Wondering whether you should invest in the NZ 50 Fund or the NZ 20 Fund? Find out why the NZ20 is ou...

Dean Anderson

18 July 2024

If you’re just getting started investing, you’re in the right place. This blog is our second instalment of a series on how to start investing, we’re covering all you need to know about building a portfolio. If you missed part one, you can read it here.

To emphasize the point again, this guide is for investors, not speculators or traders! We do not recommend short term stock picking, concentrated portfolios, cryptocurrencies or currency trading.

In his 2013 letter to Berkshire Hathaway shareholders, Buffett wrote that the instructions in his will state that the trustee is to invest 90% in a low-cost equity index fund, with the remaining 10% to be invested in short-term government bonds.

When asked whether Berkshire or the low-cost equity index fund would be a better investment for a long-term investor, he did not hesitate to answer that “I think the financial result would be very close to the same”.

When the premier active manager in modern financial history says that, you know that active management is a very hard game – and getting harder.

First, the most effective way to build your portfolio is by investing in funds. Funds that are well diversified and hold lots of different stocks or bonds, make it efficient to get diversification without having to buy each individual share or bond.

Funds are run by fund managers, the company and people that run the funds, and there are two types. Fund managers are either ‘Active’ or ‘Passive’.

Passive fund managers like Kernel, otherwise known as index fund managers, run… index funds. Index funds act like a basket of shares. They invest in all the companies listed in the index the fund tracks. For example, Kernel’s NZ 20 fund invests in the 20 companies in the S&P/NZX 20 index. There is no stock picking decisions, very little trading or associated costs, and the fund has low fees.

Active managers are stock pickers and traders. They regularly change their portfolio and try to find a select group of winning stocks that they think will outperform the market as a whole. At first glance, that sounds great. Why would you not want an “expert” doing all the analysis and why shouldn’t you aim for better than the market average? A lot of people are willing to pay big fees for this, thinking that it is like buying an expensive car – it must be better.

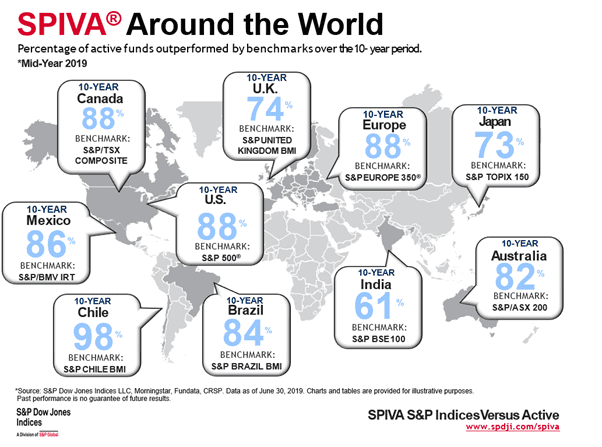

Countless academic studies and past performance returns have shown that the majority of stock picking investors and actively managed funds underperform the return of the market. You can see how poor active fund managers perform in the S&P Dow Jones annual S&P Indices vs Active (SPIVA) report card.

Source: S&P Dow Jones Indices

In markets around the world, over the past decade, active managers on average underperformed the market. In fact, in the majority of markets approximately 9 out of 10 actively managed funds underperformed and those few winners are not consistent.

Investors in these actively managed funds have ultimately paid higher fees to underperform the market, with the winner being the active manager who has collected these higher fees for themselves!

Successful investing is about owning the market and getting the market returns, while minimising the costs of that ownership. And by the way, this underperformance by active managers isn’t a new phenomenon or confined to the 2010’s. It has been consistently demonstrated across time periods, all the way back to the very first index fund launched in 1972.

When building a portfolio, you’ve got two options. You can try and pick, in advance, one of the very few funds that may beat the market. Or you can remove yourself from the game and simply own your share of the market return, at a low cost through an index fund.

This investment strategy is simple, can be implemented with as little as $100 and is backed by decades of research. The hard part is keeping disciplined through the short term excitement of the market and focusing on your long term investment strategy. As The Economist puts it:

“The truth is that, for the most part, active fund managers have offered extremely poor value for money. Their records of outperformance are almost always followed by stretches of underperformance. Over long periods of time, hardly any fund managers have beaten the market averages…And all the while they charge their clients big fees for the privilege of losing their money…you will almost never find a fund manager who can repeatedly beat the market. It is better to invest in an indexed fund that promises a market return but with significantly lower fees.”

Rather than attempting to outperform the market, invest in a portfolio of low-cost index funds.

Fees are what goes into someone else’s pocket, rather than yours. No matter how you invest, there are going to be fees. The key is watching out for high fees and ensuring you’re getting fair value for what you pay. High fees are not conducive to building a portfolio for your future!

When you see an actively managed fund charging 2% in fees, it may not sound like much, but it adds up to a significant amount over time. Remember, that the 2% is charged on your entire investment balance. Think of it this way: if you earned 6% in returns for the year, a 2% fee is actually 33% of all of your returns kept by the fund manager.

Here’s an example of how fees impact gains on a $10,000 initial investment over time (assumes a return of 6%).

Investment | Active Fund (1.50% fee) | Index fund (0.40% fee) |

|---|---|---|

Starting Amount | $10,000 | $10,000 |

Year 10 | $15,529 | $17,244 |

Year 20 | $24,117 | $29,735 |

Year 30 | $37,453 | $51,276 |

Actual rates of return may vary. Illustrative returns do not account for taxes and other expenses.

The last thing you want to do is overpay fees. Fees are so consequential, you should make sure that you aren’t overpaying for the service and outcome you are getting.

There is a small “but” to the above. Don’t just get suckered in by the lowest fee offering. The fund investment strategy (what they can invest in) needs to make sense to you. Further, the index fund manager needs to be able to demonstrate they can actually give you the index return, which is harder than you’d think.

Many index funds underperform their index through inefficiencies, incorrect operations or a number of different drag factors, including cash held, dividend treatment, tax handling or hidden costs.

A what? Dollar cost averaging (DCA) is a great strategy for those who are accumulating their investments. It means that you set up a regular investment plan into your funds and you purchase more units in the fund at a regular frequency, such as weekly or monthly.

Your strategy doesn’t change and you do this at higher prices when markets are up, and at a lower price when markets are down. The aim is to ‘average’ out the purchase price for your investments over a set period and calm your nerves along the way.

This is a really powerful, and very easy, investment strategy. In fact, in one of our blogs we compared the performance of an investor who simply put a set amount into a fund on a weekly basis for 20 years, versus someone who tried to time the top and bottom of the markets. Guess what, the investor who had a set and forget strategy, who never stressed about the markets and spent no time researching, outperformed the highly successful active investor!

Dramatic events, market corrections, misunderstanding of risk and fear of the unknown have kept – and still keep – many Kiwis away from investing. These factors have the average person believing it is risky and a game for gamblers or reserved for the wealthy.

Knowledge is power and by understanding the risk, we want you to see how easy and stress-free it can be. Our mission is to empower the financial future of millions and build products that enable great long-term wealth creation.

It is worth reminding ourselves that fear and loss is much more newsworthy than normal life and the random walk of the daily stock market. Stock markets have a habit of creeping slowly up, but “crashing” down loudly and unexpectedly.

It is easy to see why the non-professional investor worries about a 10% or greater fall. It feels like a significant amount. Fear and regret may set in. The investor didn’t see it coming and doesn’t know how long the market correction will last. This is especially the case if the portfolio value falls below the initial invested amount and we are in loss territory.

The tendency is to pull out and stand on the sideline in cash or move into more defensive assets. However, this will often compound the negative effect through transaction costs incurred and missing the rebound.

For most investors building a portfolio for the long term, a market correction is only a small pothole on the road to wealth creation.

So, what can the average person do to protect themselves from being affected by market noise?

Our advice is simple – let your financial situation and needs drive your investing behaviour. Don’t react to events in the markets. Remember, you’re building a portfolio for a specific reason or goal – don’t get distracted from that.

One of the biggest reasons many investors have low returns is because they sell at the wrong time, often reacting to news headlines. Investors also tend to be chopping and changing their investments just incurring costs in the process.

Rather than do this, you should create a plan you think will help you reach your goals over the time period you have to invest. Don’t stop investing because of bad performance. Stick to your plan without reacting to short term performance, news headlines, or opinions of “experts”.

It is also prudent to have emergency savings, so that you don’t need to sell an investment at an inopportune time, to pay for an unexpected expense.

You should always look for a fund with good diversification across the assets it invests in. This helps to reduce exposure to risks associated with a particular company or country.

Some funds offer exposure to specific assets such as property or infrastructure. Historically these assets can provide some defensive benefits, however unlike bonds, they generally move in the same direction as shares so should be considered part of the growth asset group. However they may be less volatile, as they often have stable revenue sources linked to inflation.

One of the great benefits of index funds is their transparency. As an investor, at any time you can see all of the investments each index fund is investing into. You don’t get that with active funds!

But not all index funds are the same, so consider which you want when building your portfolio. It’s important that you understand what the index invests in, how it invests and where it may sit within your portfolio. When investing in an index fund, the choice of index itself is extremely important, because ultimately, it is the index design and structure that will determine what sort of performance you can expect.

Not all indices are created equal, which is something we looked at a lot when deciding to launch an NZ 20 fund rather than an NZ 50 fund.

While we’ve already talked about the fees a fund charges, there are a number of other fees that may be hidden, or less obvious, and they can eat into your returns.

Common fees include:

Brokerage/transaction fees – these are charges you pay every time you buy or sell an investment. Brokerage fees can range from 0.10% to nearly 1%!

Buy & sell fee – like transaction fees, this is a clip that the fund manager takes every time you buy or sell into a fund. Often these range from 0.05% to 0.30% (Not at Kernel, we don’t charge a buy-sell fee)

Spread – when you buy into a fund listed on a stock exchange, known as an ETF (Exchange Traded Fund), there is a difference between the price you pay on the stock exchange versus what the actual true value of those units are. This is know as a spread and normally it should be small, around 0.05% or less, but it can become quite large.

Custody charges – if you are using a platform to invest or trade, there may be a custody charge. This is a fee charged to hold the investments on your behalf. It can be either a percentage fee or a fixed dollar fee.

NZ tax – this is the big one. In NZ, you typically only pay tax on the income (dividends) from the companies. Remember there is no capital gains tax on NZ investments, unless you are trading. The income tax is calculated using your own marginal tax rate, up to 33%. However, if you invest in a NZ based PIE fund (a tax structure), then the tax is paid on your behalf at a Prescribed Investor Rate. This is tiered like your marginal tax rate, except the maximum tax rate is 28%.

International tax – when you invest into funds or shares overseas, you are now exposed to a range of tax implications. In short – there is Foreign Investment Fund tax, withholding tax and leakage, and treaty benefits to consider. If you want to avoid this complexity, you can invest in a NZ based PIE fund that invests into international markets. This way, the fund will calculate and pay all tax on your behalf.

To recap, when thinking about building a portfolio, remember:

Diversification: Don’t have too many eggs in one basket. Academically, having about 20 companies is enough diversification. Those baskets also should be checked for asset class, sector, country and individual stock concentrations.

Minimize costs: When selecting the investments for your portfolio, be sure to use index funds with low fund fees but good net returns, so that more of the return goes in your pocket.

Minimize taxes: Reducing the taxes you pay leaves more money that can grow for you.

Index your investments: Don’t take on the risk of trying to pick stocks or an outperforming active manager. Instead, invest in a small number of low cost index funds that can demonstrate ability to get the market return.

Wondering whether you should invest in the NZ 50 Fund or the NZ 20 Fund? Find out why the NZ20 is ou...

Dean Anderson

18 July 2024

Investing in Global Infrastructure – Why, What & How

As the backbone of modern society, investing in a Global Infrastructure Fund can provide many benefi...

Catherine Emerson

15 July 2020

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices