Index funds are dramatically disrupting active fund managers and empowering a new generation of inve...

Dean Anderson

24 April 2020

COVID-19 has caused devastating harm to the health of millions around the world and to the livelihoods of billions with an inevitable economic recession. In the financial markets, COVID-19 has also given rise to another virus – a full-blown mania.

Individuals, confined to home, working remotely on flexible hours, with no social activities and no live events or sports to watch, have increasingly turned to day trading in the stock market.

Spurred on by new execution-only trading platforms, some coincidental mass marketing and a lack of sports betting, thousands of Kiwis took flutters on the New Zealand and US stock markets.

With big name, billion dollar companies taking double digit swings within a day, the volatility created opportunity and some great “big fish” stories. During the height of lockdown, the online videos and social media posts spouting great investing wisdom from bedroom analysts were many. The thing is, these often completely misunderstood and incorrectly promoted how stock prices move. Instead they were based on “hot tips” for their followers.

These factors have very likely contributed to the volatility that has recently characterized stock prices. The only true winners being those clipping the ticket with brokerage or foreign exchange charges.

The frenzied buying by day traders has been most evident in consumer brand companies, particularly on the NZ market.

Take our darling Air New Zealand for example. DIY traders are basically making a binary bet on the opening of global borders (most of AirNZ’s revenue and profit comes from international travel) and also the lack of future dilution. If the government loans are taken and converted to equity, or additional equity is issued as speculated, each current shareholder owns a smaller proportion of future earnings. Many new Sky TV shareholders, including NZ Rugby, learnt about this dilution impact recently.

There’s this nifty little tool on Google where you can find out how many searches there were for a particular term during any given period. So what about people searching for “Air NZ shares”?

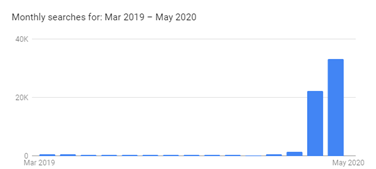

The graph below shows the extreme change and peak in people searching just that. In April & May 2019, ‘Air NZ stocks/Air NZ shares’ was searched for 1,380 times. In April and May 2020 – total searches were 92,300.

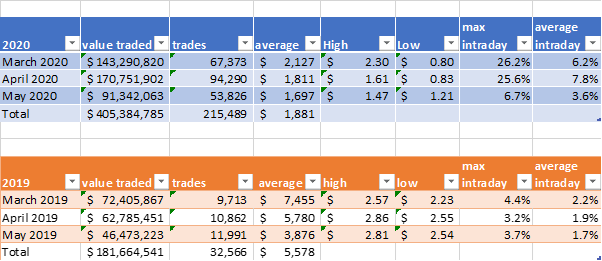

The below shows the volume of trading of Air NZ stock between March-May 2020 compared with the same period in 2019. We would highlight the max intraday trading figure for March and April 2020. This figure shows the highest daily price movement of Air NZ stock – and at 25%+ you can see why people were lured in for some “easy wins”.

Meanwhile, value traded doubled and the number of trades was 5-8x higher – part of a huge strain on the NZX systems that caused some public apologies. The true numbers are likely to be far higher due to aggregation of limit orders (you and I waiting to buy/sell at the same specific price can be aggregated as one).

More liquidity, more market participation, great potential? Except for the end result likely achieved by newbies. In fact, since the beginning of lockdown, 25% of the available ownership of AirNZ has moved to retail hands. There are tens of thousands of new investors as the professionals running institutional and KiwiSaver funds sell down.

There have been several studies of how poorly individual traders actually do in the stock market. A recently released study of day trading in Brazil, done by researchers from the University of Sao Paulo, found 97% of day traders made a loss, despite perceived emerging market inefficiencies. Another study, by the University of California, analyzed the active trading accounts of a US discount broker over a six-year period. They found that those active traders substantially underperformed a simple low-cost index fund. And the traders who traded the most had the worst returns. In another comparative study, the trades of day traders in Taiwan, where the practice has been especially popular, were analyzed over a 15-year period. It turned out that less than 1% of day traders were able to consistently beat the market returns available from a low-cost index fund. Over 80% of them actually lost money..

The risks are less that the beginner will lose all their money and more that they’re fooled into thinking this is the best way to build wealth. As per the above, the chances that the effort will pay off and supercharge your wealth are very rare.

I also have no argument with those who like to gamble. I have satellite picks to my portfolio and can tell ten-bagger stories too (thanks Pushpay!) I have a TAB sports betting account and I have won on the horses, pokies and at casinos. I came out ahead on some occasions but in the long run I am behind. That’s the cost of entertainment and the endorphins of a win.

But like the slogan, “Know the Odds”, I don’t confuse the speculation of day trading with true investing. Serious investing involves broad diversification, efficient tax management, avoiding market timing, staying the course and the use of investments such as index funds.

So please don’t be misled with false claims of easy profits from day trading. It is statistically very unlikely, especially without great tools, a lot of time and experience.

A fool and his money are soon parted.

Don’t be that guy.

P.S. before calling out a sore loser who missed great returns, you could benchmark your whole performance against this. Since 23 March lockdown to 17 June, the Kernel NZ 20 Fund is up 30% and the Kernel Small & Mid Cap is up 54%.

Index funds are dramatically disrupting active fund managers and empowering a new generation of inve...

Dean Anderson

24 April 2020

Want to know who can beat the market?

Everyone wants to beat the market, be the exception, have above-average returns. But how easy and ac...

Stephen Upton

2 December 2019

Who Are You Buying and Selling Shares From?

Most investors start investing in the share markets but don't understand who they’re actually buying...

Sam Tither

3 March 2021

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices