Headline Performance Results - an NZ Review

Uncovering performance trickery highlights that strong headline performance figures can mask a very ...

Dean Anderson

18 August 2020

Guest authors: Chris Bennett & Craig Lazzara of S&P Dow Jones Indices. Re-published with their permission.

Every May, Warren Buffett, Charlie Munger and 30,000 of their closest friends gather in Omaha for Berkshire Hathaway’s annual meeting – an event that has been nicknamed “Woodstock for Capitalists” and is on the bucket list of many financial professionals.

Buffett’s following is the stuff of legend and for good reason. $100 invested in Berkshire stock at the end of 1968 would have grown to more than $850k by the end of 2018, while a similar investment in the S&P 500 would have grown to just under $11k. What is perhaps even more remarkable is that Buffett achieved these returns in an era where the majority of active portfolio managers under-performed unmanaged indices like the S&P 500.

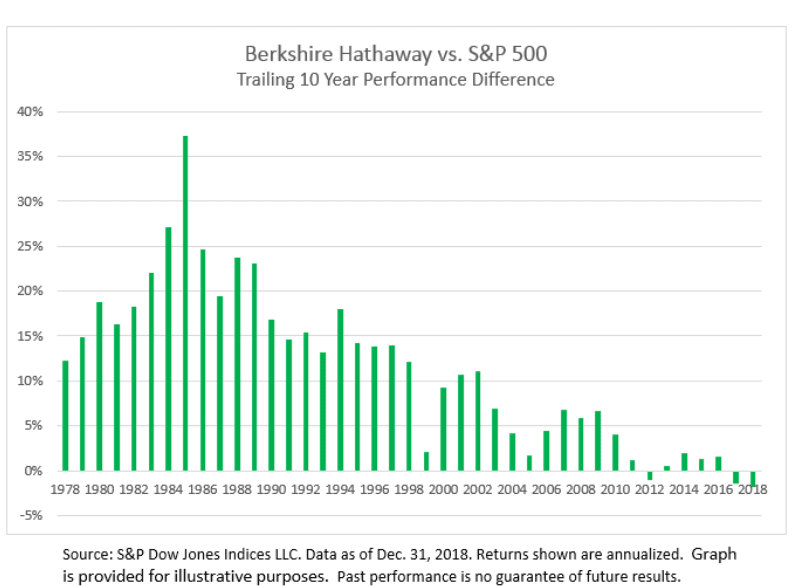

However, the magnitude of Berkshire’s excess returns have been on a downtrend recently, with the Oracle of Omaha actually underperforming the S&P 500 over the last 10 years.

There are 40 (overlapping) ten-year performance windows in the S&P 500 history. In the first 20 of them, Berkshire beat the S&P 500 by more than 10% per year. In the second 20, Berkshire’s margin of outperformance hit double digits only 3 times.

Buffett doesn’t deny this, or cry foul. When asked whether Berkshire or the S&P 500 would be a better investment for a long-term investor, he did not hesitate to answer that “I think the financial result would be very close to the same”.

When the premier active manager in modern financial history says that, you know that active management is a very hard game – and getting harder.

You can read the full analysis from Craig Lazzara on Buffetted Performance over on Indexology®.

Headline Performance Results - an NZ Review

Uncovering performance trickery highlights that strong headline performance figures can mask a very ...

Dean Anderson

18 August 2020

Why Past Performance is No Indicator of Future Returns

We’ve all heard the disclaimer “past performance is no indicator of future returns” thrown around or...

Chi Nguyen

9 December 2021

All You Need to Know About Investment Performance & Returns

Are my investments making money? An important question to know the answer to. We explain the nuances...

Catherine Emerson

14 May 2020

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices