What to know about investing: Risk

A key investment principle to know and understand is risk. Find out what the role of risk is in inve...

Catherine Emerson

11 March 2021

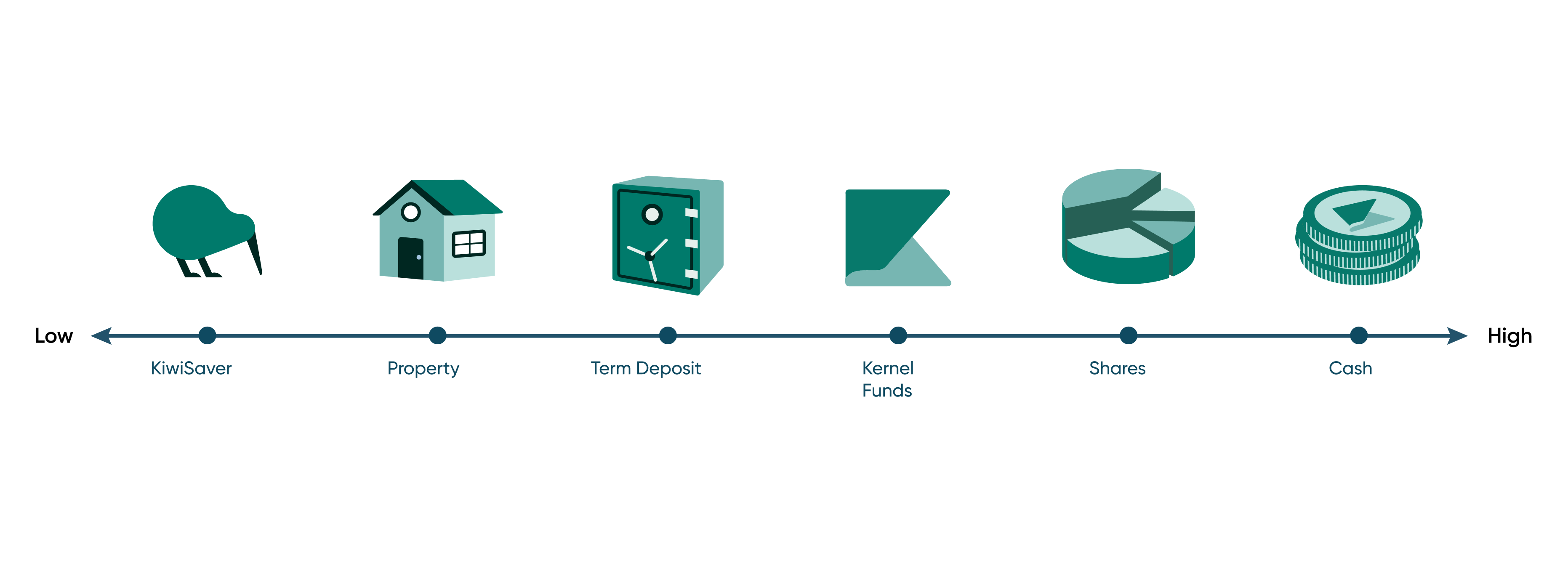

Liquidity is often a term that is thrown around, but a lot of us don’t actually understand or know how it applies to us. In this blog, we run through what liquidity is and why it’s a key element that underpins any investment choice.

Some investments cost you time and often money to exit. In other words, they are not what we would call ‘liquid investments’.

Put simply, liquidity is how quickly an asset can be converted to cash and at what cost. You can “fire sale” almost any asset, depending on the discount you are willing to accept.

Cash is universally considered the most liquid asset.

To access your KiwiSaver balance, you typically will have to be purchasing your first home or be 65 or over. You can gain earlier access to your KiwiSaver balance; however, you will need to be under significant financial hardship.

Property, for example, can take months to sell and settle with many costs involved; agent fees, advertising and preparation costs. Businesses or shares in unlisted companies are the same; often requiring a business broker and a lengthy negotiating period.

Term deposits, and even some restrictive savings accounts, charge you a break fee or require a period of notice before you can access your money.

Bonds or other fixed interest investments can be sold if you can find a willing buyer, which is sometimes easy if listed and popular but sometimes not.

Shares, exchange-traded funds (ETFs) and listed managed funds have much greater liquidity, as they can generally be sold and settled within a couple of days – but brokerage or trade fees usually apply!

Having some liquidity in your finances is important for those unexpected events – something we call an emergency fund.

Bad news when getting your WOF? Unforeseen medical event? Urgent need to travel to see a family member? These things require cash, available stat.

We suggest having a small savings balance set aside as your emergency fund that you can access within a few days - if not instantly. Some common savings options often considered are anon-call savings account, cash funds or even a mix of both.

You don’t need all your financial assets to be super liquid though – in fact, it’s a great idea to not have easy access to everything. Impulse purchases are real, as are emotional reactions to market movements.

Having some assets that are less liquid than cash can help ensure you’re not your own worst enemy.

Selling units in Kernel funds and withdrawing money will take a few business days to process and settle.

Kernel operates on daily order processing. This means any orders (buy or sell) received before 12pm on a business day will begin processing that day. Your order will then be completed and be available in your wallet, ready to be reinvested or withdrawn within 2 business days.

If you’re withdrawing to your bank account from your Kernel wallet, you can load a withdrawal request before 4pm on business days for the money to normally reach your bank account that evening.

When choosing investments for your own goals, make sure you’re clear on how quickly you can convert the assets into cash.

What to know about investing: Risk

A key investment principle to know and understand is risk. Find out what the role of risk is in inve...

Catherine Emerson

11 March 2021

Starting to Invest – 5 Things All Investors Need to Know

Are you thinking about starting to invest? You don’t need to know as much as you might think. Here a...

Catherine Emerson

18 November 2024

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices