Home & Away – Investing in Global vs NZ Shares

What proportion of your portfolio should you consider having in global vs NZ shares? We help you dec...

Stephen Upton

27 October 2023

Infrastructure: noun. The basic physical and organizational structures and facilities needed for the operation of a society or enterprise.

Global: adjective. Relating to the whole world; worldwide.

Kernel Global Infrastructure Fund: noun. A globally diversified exposure to infrastructure lines of business providing a relatively stable cash flow and inflation hedge.

Infrastructure is the backbone of modern societies, often benefiting from guaranteed government contracts or licensed monopolies and limited competition. It’s all around us, but not always thought about by investors when putting together a portfolio. Given its increasing popularity amongst investors seeking resilience and diversification in equity portfolios and the limited index options available in the space for Kiwi investors; it’s a welcome addition to the Kernel stable.

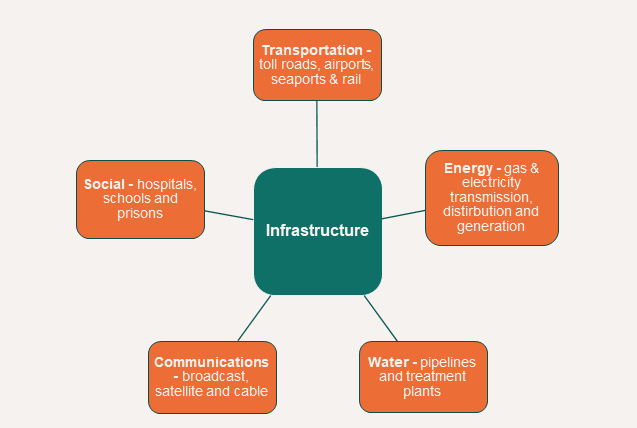

Broadly speaking, infrastructure assets are divided into five general sectors:

The Dow Jones Brookfields Global Infrastructure Index consists of only pure-play infrastructure companies. This means the companies focus on infrastructure: defined as having at least 70% of their revenue generated from infrastructure activities and at least 70% of their cash flows derived from infrastructure assets.

When you invest in this index, you can be sure you are investing in true infrastructure companies that position you well to reap the benefits below.

To give you an idea of the types of companies we are talking about, here’s a couple of the larger ones.

American Tower Corp & Crown Castles are leaders in communication services – owning, operating and developing cell towers, fibre networks and broadcast communications real estate. American Tower owns assets in over 19 countries (truly global) and they are one of the largest global Real Estate Investment Trusts (REITs).

Vinci, a global infrastructure conglomerate, is involved in the design and construction of the Auckland City Rail Link – NZ’s largest transport infrastructure project ever.

We’re glad you asked. Here are a couple of reasons.

Infrastructure companies provide essential services to society, services that we are always going to require. Therefore, companies who are involved predominantly in infrastructure business can offer stable and predictable cash flow, thanks to the support of long term contracts and regulation. This also translates into a higher yield than most other global equities. Something that may be attractive to an income-seeking investor.

Setting up a new global infrastructure company is no mean feat due to significant barriers to entry. Those within the index are exceptionally well established due to large economies of scale and exclusive use of key assets and government projects. Great examples here is the UK National Grid and Con Edison, which owns 150,000km of underground cable in New York. Not easy to compete with or substitute.

Due to the monopolistic characteristics and customers involved (often Governments), contract clauses often link infrastructure revenues to inflation. This provides investors an inflation-hedge – something that can be hard to find elsewhere.

The world’s population is due to reach 8 billion by 2024 and is only set to continue increasing. Not only this, but global living standards are rising. Both these factors drive need for more and better infrastructure assets. Both in the improvement of assets in developed nations and the creation of assets in developing nations. Increasing collaboration between the private and public sectors to fund infrastructure development is resulting in significant uptake globally. But who’s going to spend all this money to make these developments happen? Heavily indebted governments can’t afford to spend that money themselves, so listed infrastructure companies must be part of the solution. Companies such as Australia’s Transurban, France’s Vinci and Spain’s Ferravial would construct to undertake public works projects and even operate them.

Infrastructure is a great tool to provide additional diversification into a portfolio. It’s typically had low correlation to stocks, bonds and real estate – therefore being an asset class worth considering its own allocation. Additionally, the Global Infrastructure Fund provides investors access to investment opportunities that may not be available through direct investment.

So does that sound like something that could work into your asset allocation and goals?

The must-knows about the Kernel Global Infrastructure Fund:

Ready to invest in Global Infrastructure? Find out more below.

Home & Away – Investing in Global vs NZ Shares

What proportion of your portfolio should you consider having in global vs NZ shares? We help you dec...

Stephen Upton

27 October 2023

How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

Investing in International Shares: Location or Tax?

Tax can have a huge impact on your overall portfolio returns - in some cases by up to 2% p.a! We've ...

Stephen Upton

29 November 2020

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices