Three Forces Accelerating Sustainable Investing

Since 2018, sustainable investing has been on the rise both locally and globally. But what's driving...

Dean Anderson

20 December 2021

As investors, a primary goal is to maximise returns while minimising risks. Diversification is an effective way to achieve this goal. Global equity funds can provide a simple, convenient and cost-effective way to do just this by allowing investors to indirectly own a small part of large international companies.

Today, arguably more important than ever, investors can also focus their investments on a globally diversified index fund that offers robust ESG integration for investors who want to align their values with the companies they invest in.

The Kernel Global ESG Fund is the latest investment option added to our fund range, offering investors diversification across all 11 major industry sectors (as categorised by GICS) and across 24 markets.

The fund can be complemented and customised with Kernel’s New Zealand equity funds and Cash Plus Fund, as well as the broader spectrum of Kernel funds.

Like all of Kernel’s funds, the Global ESG Fund features incredibly low fees. Just 0.25%, with no hidden costs or transaction fees. It’s also a multi-rate PIE fund, holding all the underlying company shares directly, which means it’s tax efficient for a majority of investor profiles.

Read more details about the Kernel Global ESG Fund, including the country and sector diversification.

With dozens of global equity index funds to choose from, each tracking slightly different indices, there are several methods to determine which fund is best for you.

A key measurement to assess how one fund performs in relation to another is ‘correlation’. Put simply, correlation shows the strength of a relationship between two variables and is expressed numerically by the correlation coefficient. You can read more on how correlation works.

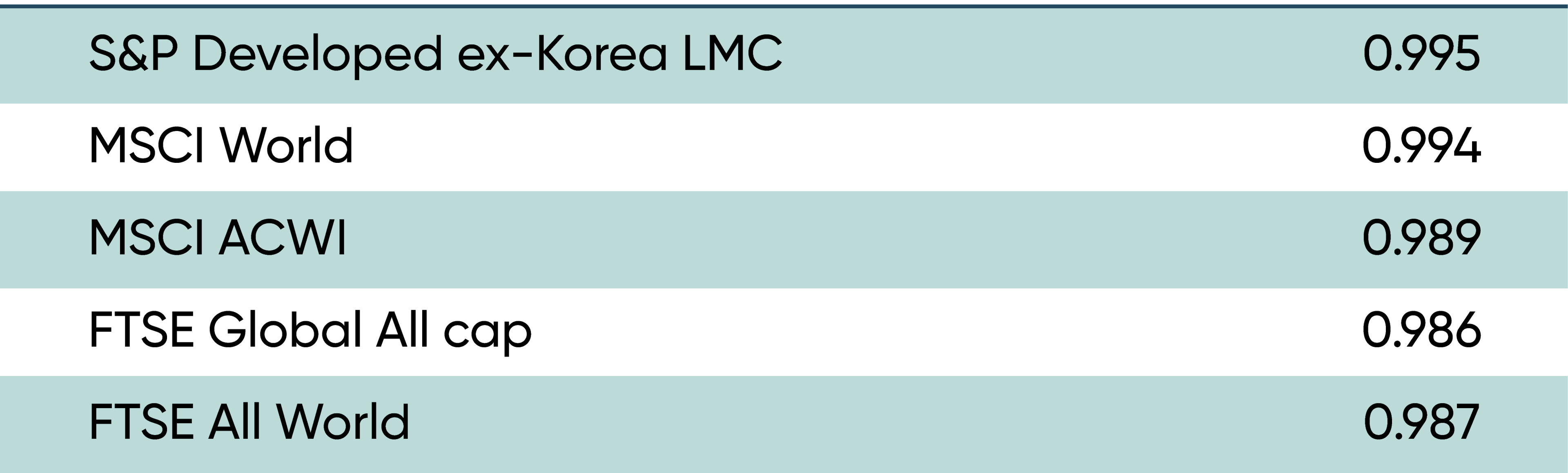

The correlation between the Kernel Global ESG fund index and other major indices has been very high over the past six years to 31 May 2023:

Although each of these indices is slightly different - because they are all highly diversified, investing across the same major sectors, and dominated by companies listed in developed countries - over the long term they tend to be highly correlated.

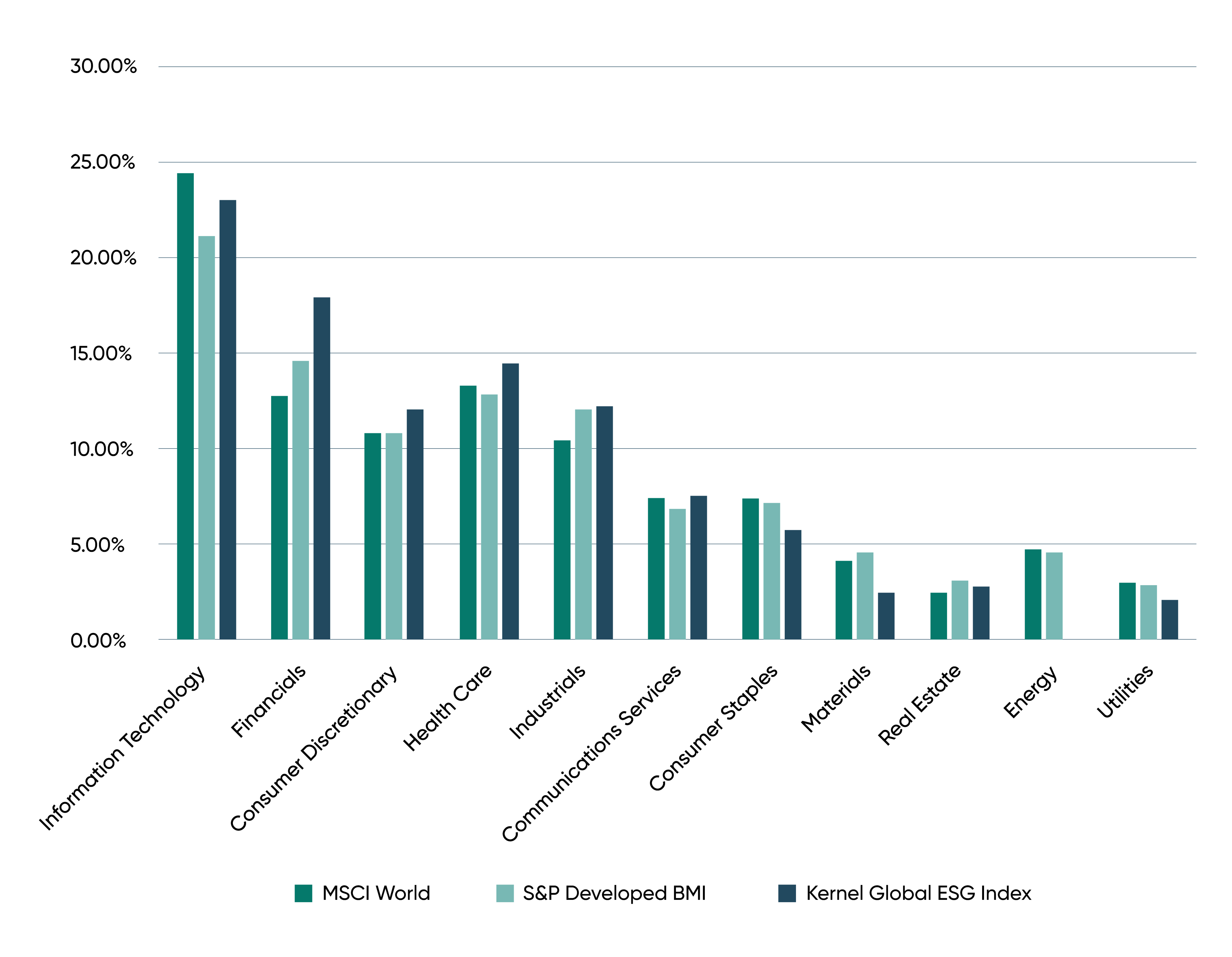

There are similarities between the index followed by the Kernel Global ESG Fund and a number of global equity index funds when examining indices. Compared to developed global market indices such as the S&P Developed BMI and MSCI World, the Kernel Global ESG strategy has an aligned country and sector composition.

When compared to the broader MSCI All Country World Index and S&P Global BMI, the Kernel Global ESG strategy country allocation is broadly similar with marginally higher weighting to the U.S. and underweighting to China.

When making investment decisions, investors are increasingly taking into consideration non-financial factors in their decisions. These include environmental, social, and governance (ESG) criteria, such as a company's carbon footprint, treatment of employees, and board diversity.

Increasing awareness of the effect of enterprises on society and the environment has led to a greater demand for sustainable investments. Non-financial factors are increasingly viewed as a means to mitigate risk and improve long-term financial performance – for example, an index that invests in companies with a lower carbon footprint, for instance, may be subject to less financial risk in a scenario where there is greater use of global carbon pricing on high greenhouse gas emitters.

Using thousands of data points, the Kernel Global ESG fund takes into consideration a company’s carbon emission and long-term climate risk, which is weighted in the index and how aligned they are with the 1.5°C of global warming.

In addition to the climate alignment, companies with activities in the following social concerns are also excluded from the fund:

To find out more, read more about the Kernel Global ESG Fund plus our ESG policy.

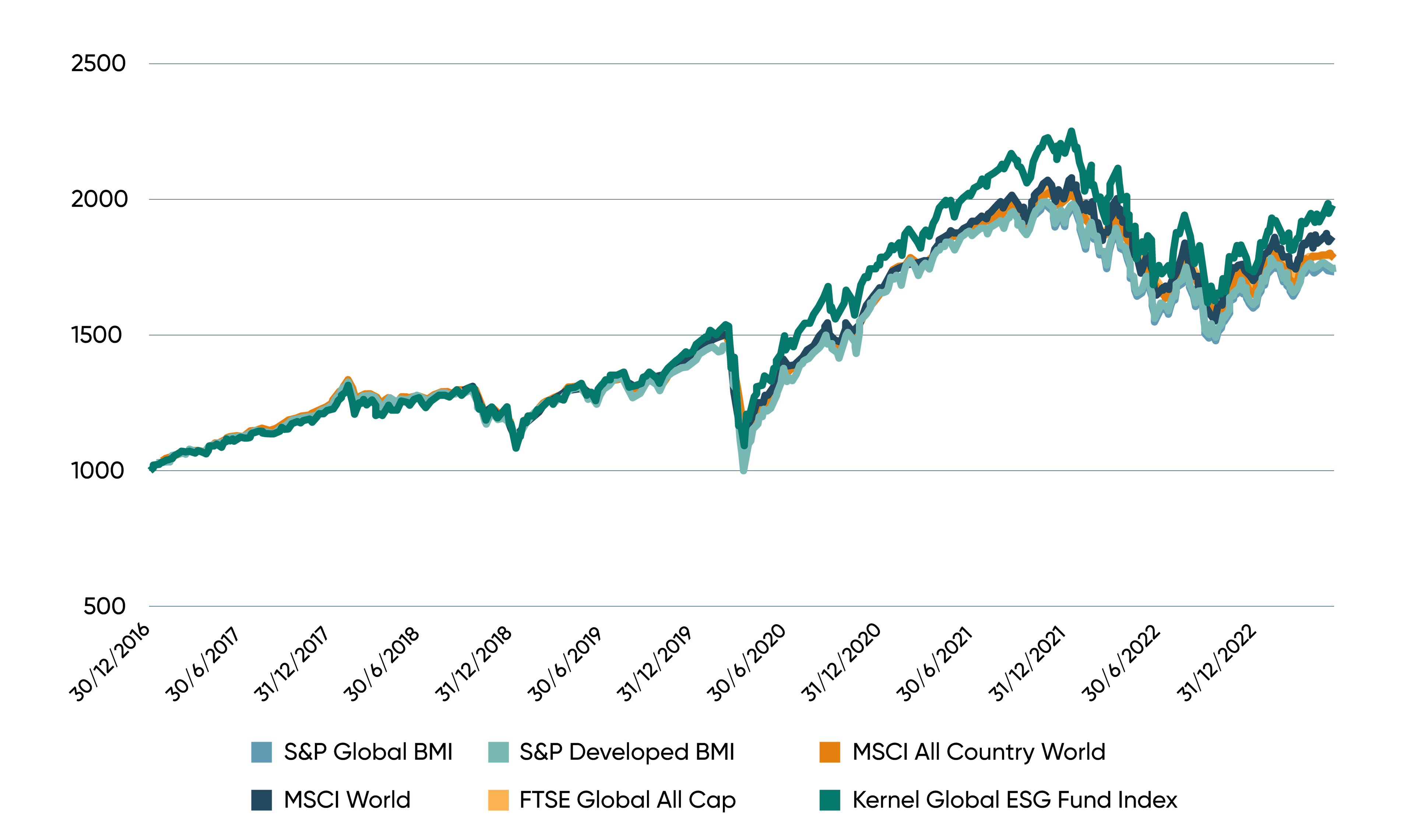

As highlighted above, the Kernel Global ESG Fund is expected to be highly correlated with other broad global equity indices, despite the variations between each index. This means investors should expect the long-term return and volatility to also be consistent.

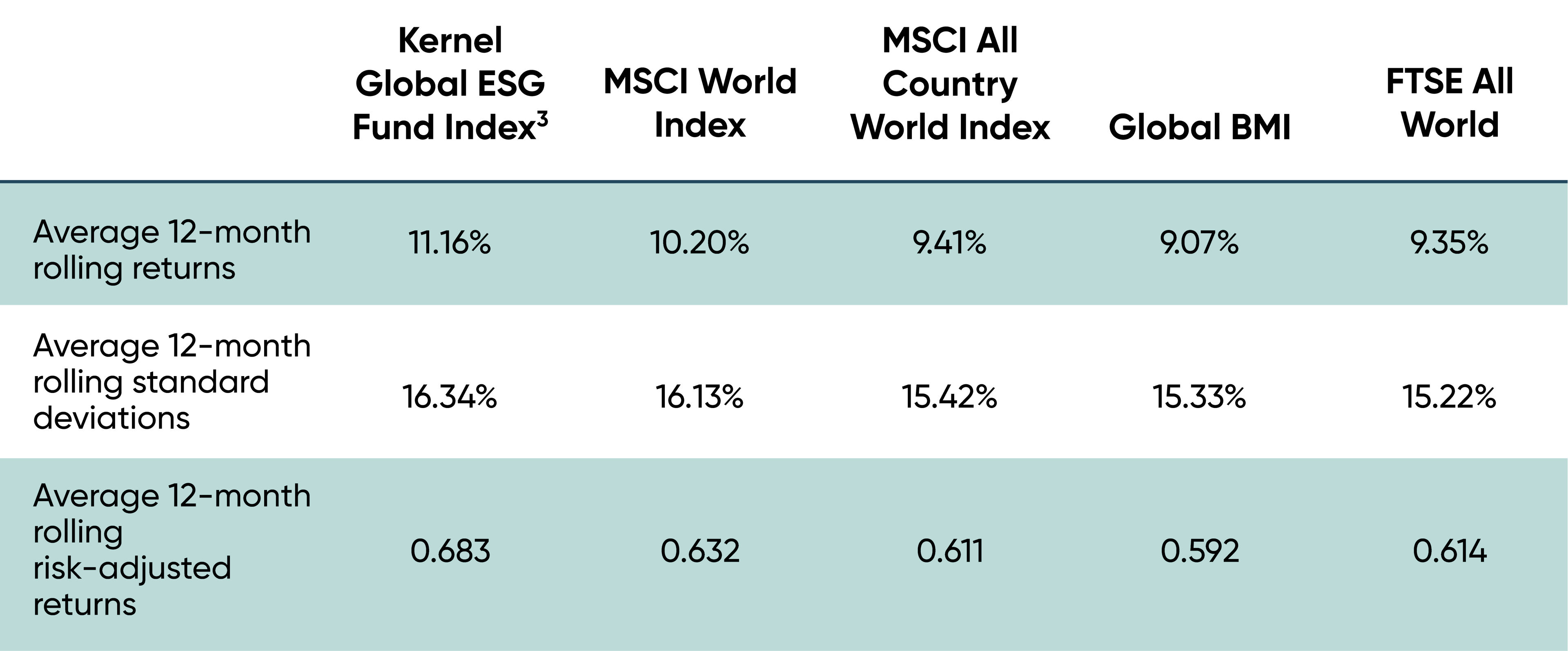

The table below shows how the Kernel Global ESG index has performed against broad market indices¹ over the six-year period to 31 May 2023, showing the Kernel Global ESG index had the highest average 12-month rolling² risk-adjusted returns during this time:

The Kernel Global ESG fund does have slightly higher volatility than other comparable broad market indices, but as a result, achieves a higher average 12-month rolling risk-adjusted return.

Its focus on investing in climate-resilient companies may soon help to reduce risk in a future where climate change increasingly impacts businesses and equity markets, such as the risk of greater use of carbon taxes.

A global equity index fund is likely to be a fundamental component for most investor portfolios. Investors gain exposure to equities which have historically generated higher returns than other asset classes like bonds or cash.

In addition, a global equity index fund can act as a hedge against inflation. As inflation rises, established companies can usually pass on higher costs to consumers, resulting in increased profits and higher stock prices over time. This can help to protect and preserve the investors' purchasing power over the long term.

Moreover, a global equity index fund can offer investors peace of mind. Instead of worrying about market volatility and attempting to time the market, investors can simply invest and allow the market to work for them over the long term. This can help to reduce stress and anxiety to allow investors to focus on aspects that can positively impact their long-term returns, such as maintaining a regular investment plan.

A global equity index fund can be an excellent tool for investors seeking to diversify their portfolios and gain exposure to a wide variety of companies across different geographies and sectors.

By providing low-cost access to global markets and acting as a core building block for most investor portfolios, the Kernel Global ESG fund can help investors achieve their long-term investment goals while minimizing risk.

With many global equity index funds to choose from, it is important to look for a fund with low total costs (including tax and transaction fees) and to consider if the fund's underlying index is suitable for your investment goals and risk tolerance.

Interested? Click the link below to check it out.

Three Forces Accelerating Sustainable Investing

Since 2018, sustainable investing has been on the rise both locally and globally. But what's driving...

Dean Anderson

20 December 2021

Introducing the Kernel Global ESG Fund, a Paris Aligned index fund

The Kernel Global ESG Fund is a globally diversified index fund aligned with the objectives of the 2...

Dean Anderson

7 June 2023

How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices