Diversifying With Purpose: The Role Of Global Equity Index Funds

Global equity funds can provide a simple, convenient and cost-effective way to invest by allowing in...

Dean Anderson

22 June 2023

Climate change and social issues are increasingly top of mind for consumers and investors, and as a result, the demand for ESG and climate-aligned investment products has surged.

The Kernel Global ESG Fund is a market-leading response to this demand.

The Fund holds a broad range of global equities that collectively align with the 2016 Paris Agreement, rewarding companies with strategies and outcomes aligned to keep global warming to 1.5° Celsius. The fund also goes beyond simple exclusions to deliver a more robust ESG integration for investors who desire the companies they’ve invested in to be aligned with their values.

Using thousands of data points, the index provider has profiled each company’s carbon emissions and long-term climate risk, with a transparent index methodology enabling us to build an efficient index fund for investors. Collectively, the companies and their weights in the index are optimised to align with the 2016 Paris Agreement.

This comes at a time when over half of Fortune 500 companies still have not committed to significant climate milestones, according to Climate Impact Partners data.

After the wild weather in the North Island in 2023 many of us have experienced the costly and tragic damage that the effect of global warming can cause. The data used to build the index also factors in where company assets are physically located and what the long-term climate risk may be, with weighting toward more climate-resilient companies.

While climate is the core focus of the fund; other ESG factors are also considered.

Our Global ESG Fund excludes industries that have been flagged as critical concerns for Kiwis such as controversial weapons, gambling and the revenues generated from fossil fuels.

With that said, exclusions can be a binary and overly simplistic tool for creating a fund that’s aligned with climate and ESG factors.

The Kernel Global ESG Fund goes further than exclusions and takes a more nuanced approach.

Each stock in the fund has an ESG score, with these individual scores impacting the weight of a company in the index. In other words, the fund puts more investment into companies that are treading lighter on the planet and causing less harm. There are very few funds in Australia and New Zealand that go beyond blunt exclusions to integrate ESG factors and align with the 2016 Paris Agreement.

What’s more, ESG and climate considerations don’t have to come at the expense of investment returns.

Investors are increasingly considering non-financial factors when investing however financial outcomes are still top of mind.

Critically, the index is designed to keep close alignment with standard global indices, meaning the Kernel Global ESG Fund’s long-term performance shouldn’t be compromised by its non-financial considerations.

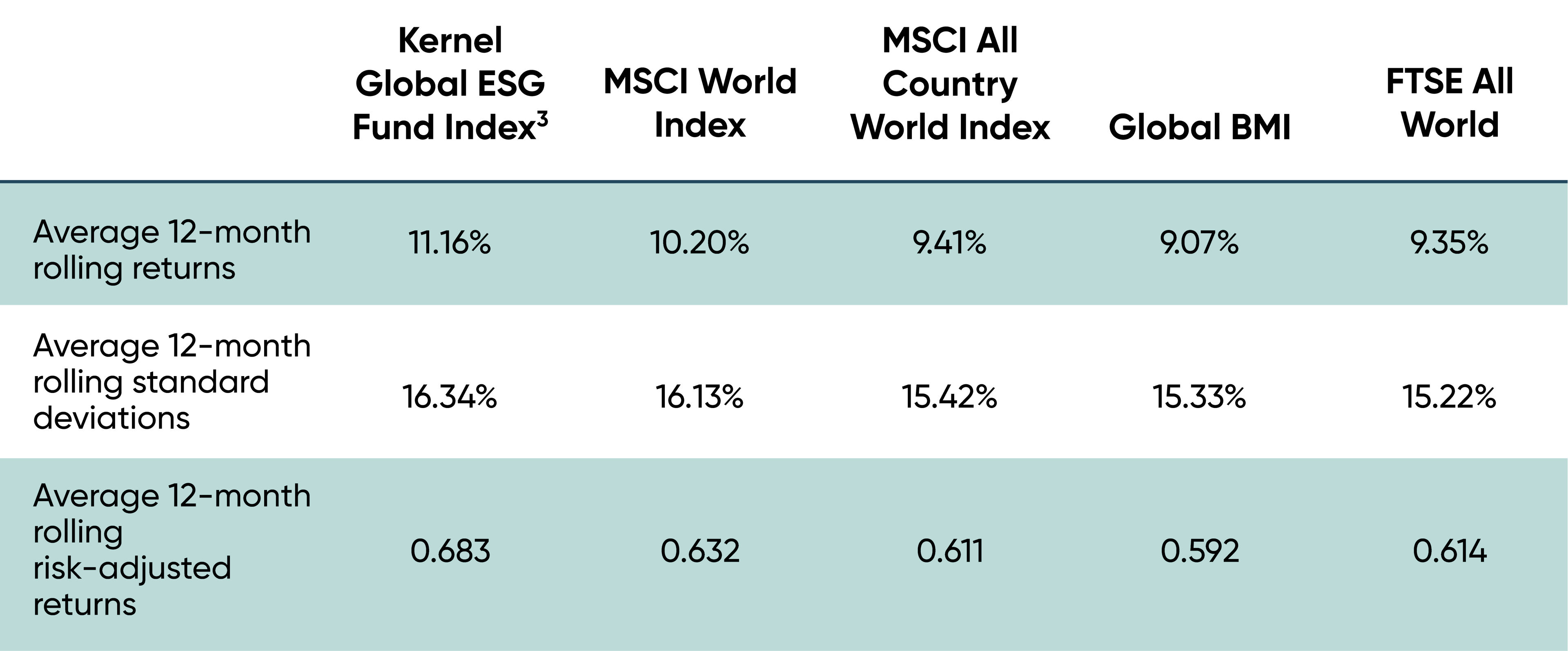

In fact, the table below shows how it has performed historically against common broad market indices¹ over the six-year period to 31 May 2023, showing the highest average 12-month rolling² risk-adjusted returns during this time:

The fund does have marginally higher volatility than other comparable broad market indices but still achieves a higher average risk-adjusted return on a 12-month rolling basis.

Its focus on investing in climate-resilient companies may even help to reduce risk in a future where climate change increasingly impacts businesses and equity markets, such as the risk of greater use of carbon taxes.

Like all of Kernel’s funds, the Global ESG Fund features incredibly low fees. Just 0.25%, with no hidden costs or transaction fees. It’s also a multi-rate PIE fund, holding all the underlying company shares directly, which means it’s tax efficient for a majority of investor profiles.

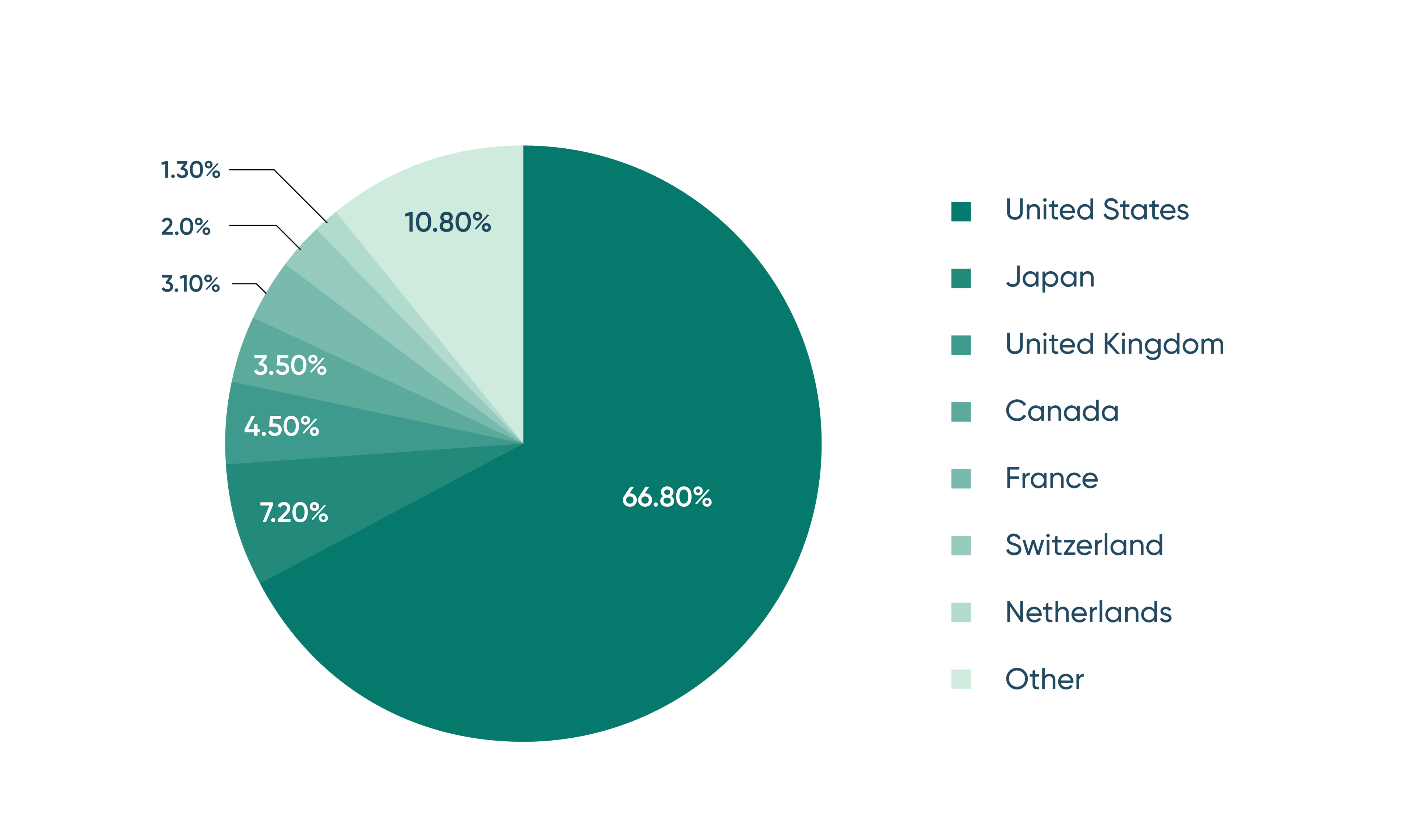

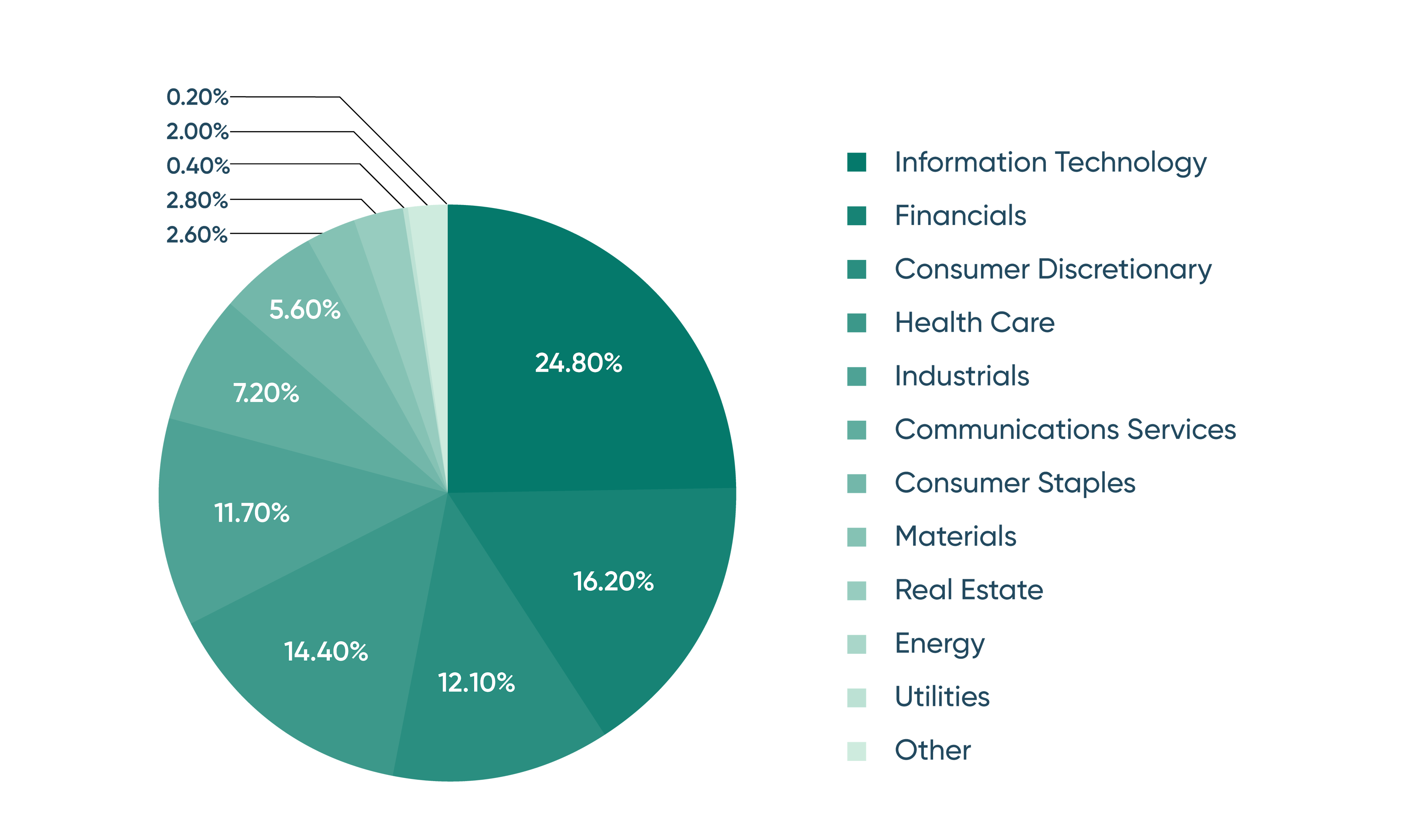

What’s more, the fund is diversified across several sectors and countries to give investors broad exposure across 24 developed markets and 11 major industry sectors (as categorised by GICS).

Diversification by country of the benchmark index of the Kernel Global ESG Fund as at 31 May 2023³.

Due to its ESG leaning and exclusions, the Kernel Global ESG Fund has a much lower allocation to Energy, compared to comparable funds such as the S&P Global BMI and the MSCI All Country World index. The Kernel Global ESG Fund has a higher weighting toward I.T. and Healthcare.

Diversification by sector of the benchmark index of the Kernel Global ESG Funds at 31 May 2023³

As a part of our commitment to ESG, we’re providing a high level of transparency for all investors. To do that we’ve published our ESG policy in full here and committed to monthly reporting to keep investors informed about all our ESG funds. This will include the following:

In addition to reporting, Kernel aims to use simple, clear and consistent language when discussing the non-financial objectives of our ESG funds. The full details can be found in our published ESG policy, including links to a number of great resources should you want to dive deeper into the topic.

Many institutional investors are already shifting their investment portfolios to indices that align with the Paris Agreement and consider ESG outcomes, including the NZ Super Fund.

Advances in the richness of available data has allowed these non-financial factors to now be available via a low-cost index design, resulting in the Kernel Global ESG Fund. This fund is an institutional quality, sophisticated investment solution with market-leading climate and ESG outcomes that allows everyday retail investors to also capitalise on promising ESG trends.

There’s no minimum investment, no transaction fees and no foreign exchange fees, so you can get started right away with any amount.

Interested? Click the link below to check it out.

Diversifying With Purpose: The Role Of Global Equity Index Funds

Global equity funds can provide a simple, convenient and cost-effective way to invest by allowing in...

Dean Anderson

22 June 2023

Do ESG and Sustainable Funds Have a Place in an Investment Portfolio?

Find out what exactly sustainable funds entail and how they can fit into an investment portfolio in ...

Dean Anderson

17 June 2021

Three Forces Accelerating Sustainable Investing

Since 2018, sustainable investing has been on the rise both locally and globally. But what's driving...

Dean Anderson

20 December 2021

Getting to know Kernel’s Sustainable Funds

With growing demand for ESG funds both in NZ and globally, we're proud to introduce Kernel's sustain...

Christine Jensen

28 July 2021

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices