Home & Away – Investing in Global vs NZ Shares

What proportion of your portfolio should you consider having in global vs NZ shares? We help you dec...

Stephen Upton

27 October 2023

The world of investing can be a scary yet exciting place for new investors. There can be highs and lows, and both irrational behaviour (GameStop gambling) and sensible behaviour (auto-investing). But with all of this, investors often don’t fully understand who they’re trading with, or how the share markets work. Do you know who you’re buying and selling shares from?

When broken down to its core, the world of investing is quite simple.

The best way to think of the share markets is hidden in the name. It’s a market, one big marketplace where buyers and sellers interact. Just like a food or clothing market, there are goods which are being bought and sold. But instead of food or clothing, the goods being sold are ownership stakes in companies. To make these large companies affordable, they are divided up into fragments, which we call shares.

For example, on 16/02/21 A2 milk had 742,606,937 shares on issue, priced at $10.70 each. If we multiply the price of each one of these shares by how many are on issue, we get about $7,945,894,000.

This figure is referred to as the market capitalisation of the company. It reflects how much the public thinks the company is worth.

Just like a regular market there needs to be willing buyers and sellers of these companies. If you took economics at school you might’ve realised that the simple economic rules of scarcity and supply/demand will come into play here.

For those who didn’t, scarcity implies that if there is a lack of buyers and plenty of sellers (supply), the price will be driven down. In the same way, if sellers are lacking and there is a lot of buyers (demand), then the price will be driven up.

At any one time (for most shares) there are a number of buyers and sellers that have ‘active’ orders on the market. Active orders are those which have been placed but not processed yet. These orders will be filled if an opposing party submits an order which meets the criteria of their own.

All active orders are collated into the ‘order book’. This lists all the active orders on the market for any one stock. Your average retail investor in New Zealand can’t view the order book. To do so, they must pay a pricey premium. In the same way, you can only view the market with a 20-minute delay unless you pay for premium services. This is where the average retail investor starts to lose out.

Below is A2 milk’s current order book as of 16th Feb. As you can see, the top bid (buy) order is slightly below the top ask (sell) order. This is to be expected. The difference between the two is referred to as the bid-ask spread and is likely to be larger for less liquid shares that aren’t traded as much. The market price (the one you will see when looking at the NZX) is whatever price the most recent trade went through at.

If you submit a ‘market order’ when buying or selling, then you’ll receive the best available ask if you are buying, and the best available bid if you are selling. You will generally receive a slightly worse price than if you had just submitted a limit-order. But your order will be filled instantly, you’re paying a premium for instant liquidity.

In short, you are trading with anyone willing to buy your shares at the price you’re offering (selling at).

These can be individual retail investors or large financial institutions, with a large team of analysts and resources at their disposal.

Financial institutions have entry and exit plans when buying securities. They have the discipline to sell when they believe a security is overpriced. Most retail investors don’t and are driven by emotions when making decisions about their money and investing. They might have a case of FOMO and irrationally buy or sell their shares at a price which is too high or too low. Often resulting in a worse outcome.

These institutions will also be viewing the share market data live, whilst you are still looking at what happened 20 minutes ago. This makes day trading a near-impossible task for your average Joe. You’re always on the backfoot when up against the Goldman Sachs of the world.

As an individual retail investor trading against large financial institutions, you’re immediately at a disadvantage.

To reiterate the point, let’s look at some data.

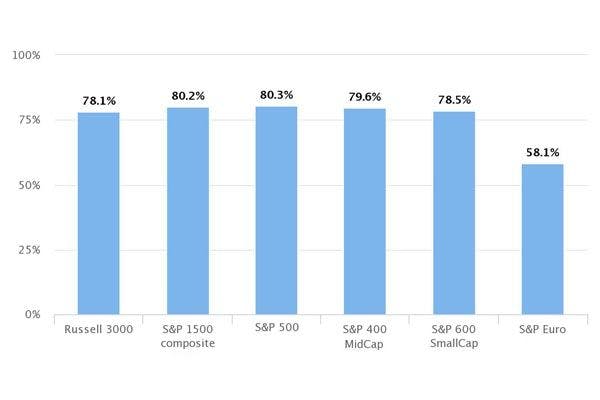

According to Index Provider, S&P, institutions own roughly 80% of companies in the Large-Cap S&P 500. In USD, that’s about $18 trillion.

Index Institutional Ownership – April 2017. Source.

If you thought that was surprising, turns out S&P also states that institutions also own between 70% and 85.8% of the 10 largest U.S. companies!

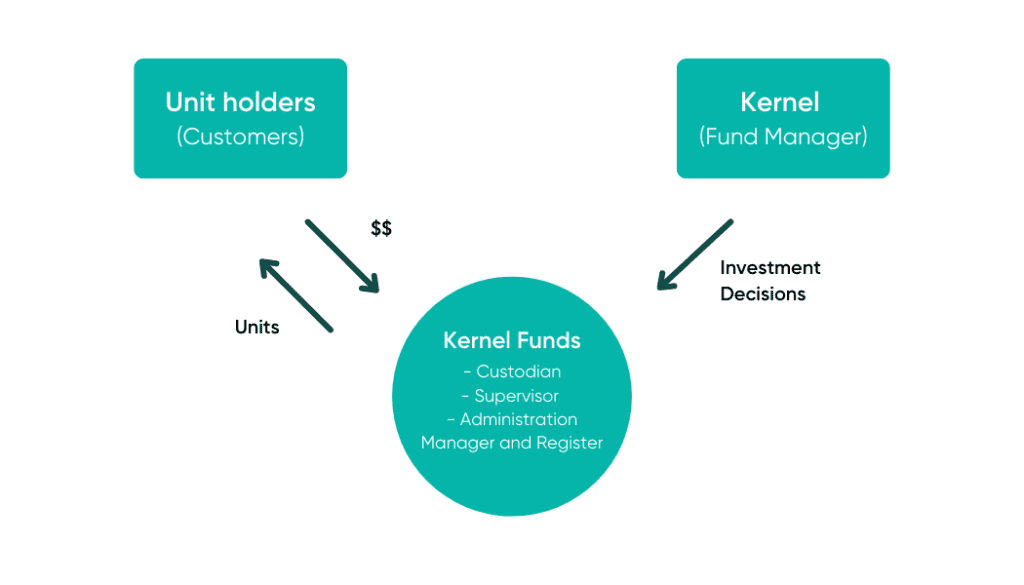

Kernel funds work by pooling together customers’ money and purchasing shares according to the specific index. This way you own a little piece of each company within the index and are instantly diversified. Greatly reducing your risk.

Our total pool of shares for each fund is then split into smaller units by us. You are then assigned a certain number of units based on how much money you gave us to invest. This is how all funds are managed, as opposed to assigning individual shares to every single investor. If we did this, we would be looking at a logistical nightmare!

Let’s say you invest $10,000 into the NZ 20 fund at a unit price of $1. You now own 10,000 units. If the fund returns 1% the next day, then the unit price increases to $1.01, and your 10,000 units are now worth $10,100 (10,000 x $1.01).

Investing in index funds can save you the time and effort of researching individual companies to invest in. Not to mention providing you with instant diversification across a range of companies and sectors.

More than that, you avoid the risk of being outsmarted by institutional investors when trying to pick the best buy/sell prices of individual companies.

By owning just a portion of the entire market through index funds, you’re also reducing potential market volatility (and FOMO).

Home & Away – Investing in Global vs NZ Shares

What proportion of your portfolio should you consider having in global vs NZ shares? We help you dec...

Stephen Upton

27 October 2023

You want to start investing or grow your wealth and you’ve heard you gotta get into this “stock-pick...

Catherine Emerson

10 November 2019

What’s the Difference Between an Index Fund, ETF, and More?

Need to know the difference between an index fund and ETF, the types of managed funds to invest in a...

Catherine Emerson

13 January 2020

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices