How to Build an Investment Portfolio Using Index Funds in NZ

With everyone's needs and goals being unique, how should you approach building your index fund portf...

Dean Anderson

7 September 2023

As they say, there’s no such thing as a free lunch (or a free investment).

When you put your money into a managed fund, index fund or other investment product, chances are, the investment provider will charge a fee, to enter, exit or for the administration while you are invested.

While these fees may seem minimal, they can greatly impact the total return of your investment over time so it’s worth knowing how they work.

Fees for managed funds, ETFs and index funds are usually charged annually as a percentage of your total investment value. Usually, this fee will be deducted from your returns or investment account automatically inside the unit price so it may be easy to forget that you’re paying them.

If you’re not sure what exactly you’re getting charged for, it’s a good idea to ask your provider for the investment’s product disclosure statement and a breakdown of all the costs involved in investing with them.

Lately, low-fee investments are all the rage, and with good reason. Paying 0.25% instead of 2.00% on your KiwiSaver balance could save you thousands, even millions depending on the investment amount and time horizon. This is due to the immense power of compounding interest.

But what’s most important is value.

In other words, when it comes to investing, fees shouldn’t be viewed in isolation - what’s most important is your return after fees are deducted. That’s why, when assessing investments, you should always consider fees as part of the whole, rather than a separate cost.

Broadly speaking, there are two main investment styles which can vary in cost and performance:

Actively managed funds: These types of funds are managed by an investment expert. They aim to outperform a set benchmark, which is why they typically charge higher fees.

Index funds: are a basket of shares that aim to track returns by mirroring a specific index or a specific market segment. This style of investment usually requires fewer resources, which is why they can typically charge lower fees.

Fees whether high or low, don’t indicate future fund performance. However high fees can work against you and can have a great impact on your returns over the long term.

In fact, according to S&P Index vs Active (SPIVA) data, 85%+ of actively managed funds fail to beat their respective index benchmark over 10 years or longer.

While some active fund managers will beat the market over shorter, or perhaps even extended periods, continued performance becomes incredibly difficult over time. There is little to no evidence that higher fees create higher returns, with much more evidence of the inverse.

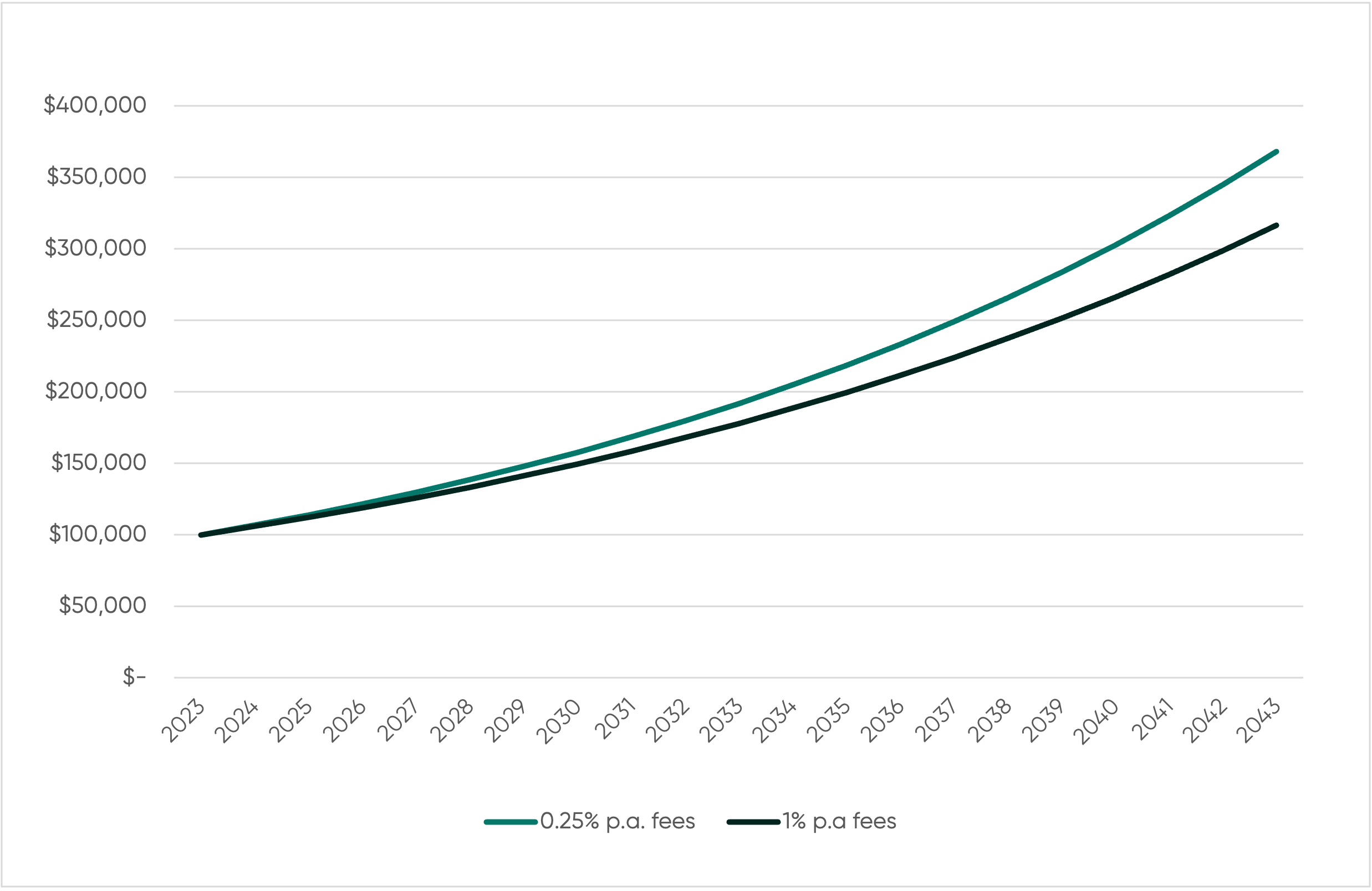

To give you a simplistic idea of the impact of fees, let’s assume that you and your friend both had $100,000 to invest over 20 years.

You both chose funds that happened to consistently return 7% each year. However, you chose a fund that costs 0.25% p.a. while your friend chose a fund that costs 1.00% p.a.

This is an overly simplistic example and doesn’t factor in any market conditions, other fees, or the variability in the fund manager’s performance.

Assuming both had equal performance you would’ve earned $368,072.73.

In contrast, your friend would’ve earned $316,504.18.

That’s a 52% higher return and $51,568.55 that you saved purely on fees!

This example is to give you an idea of the compounding impact high fees can have on your investments.

It’s a great idea to review your investments regularly to check whether they still fit with your investment goals, risk profile and principles. While management fees are an important part of the equation, it’s worthwhile checking how your investment costs compare to other similar funds and the impact over the life of your investment (the size of this number may shock you).

You can jump over to the New Zealand Sorted (www.sorted.org.nz) website's KiwiSaver and managed fund finder and pop in your details. It’ll give you a list of funds available, which you can sort by fund type, past returns and fees, allowing you to compare your fund to the rest easily.

Noting fund performance is for 5 year periods only and therefore currently excluding Kernel funds.

Sort by fees low to high and you may notice that Kernel funds are among those with the lowest management fees, as we charge 0.25%p.a on most of our funds.

What’s more, Kernel doesn’t charge any extra fees for our KiwiSaver funds - just one low, transparent annual management fee.

While our funds have low & transparent fees, we encourage you to consider all relevant factors, including investment objectives, risk tolerance, and fund performance, in addition to fees, when making investment decisions.

How to Build an Investment Portfolio Using Index Funds in NZ

With everyone's needs and goals being unique, how should you approach building your index fund portf...

Dean Anderson

7 September 2023

How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

3 Tips to Make the Most of Your KiwiSaver Plan

Want to make the most of your KiwiSaver but don’t know where to begin? Here are 3 tips to get you st...

Tim Rodriguez

10 January 2023

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices