Investing in International Shares: Location or Tax?

Tax can have a huge impact on your overall portfolio returns - in some cases by up to 2% p.a! We've ...

Stephen Upton

29 November 2020

Okay, we're not talking about the Aussie TV drama here. No, we're talking about asset allocation - how to divide your money between different assets. This time, with relation to location.

Once you’ve made the important decision on how to split your funds between defensive and growth assets in your portfolio, the next question to ask is:

“How much of my share portfolio should be invested in NZ vs globally?”

While this blog focuses on shares, many of the arguments hold true for property, bonds, and cash. Let’s dive into a few things to consider when making this decision.

Investors in most countries have significant asset allocation to their home market, compared to their country’s relative size in the global economy. This is what we call an investor home bias. After all, it’s hard to go past supporting local where we can!

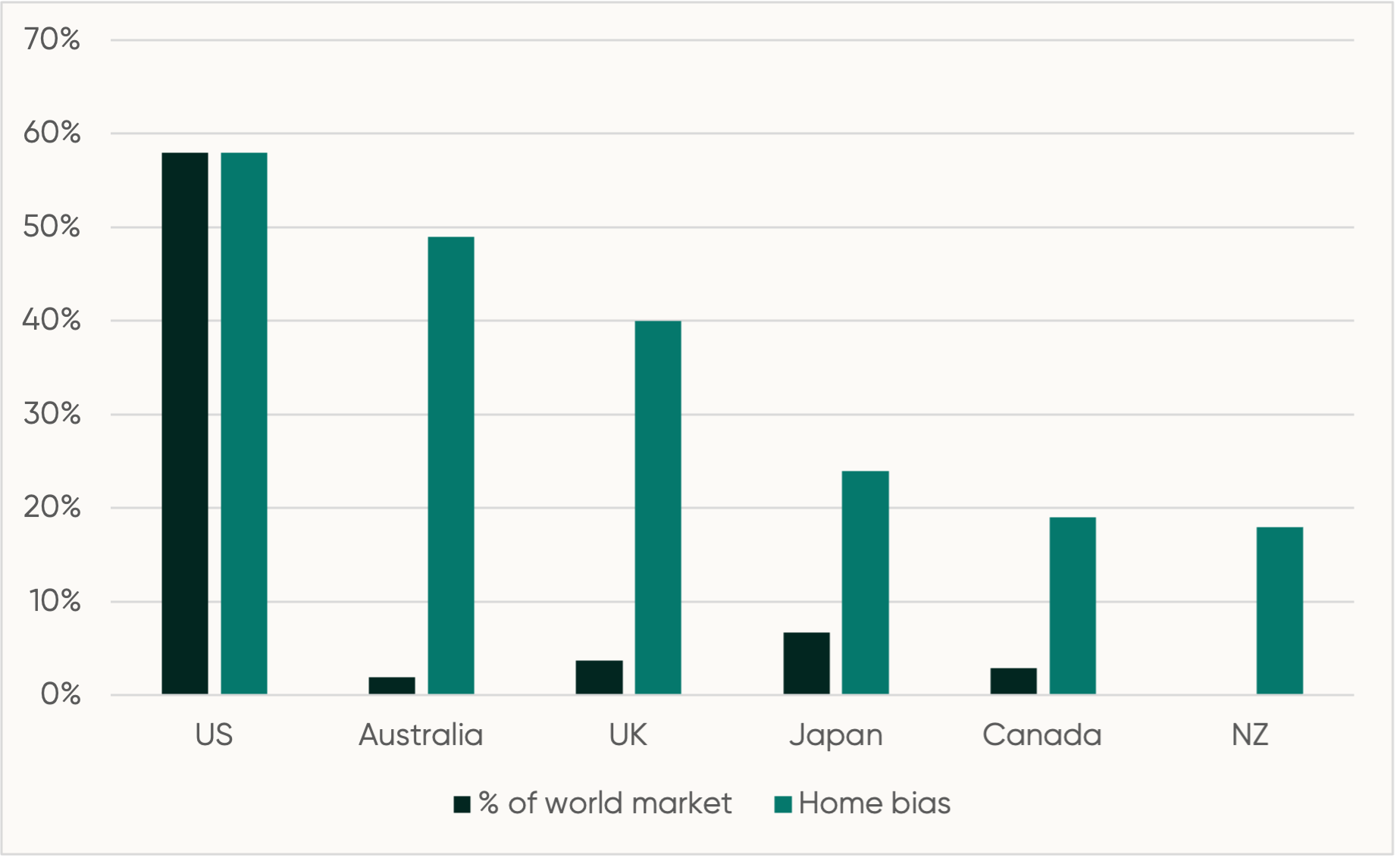

The chart below shows the percentage of the average investor who has invested in their domestic share market.

Data source: S&P Dow Jones Indices BMI allocation as at 30 September. Home bias based on research available. NZ is an estimate based on KiwiSaver allocations.

For American and Australian investors, it’s quite the majority – sitting at 58% and 49% respectively. The dark green bars show how large that market is as a percentage of the S&P Global Broad Market Index, an index that provides a broad measure of the global share market.

While New Zealand is for only 0.1% of the global economy, we don't have exact data available for home bias, however, research firm Morningstar reports that based on KiwiSaver share allocations less than 20% are invested in NZX stock exchange listings.

Many Kiwi investors fall into the trap of assuming that because the NZ market is a small percentage of the global economy, they should have limited investment in NZ shares. While there is some merit to this argument, there are equally many beneficial factors for you to consider.

The most boring but also most important point is tax.

Any PIE fund investment outside Australasia must assume a 5% taxable fair dividend rate. This creates a tax obligation for those earning over $48,000 p.a. of 1.4% every year. That’s quite a hurdle to overcome in your total return. This deemed amount often exceeds any credits for foreign tax withheld.

Meanwhile, for a New Zealand resident investing in New Zealand companies or a fund, you are taxed on the income received (i.e., the dividends and interest payments from the underlying investments), minus any available tax imputation credits.

Imputation credits are issued to investors when an NZ company has already paid tax on some or all of the amount they have paid out as a dividend. This avoids a double taxation issue.

Within an unlisted PIE fund, such as Kernel’s, we also take care of all this, therefore not requiring a tax return to claim those credits.

For a more comprehensive understanding, you can read our tax guide.

Many Kiwi investors tend to downplay how comparatively stable and well-performing our share markets are compared to others.

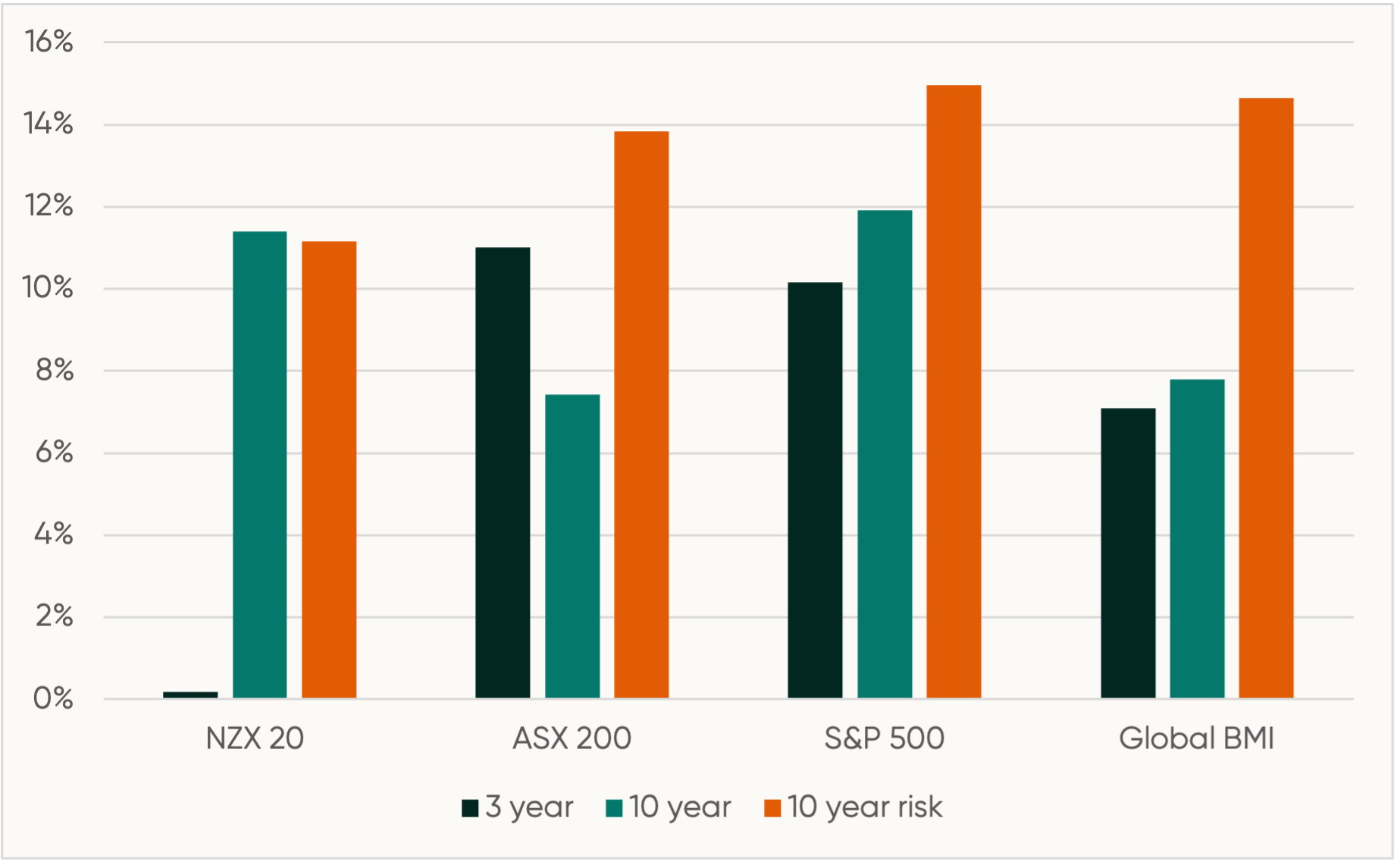

However, the S&P/NZX20 index has had 10-year gross total returns of 11.40% p.a, compared to 11.91% p.a. for the S&P 500 index, 7.43% p.a. for the S&P/ASX 200 Index and 7.80% p.a. for the S&P Global Broad Market Index overall.

Source: September 2023 S&P Dow Jones Index Factsheets

That is some impressive performance from little old NZ, despite flat returns over the last 3 years. Meanwhile, our annual risk as a measure of volatility has been the lowest of all the above markets at 11% vs 15% for the S&P 500.

Naturally, past performance is no guarantee of future results. Structurally, however, we don’t see obvious macro reasons to bet against NZ in favour of others. Certainly, not over 1% each year is necessary to overcome the tax disadvantage for the average New Zealand investor.

Correlation, in simple terms, means a relationship between two or more things. In the world of investing, a high correlation means your investments will be influenced similarly by a specific event or market change. Typically, many investors aim to diversify their investments, to reduce correlation; minimising any swings in their portfolio value.

This is where NZ shares can provide diversification benefits, as it has historically shown a low correlation with global shares.

Over the past 10 years, as at 30 September 2023, the S&P/ NZX 20 displayed a low daily and monthly correlation with the S&P Global Broad Market Index at ~0.4.

The value of ~0.4 simply displays how strongly correlated the S&P NZX 20 is with the Global Broad Market Index. A measure of 1 shows a perfect relationship, with values closer to 0 showing a weak or no relationship.

Possible explanations for this are global economic conditions, commodity price impact, currency exchange rates, and different sector exposures.

As soon as you’re buying foreign shares or funds using foreign currency, you are introducing currency risk, global geopolitical risk and the difficulty and cost of accessing the global share markets.

Many investors’ returns on the S&P 500 Fund, for example, can be destroyed by a strengthening New Zealand dollar or doubled by its weakening. Trying to predict currency movements or the international flow of capital is speculation.

While we don’t know how this will play out in the future, it‘s one of the reasons we launched a range of New Zealand dollar-hedged funds, including the Kernel S&P 500 Fund.

For non-professional investors, the costs of transacting and holding foreign shares can be high when investigating the total cost, especially when the currency conversion rate is often poor. There are also added tax filing obligations when investments are over $50,000 (FIF tax).

As the earlier chart showed, both Americans and Australians have significant home biases. Driven by the desire to own their own and benefit from the self-belief that their large companies will outperform on a world stage.

In addition to the more rational arguments for outperformance, there is the subjective argument to seize some national pride. You want to benefit as a part-owner of the success of our brands.

We are certainly passionate about New Zealand and hope you are too!

Historically, many advisers and professional investors have leaned allocation toward large foreign shares. This argument is typically based on the size and depth of the NZ market and our relative economic size. Here are four reasons often cited for going global:

A share’s liquidity generally refers to how quickly it can be traded without significantly impacting its price.

If you are a multi-billion-dollar fund manager, liquidity issues might have some weight, but the NZ stock exchange (NZX) has a total free-float market cap of $150 billion. This means that there are 150 billion dollars worth of shares available for trading to the general public.

The everyday investor will likely be just a drop in the ocean, as the size of our market is tiny in comparison to others. If correctly invested, especially in companies within the NZX 20 index, you’re very unlikely to be unable to trade your shares or affect a company's share price substantially.

Did you know: If half the share allocation of all KiwiSaver accounts were invested into NZ shares, this would mean New Zealanders through their retirement savings collectively owned about 25% of the NZ stock exchange. The reality is this ownership is currently closer to 7%.

Increasing this wouldn’t be a bad thing and would probably encourage more companies to want to list publicly, something the NZX wouldn’t mind either.

The most common objection to investing in NZ shares is that we are a little group of islands and there is a big world out there to get a piece of. At 0.1% of the world’s listed companies, we have little influence or impact and so investors seek the world economic return.

Fair enough, we say. We get the excitement of big global multinationals and their ambitions.

Except it’s the return on your investment that is important. Not whether you personally own 1 millionth of a NZ company or 1-trillionth of a foreign company.

There are only 126 companies listed on the NZX main board and about 45 New Zealand companies listed on the ASX and not NZX (hey, Xero).

The flipside is how many do you need to consider? Only about 70 of those listed on the NZX have professional fund analyst recommendations (this is called “coverage”) and about 25 have more than 5 analysts.

Naturally, the opportunity for diversification in NZ is lower, but good diversification only requires an avoidance of concentration. This can be achieved with as few as 12 companies, but ideally a few more.

See our article on the NZ 20 Fund and why we think it is sufficiently diversified.

A counter to some of the arguments for investing in NZ shares is that your overall wealth allocation is tilted to New Zealand's economic conditions already. Your income is in New Zealand dollars, your job security depends on the New Zealand economy, and your home or investment property is in New Zealand.

This is a fair argument, however, don’t forget that many large New Zealand-listed companies are significant exporters and that the performance of the share market and the economy are only weakly correlated (about 20%).

This is because expectations about future changes in the economy play a key role in current valuation. Although there may be some feedback effects involved, as changes in the share market may cause changes in the wider economy.

Trying to provide some balance to the common arguments, we favour a mix of both local and global. Some global exposure is certainly good, but as you have read, don’t discount New Zealand too quickly.

As to what the ‘magic number’ is when selecting your country allocation – that’s the million-dollar question.

Investing in International Shares: Location or Tax?

Tax can have a huge impact on your overall portfolio returns - in some cases by up to 2% p.a! We've ...

Stephen Upton

29 November 2020

Investing in Global Infrastructure – Why, What & How

As the backbone of modern society, investing in a Global Infrastructure Fund can provide many benefi...

Catherine Emerson

15 July 2020

NZ companies are pretty great and there many reasons you should want to invest in Kiwi made brands, ...

Catherine Emerson

21 November 2019

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices