Investing without a strategy is like a sports team going into a game without a game plan. Even though you don’t necessarily need one, defining an appropriate investment strategy before starting to invest will increase your chance of meeting both short-term and long-term future financial goals.

However, before beginning to research your investment strategy, you should take a comprehensive look at your current financial situation, investment goals, time horizon and your comfort zone in taking on risk.

A quick look at your investing objectives

Wondering where to start? Try asking yourself these key questions:

1. What is your current financial situation?

Before pursuing investing, make sure that you have cleared all your higher-interest consumer debt (e.g., credit cards, car loans, hire purchases). Plus, ensure you have enough of an emergency fund to cover unexpected expenses or disruptions.

2. What is your money invested for and when you will need some or all of it back?

The purpose of knowing your investment time horizon and financial goals is to land on a suitable asset allocation. Some investments are more suitable for longer time horizons. This is because you can afford to weather the market fluctuations when there is more time remaining or the horizon can be flexible if required. Other investments that focus on capital protection are more suitable for the short-term. For instance, when you need to withdraw all invested money for a specific goal.

3. Are you financially secure enough to weather a market downturn?

What we mean by this is, how long can you wait for the potential losses to recover? Do you have stable current and future income sources? Do you have other existing financial and real estate assets? All investments are associated with some degree of risk, meaning accepting the possibility that there is a market downturn and the value of your money drops as a result. If diversified, this will usually recover after a period of time but it’s whether you can wait for that to occur. The reward for taking on this risk is the potential for a greater investment return.

The understanding of your personal tolerance for risk matters. It helps you stay within your comfort zone when making an investment decision and ideally stick to it when adverse market conditions exist. Some, especially the inexperienced, can’t stomach the rollercoaster.

However, selling your investments when the value drops is worse than not getting on a ride that you’re anxious or uncomfortable with. i.e. not investing in individual stocks. A lot of comfort can come from diversifying your portfolio into funds rather than investing in a few speculative stocks.

If you understand these fundamentals, perhaps you’ve dabbled in investing already. But now that you want to take your investments more seriously, you might be wondering what common investment strategies are out there and how to choose the right one – this article is for you.

What is an investment strategy?

An investment strategy is a set of principles and practices that shape how you select investment assets in your portfolio as well as how you approach buying and selling those assets. This plan should closely track your investment horizon, risk tolerance and future needs for capital. It should be reviewed periodically as the investment horizon reduces over time and your financial situation changes.

To pair the right strategy with the right objective, it’s always important to quantify what you are seeking to achieve . Plus when you will need to spend all or a significant part of the money invested. Simply stating that you want retirement income security or become wealthy isn’t always helpful. Something like “I want to achieve a 10% average annual return on my investment over the next 10 years so that I can have a $300,000 portfolio for my second real estate investment” sounds much better. The more specific the objective, the better.

Why is it important to have an investment strategy?

In times of market turmoil and a highly uncertain economic environment, too often, investors let emotions get in the way and behave irrationally. People tend to overreact and are tempted to sell assets at low prices when the economy is experiencing some chaos.

Investment strategies enable you to control your emotions, lock out the market noise and redirect your focus to the long-term goals. A large market drop in reaction to the news of some catastrophic events has little impact on the long-term results of a well-designed investment strategy.

Take the 2008 financial crisis as an obvious example. During this period, from October 2007 to March 2009, the S&P 500 fell 46.3%. Nonetheless, by March 2013, the index had recovered all its losses. It continued on the 10-year bull run from through to 2019 to go up more than 250%.

When negative events happen, such as the 2008 financial crisis, they tend to receive a lot of attention in the media which in turn drives fear. Compare this to positive market news that creep valuations up slowly and quietly and can often go unseen.

By creating (and sticking to) an investment strategy, you have a rational process that guides your decision-making. There will be no room for panic reactions and second-guessing, just a regular assessment of where you are today in relation to where you want to be. Plus, whether the current strategy is still the suitable one to get you there or needs to be adjusted.

What are common investment strategies?

In general, investing strategies can be broadly split into two categories – active and systematic.

Active and systematic investing strategies can be applied in two ways – first in terms of how to select investment assets in your portfolio, and second, when it comes to how you approach buying and selling investments.

Strategies for selecting investments in your portfolio

Index investing strategy

The index investing approach (often called passive investing) generally involves the replication of a specific benchmark or index (e.g. S&P 500, S&P Global 100) to match its performance. It does not require stock picking, as the investment portfolio is systematic and based on the index’s rules (otherwise known as a methodology).

Active investing strategies

On the contrary, active investing involves a stock picking process as an attempt to beat the market. Within active investing, there are two common strategies – value investing and growth investing.

Value investing strategy

Value investing is a long-term investment strategy in which investors use fundamental analysis to identify stocks and assets that according to the analysis are of quality but currently undervalued by the market. In order to make value investing work, you must play a long game, considering the big picture, not a temporary bad event.

The potential flaw with this investing strategy is that the market collectively can undervalue companies for a variety of reasons, including concerns about growth potential, recent negative news, or some future uncertainties.

The value of any given investment can change in an instance – according to a news story, a new product development etc. However, this doesn’t necessarily mean that undervalued stocks at specific periods should or will grow over the long-term.

Growth investing

Another common active strategy is growth investing, which aims to find investments with strong upside potential, considering the current financial status of companies and the prospects of the industry in which stocks can thrive.

For example, you believe that there is likely to be strong demand for electric vehicles in the future before investing in Tesla or Lucid Motors. The company should also have a consistent trend of strong revenue and delivering on projections. A sign that it’ll be able to meet the growth expectations.

This strategy might not be suitable for investors looking for steady income streams. Companies in growth mode often need capital to support their expansion rather than distributing dividends to shareholders. Moreover, faster earnings growth comes with higher business valuations and more market noises, meaning highly volatile stocks.

The automotive industry is a good example where a mature established company like General Motors has a Price to Earnings ratio of about 8, whereas Tesla has a ratio of 335. In other words, Tesla, a high-growth company with huge future expectations is much more volatile than General Motors, an older company likely to be focused on delivering dividends to stakeholders but that investors seem to feel has less future growth potential.

Strategies for approaching buying and selling investments

When it comes to how you approach buying and selling investment assets, you can choose between buy-and-hold and dollar-cost averaging strategies, as passive investment strategies. Momentum investing is a common active investment strategy which we explain further below.

A buy and hold strategy

Both systematic investing approaches here are based on the belief that “more time in the market” will offer higher overall return than “timing the market”. So, systematic or “passive” investors often keep their portfolios relatively stable over the long term regardless of short-term market fluctuations. In turn, they avoid market timing or frequent buying and selling of assets to minimise trading costs.

A buy and hold strategy simply means that investors purchase an asset and hold it for long periods of time (7+ years). There’s no jumping ship to something else because of a particular trigger (e.g. 20% increase) or opinion.

Dollar-cost averaging strategy

On the other hand, dollar-cost averaging is the practice of making regular investments over time regardless of market conditions. So, it helps avoid the ill-fated strategy of timing the market, by consistently and systematic continuing to invest. When investments happen on a regular basis, you can capture prices at all levels, from high to low, reducing the level of risk and the effects of volatility.

Momentum strategy

The active approach here means timing the market. Active investors aim to outperform the market, making buying and selling decisions by predicting the future price movements of assets.

Momentum investing is an active trading strategy where investors use technical analysis or moving average analysis to look for buying opportunities when the share markets trend upwards in the short-term and jumping on the trend. They then sell when the investments start to lose momentum, hence the name of the strategy. The challenge being trends continue…until they don’t. That is near impossible to see without hindsight.

The active vs passive investing debate

Investors have been debating the benefits and costs of active vs passive investing for a while now. Active investing is a more hands-on approach with frequent buying-selling decisions. Active investors/managers can sell money-losing investments in favour of new or well performing stocks and get out of specific holdings or market sectors when the perception of risk gets large.

However, flexibility does come with higher costs. In fact, active investing is more expensive than passive investing since you need to pay research analysts and portfolio managers to select investment assets in your portfolio. There are also additional costs due to more frequent trading, like higher transaction costs.

Empirical research has shown that over all types of markets, conditions and periods, over 90% of active investors/managers failed to beat the appropriate index after accounting for expenses in the long term. Despite the illusions of control and prophesy, we naturally want to believe that some can consistently cover the costs of their efforts and also outperform compared to the average, even when research proves otherwise.

Core-satellite investing strategy – The best of both worlds

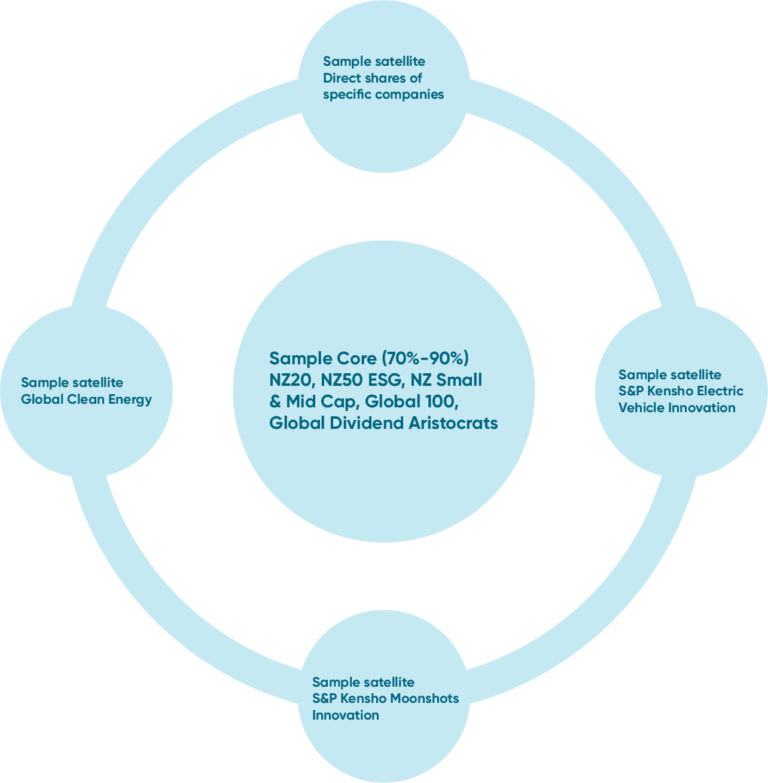

Core-satellite investing combines the diversification and low-cost benefits of index funds with active strategies (e.g. value investing, growth investing) that can offer the potential for outperformance.

The appeal of this approach is that it shields a significant part of the total portfolio in index investment (the core) with lower volatility. All while allowing investors to add more direct shares or sector funds (the satellites), which are believed to have great prospects in the future.

To be more specific, the “core” of the portfolio consists of investing 70-90% in broadly diversified low-cost index funds. How you allocate your assets within the “core” is planned according to your long-term goals and to generate higher returns with lower risk. Importantly, the core only needs infrequent asset class rebalancing to achieve long-term investment objectives.

The “satellites” then allow for specific companies, sectors and/or regions to be overweighted within your portfolio. For example, if you’re invested in the Kernel S&P Global 100 Fund within your “core”, however you would like a larger percentage of your overarching portfolio to be invested in Apple stock (noting Apple is included in the S&P Global 100), you might like to invest in the individual stock as a “satellite” to achieve this higher percentage. The idea of adding these satellites is that you’re attempting to generate a return above those generated by the index (core) portion of the portfolio.

This requires an active management approach that involves regular oversight of the portfolio in order to take advantage of opportunities. The effort and continuous rigour required to do this, regardless of enjoyment, shouldn’t be underestimated. In other words, the opportunity cost of doing something else shouldn’t be ignored.

Benefits of core-satellite investment strategy

- Cost advantages: The core portion of the portfolio helps minimise costs because index funds incur lower management and transaction costs than their active counterparts.

- Greater portfolio diversification: A broader spread of securities in the core part ensures less exposure to the performance volatility of single investments. Active funds are typically either index huggers (they essentially replicate indices anyway) or more concentrated.

- Greater discipline: the core “indexing” portion lessens the reliance on picking winning stocks or chasing fund-manager returns.

- Greater control over risk and return: The satellite approach involves active investment strategies or choosing investments that create opportunities to react to various market conditions. As the index is transparent and stable, you can choose satellites to complement not unintentionally concentrate your portfolio

So, the primary objective of a core-satellite strategy is to reduce risk through diversification while at the same time offering the possibility to achieve higher returns than a standard benchmark index. In other words, this approach might help investors to achieve above-average returns with below-average risk.

Our investment approach at Kernel

As you might know, the word “kernel” means the heart or the core of something. At Kernel, we believe that the core of your investment portfolio (70%-90%) should come from a well-diversified index fund.

For this core part, we are not trying to pick winners or predict the future or time the market. But rather cut the noise, reduce the costs and drags on growth, and focus on building your long-term wealth. It might sound unattractive, but it works and is recommended by many experts in the finance world – Buffett, Kahneman, Bogle, and Samuelson.

At the same time, we do appreciate it if you have a higher threshold for risk beyond the core “indexing” part. You can add some “satellites” – higher risk investments such as direct shares or thematic funds – that you believe to have great future earnings growth.

Some final words…

Whichever way you choose to go – active, index or the combination of both – we encourage you to try to stay consistent. Don’t make changes that are driven by your emotions along the way.

To summarise, we have listed some principles that you might find helpful to define your investment strategies:

- Regularly contribute – “The best time to start was yesterday” is the famous quote (in other words, don’t delay or wait) and then contribute regularly. If you are regularly contributing, you don’t need to worry about timing the market because you’ll be buying at the highs and the lows and averaging out the cost at which you’re buying. Tools such as auto-invest can help with this.

- Keep costs low – Transaction and trading costs will destroy your returns. So, if you are regularly contributing you’ll want a investment provider or platform that is going to put all your money to work. At Kernel, you won’t pay a transaction fee on an order, EVER!

- Diversify, diversify, diversify – This means building an investment portfolio that’s made up of many different types of investments that behave in different ways. A single diversified index fund such as the NZ20 or Global 100 can do that on its own. Or you can combine across asset classes. You can also think about your exposure to global sectors and emerging future themes. Concentration into assets you don’t have strong control over is like spinning the roulette wheel.

- Consider “the best of both worlds” approach via a core-satellite strategy – The core “indexing” part (70%-90%) of the portfolio helps reduce risk through diversification and the remaining satellite part offers the chance to achieve above-average returns.