What do you want your future to look like? You might want to take care of your family, retire comfortably, buy a home, or simply spend more time with the people you love.

Whatever your future life goals are, investing and growing wealth is a great way to help reach them. To help you get cracking, we’ve put together a guide on how to start investing in New Zealand.

Why invest?

You could save your money under your mattress or in your main bank account. The problem with this approach is that your money’s unlikely to earn a positive real return, as inflation erodes its buying power every year.

E.g., You have $1000 saved towards a holiday next year and you’re earning 1.5% interest in your standard bank account but in a year’s time the holiday costs 3% more, you’ve effectively lost 1.5% of your buying power.

Think of investing as a way to outpace inflation by buying assets that can grow their value or produce income over time. While there are no guarantees and returns vary, a sensible, long-term approach can help build wealth.

The tricky part is choosing the right investments for you (and getting into a habit of investing regularly over a long time).

Three steps to start investing successfully

1. Set clear goals

To invest successfully, you first need a goal, or goals. This shouldn’t just be a number; it should be meaningful.

For example, it’s pointless to set a goal to just have a million dollars in investments or to own 10 properties. Instead, you should start with what you want to spend it on whether that’s something physical like a home or car, experiential like a holiday or education, or emotional, such as the feeling that you can retire in comfort.

This makes it easier to persevere and make the tradeoffs and sacrifices necessary to reach your goals.

Your goals and investing should also be:

- Simple - figure out what you want to achieve and work backwards

- Achievable - make sure your goals are doable and not impossible

- Automated - set up automatic payments and strategies to make investing easier

- Shared - tell others about your goals so they hold you accountable

2. Have an Emergency Fund

Before you invest in longer-term aspirations, it’s wise to set a base. Put simply, an emergency fund is easily accessible savings set aside for genuine surprises, e.g, job loss, medical costs, car repairs or urgent travel - so you’re not forced to sell investments at a bad time.

You can learn more about how to set up an emergency fund here.

Once you’ve built a buffer that suits your situation, you can invest with more confidence and reduce the risk of having to sell investments to cover bills or unexpected expenses.

3. Choose the right investments for your goal & start a habit

Many people have been tricked into thinking that they need to be financial experts to invest successfully, but the fact is, most everyday Kiwis are completely capable.

The secret isn’t spending days pouring over data attempting to beat the “market” - you don’t need to be a genius to invest well. The way forward for most Kiwis is to choose investments that suit their goals, risk appetite, and investment horizons, then build a diversified portfolio and get into the habit of regularly investing over a long period. That’s it.

To do this, work backwards from your goals to figure out what investments are most suitable and how much you need to invest regularly. Then all that’s left is to set up your portfolio, get started, and keep going for as long as possible (the longer the better).

Here’s a simplified example you could work through:

- The goal: To retire comfortably at 62 (random number, but it made our maths easier).

- Working backwards: The average life expectancy in New Zealand is around 82 years old, so you’ll need enough cash to live on for at least 20 years (women live a bit longer, men a bit shorter). The Society of Actuaries recommends spending a maximum of 6% of your retirement funds a year to ensure your savings last for 20 years, with a little left over.

- The amount: assuming you plan to live a comfortable lifestyle with plenty of choices, you’ll need $260,000 if you receive NZ Super and have a mortgage-free house to last 20 years (according to Massey University’s NZ Retirement Expenditure Guidelines).

- The investment strategy: if you were to invest $125 a month in a selection of low-cost index funds from the age of 32 to 62, you could end up with around $274,899 to retire with (assuming you earn a return around the same as the S&P 500 historical average)

(Example above is illustrative only. They are not a recommendation.)

You may not want to rely on NZ Super for your retirement, and fair enough. Whether or not you can still access NZ Super down the track is mostly out of your control, but you can control your investment habits.

Things to think about when choosing an investment

Investment horizon & volatility

Knowing your investment horizon, or how long you intend to invest for, will help you work out what type of investments are right for you - and how much volatility you can handle.

For example, a conservative fund may go up and down in value less frequently and dramatically, but over the long term, its expected returns are likely to be lower than a high-growth fund.

That’s why if you’re investing for the short term, it’s generally considered wise to lean towards less volatile investments to have less chance of losing money due to short-term volatility.

Here’s a general rule of thumb:

- If you’ve got less than three years, Cash and ‘Conservative’ fund options may be more suitable, as they aim to minimise short‑term fluctuations and preserve the value of your investments.

- If you’ve got 3-7 years, A diversified mix of cash, bonds and shares may be appropriate, accepting some volatility in pursuit of moderate growth. (e.g, Balanced Funds)

- If you’ve got 7+ years, growth‑oriented options, such as shares & property, may suit investors who can tolerate larger short‑term movements for the potential of higher long‑term returns. (e.g, High Growth Funds and index funds)

However, one thing to note is that higher volatility doesn’t guarantee higher returns.

Diversification

All investments have some level of volatility and will go up and down in value. To protect yourself against this volatility, you can consider diversifying your portfolio - or as Nanna used to say:

“Don’t put all your eggs in one basket.”

Nanna

This spreads your risk to reduce your exposure to a particular company’s failing or fall from grace, tough times for specific sectors, and other events you can’t foresee. While diversification reduces exposure to individual company risks, it does not eliminate the risk of loss.

There are lots of ways to diversify, but our favourite is core-satellite investing. This involves holding 80% to 90% of your portfolio in broadly diversified low-cost index funds, and 10% to 20% in slightly more speculative, volatile investments like individual shares, or thematic funds.

Fees

You’ll pay fees on any investment you buy and hold, whether index funds or actively managed funds. You should always be aware of what you’re paying for, details of which you can find in product disclosure statements for most investments.

Fees shouldn’t be viewed in isolation; what’s most important is your return after fees are deducted. It’s also worth knowing that fees, whether higher or lower, don’t necessarily indicate future fund performance, but high fees can work against you and can have a great impact on your returns over the long term.

Actively managed funds often have higher fees, and while they aim to outperform with their high fees, independent scorecards such as SPIVA, show that over longer time periods, the majority of active funds in almost all categories underperform their benchmark after fees, and there is little to no persistence, meaning repeating of outperformance. That’s why for most investors, it’s worth considering low-cost, passively managed options like index funds.

Liquidity

Liquidity is how quickly an asset can be converted to cash, and at what cost. This concept is relevant for investors because unexpected stuff happens all the time, and it’s a good idea to have some investments that can be sold quickly just in case.

On the other hand, it’s also a good idea to have some investments that are illiquid, or difficult to sell, so that you can’t impulsively sell them all to go on a shopping spree, or panic sell when the market dips.

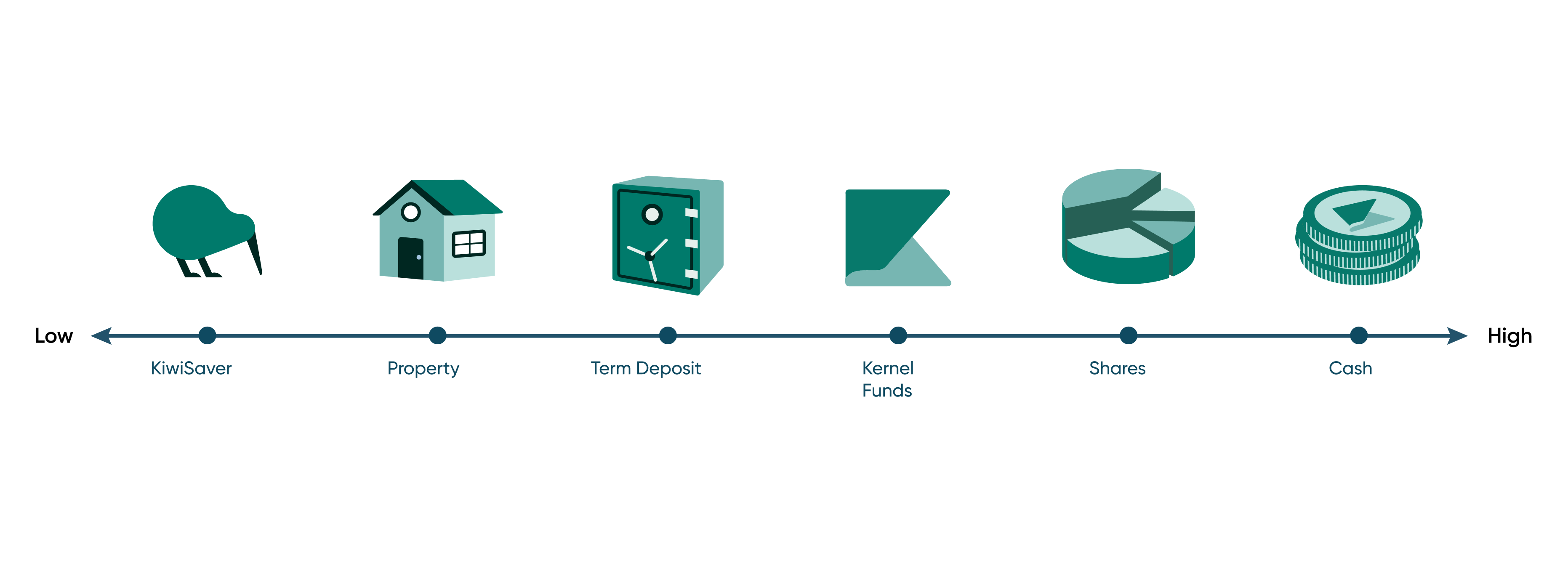

KiwiSaver investments and property are considered to be illiquid, whereas shares and Kernel Funds are more liquid. While KiwiSaver can be switched to lower or higher risk profiles, it cannot be withdrawn for most people under 65.

Liquidity scale

Types of investment to consider

Now you know the basics, and you’re ready to start investing. What are the assets you should consider?

- Savings accounts: a great way to store money for the short term, but they won’t earn high returns. Smart Saver is a Kernel account that pays a competitive interest rate, with minimal fees.

- Term deposits: these are a bit like a savings account, except you can’t access your money for a given period of time and are therefore paid a higher interest rate at the end of a given term.

- Property: can be a great investment, but there’s a high barrier to entry, and property investments tend to require more work and upkeep than most others. Returns from property investment comes from rental income, and capital gains (if the property’s value increases and you sell). You can also gain exposure to the property market via products like Kernel’s NZ Commercial Property fund.

- Bonds: are a promise by a government or business to pay you back over a given number of years. As the holder of the bond, the organisation will pay you an interest rate. Learn more about bonds here.

- Shares: when you buy a share, you buy a little part of a company. If that company is perceived to be going well, your share may go up in value, and if they make a profit, you may be paid a share of that profit (called a dividend). The problem with shares is that, since their value hinges on the perception of success or failure of a single company, they can be very volatile and risky. Read a full guide to buying shares.

- Actively managed funds: these are a portfolio that are actively chosen and changed by an investment professional to outperform a given benchmark. They often charge higher fees, which can make it difficult for them to match the performance of lower fee options like index funds. However, they may have a chance to outperform the benchmark depending on the timing and skill of the fund manager.

- Index funds: are a selection of shares that are designed to track the composition and performance of an index. There are many varieties like the S&P 500, NZ50, an index of a specific industry sector (like the NZ commercial property market), or considering an investment preference (like ESG). These are passively managed, meaning an investment professional isn’t actively picking good companies over perceived bad companies, and because of this, the fees are often lower (many of Kernel’s index funds have a fee of only 0.25%). These funds hold a variety of different shares, so they are diversified to an extent, which can help reduce volatility.

- ETFs: Exchange-traded funds are often confused with index funds, but they’re not the same thing! An ETF is simply a fund in which you can buy and sell units on the share market from other investors rather than from and to the fund manager. They can be index funds, but they can also be actively managed funds.

- KiwiSaver: you can hold index funds, ETFs, managed funds, and individual shares through your KiwiSaver investment. It’s a great way to automate savings, get a 3% contribution from your employer, plus an annual government contribution. While it’s important to keep in mind that you can’t withdraw until you’re 65 years old or buying a house, the fact that you can’t withdraw your investments can be a good thing. Read our guide to choosing a KiwiSaver fund.

- Alternative investments: there are countless other types of investments that you could consider, but many of these are much higher risk. Cryptocurrency, for example, can provide high returns, but can also be extremely volatile - there are cases of currencies dropping in value to near zero. Foreign exchange trading (FOREX) is another high-risk investment, which should only be considered by well-informed and highly experienced investors. Commodities like gold can also be good for diversification as their price might move in a different rhythm than other asset classesbased on demand for that physical material, but these can be risky too and should be approached with caution. Private Equity or Debts, where there is less public information and reporting to help establish whether performing well or poorly.

The moral of the story is that all investments are risky to some degree, and you should never invest in anything you don’t fully understand. If something seems too good to be true, it probably is.

If you want to read more about different types of investments like crypto, FOREX, and gold, the Financial Markets Authority has a detailed list that’s worth checking out.

Getting financial advice

As you can see, there are a lot of investment options and plenty to learn. But do you need help from an expert to make sense of it all?

Generally, no, if you're comfortable managing your investments and you like doing it, you don’t need to hire a financial advisor. There’s been a huge rise in DIY investing, supported by the rise of low-cost, user-friendly investment platforms like Kernel.

The information and customer support offered by Kernel and similar platforms make it easier to make informed investment choices and upskill without the help of an expert.

Read more about DIY investing VS using a financial advisor.

That said, a good financial advisor can add value. They may help you get out of a sticky financial situation, help you decide on the right level of risk, and keep you accountable when you need a nudge in the right direction.

If you are planning on choosing a financial advisor check out this page on financial journo, Mary Holm’s website on choosing a good one.

Learning about investing is like putting money in the bank

Even if you know next to nothing about investing right now, you can learn everything you need to know. There are countless great resources to look at, including:

- Sorted: a great place to learn the basics.

- The It’s No Secret podcast hosted by Kernel’s very own Cat.

- Kernel’s educational resources and resources from other investment providers.

- Books, especially New Zealand-specific ones. One of our favourites is Rich Enough by Mary Holm.

- Anything from MoneyHub and Interest.co.nz. These guys provide great impartial advice on all things finance.

Being curious helps you be a good investor, but you don’t need a degree or to spend your weekends studying (unless you want to). Learning the basics is enough for most people to achieve their goals if they’re investing for the long term.

The secret to investment success? Small actions, taken regularly, over a long time

You could choose a single stock that goes to the moon. Maybe you’ll invest early in a new memecoin, or perhaps you’ll win the lottery. All these things could happen, sure, but they’re very unlikely, and the vast majority of people will lose more money than they make trying.

A better option is to set up a solid, diversified portfolio that suits you, then regularly invest over a long period of time. The keyword here is time - because the longer you invest, the stronger the effects of compound interest are.

Over time, the magic of compound interest will supercharge your investment returns, and even if you’re only contributing a small amount and not earning huge returns, you may still be surprised by what you end up with.

- Sign up for Kernel and start building a better financial future one step at a time.