page events of doom, gloom and traders in despair. Well it is quite simple really; it is collective speculation whether that company or the whole world is going to be better or worse than currently expected in the future. If news comes out, where the majority of those watching closely (i.e. traders) think the future will be worse, the price will fall. Sometimes fast, because there are few wanting to buy anymore, at least not without a big discount.

The number two mistake most investors make is trying to pick winners.

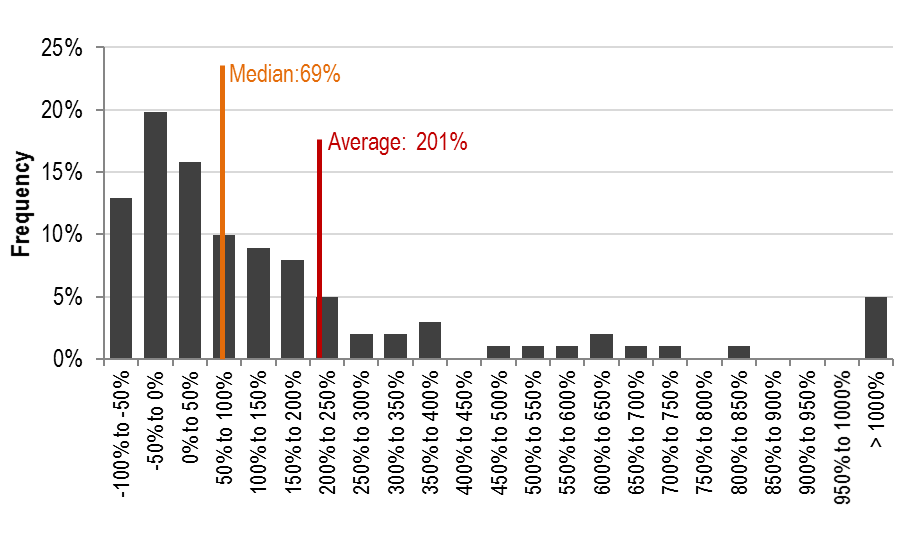

Below is the chart of the growth of companies in the NZX50 for the 15 years through Dec. 31, 2018. This chart shows us that 15% of the companies are worth less than half what they started at, whilst 5% of the companies are worth 10 times more.

Source: S&P Dow Jones Indices

It would be great to pick the 5% wouldn’t it? That’s what everyone aims to do. We will cover in the next two weeks why that is (almost) impossible, even for experts.

More importantly, the average return is higher than the median return (the median being the middle of all the companies). This is because stock returns can go up more than 100%, but only down 100%.

You have a 50/50 chance of picking a stock that will perform above the median, but that doesn’t mean you are likely to beat the average return.

In order to get the average return, you have to do more than just pick the great companies – you also need to avoid the bad companies and foresee when the good are becoming bad and vice versa. Sounds like a lot of hard work, doesn’t it?

So investing is all too time-consuming and scary…as we started with. Except, if you understand these concepts and use the benefits of index investing, it is neither time-consuming or scary.

This is one of the reasons index investing offered by Kernel and others, has increased in appeal around the world. Index funds are now the majority of new funds invested in the US. The internet and increased access to information has exposed the common misconceptions about how markets work and how to best grow your wealth.

The evidence showing the shift in funds from other investments into index-linked products shows just how much investors are coming to understand this.

With Term Deposits So Low in NZ, How Should You Invest in 2020 and Beyond?

Want to make your money work for you but don't know how when term deposits and savings account rates...

Catherine Emerson

9 September 2020

Wondering whether you should invest in the NZ 50 Fund or the NZ 20 Fund? Find out why the NZ20 is ou...

Dean Anderson

18 July 2024

How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices