How to Set Up an Emergency Fund

We never know what life can throw at us financially, so we need to be prepared when big expenses hit...

Dean Anderson

4 August 2025

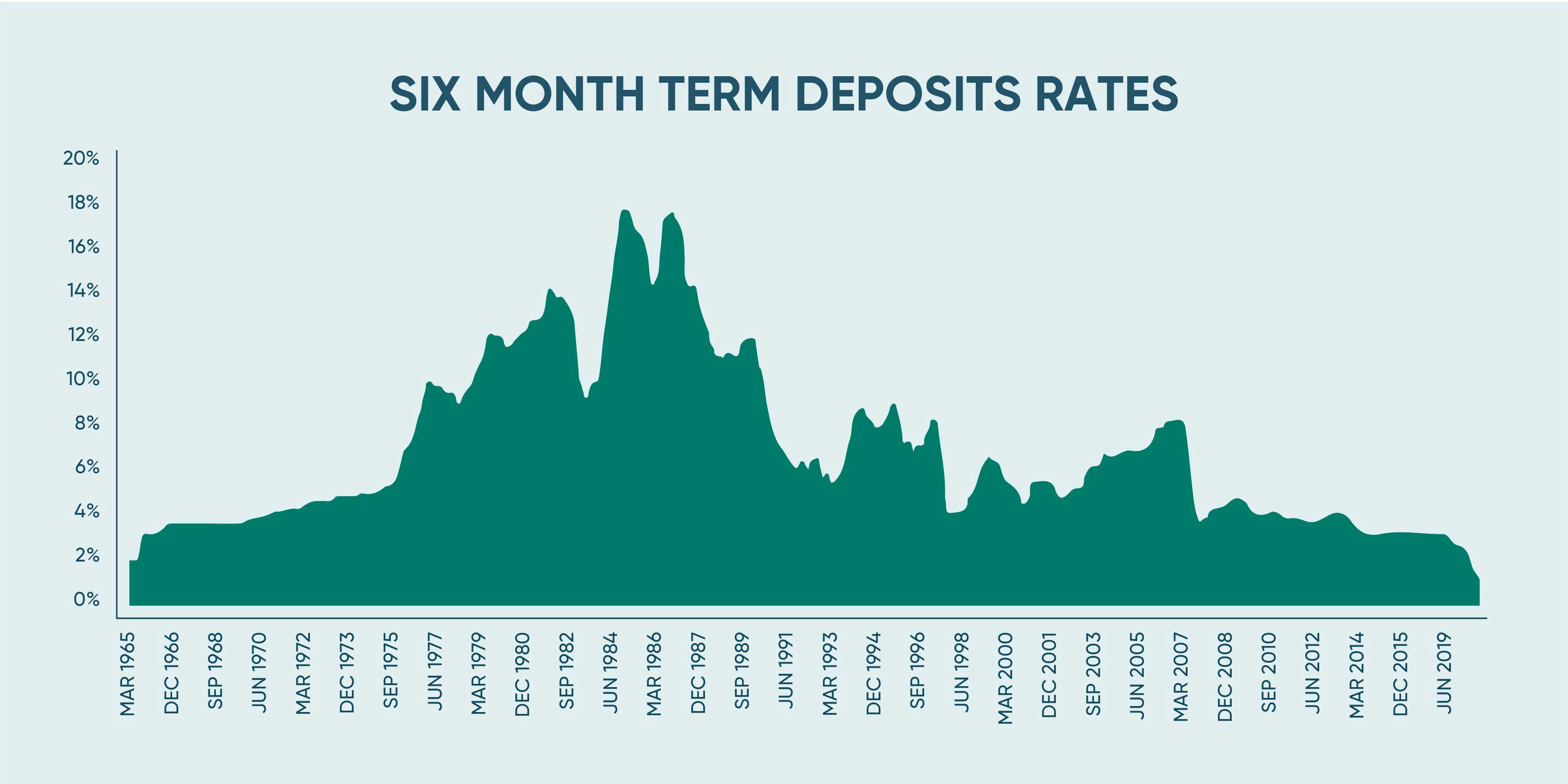

Many of us would have had savings in bank accounts when interest rates were 0% in 2021. Interest rates have increased, however let's unpack why they hit zero and how it might impact our investments if they were to hit 0% again.

Before we look at how to invest when interest rates are 0%, it’s worth looking at why interest rates are that low.

Falling interest rates isn’t a new phenomena (negative interest rates are though!), in fact it’s been a 40-year macroeconomic trend.

Most recently, interest rates have been cut on the back of two major economic shocks; the Global Financial Crisis and COVID-19.

Let’s look at it from the banks perspective. When COVID-19 struck, people rushed to put their money in a safe place, like a savings account. Banks pay you money to keep your money there because they need cash to do what banks do; lend money out to homebuyers and businesses. As the supply of money available to banks increases, the less they are willing to pay you for your money.

During this time, The Reserve Bank of NZ lowered interest rates, simultaneously increasing the money supply.

This helped struggling businesses stay afloat by lowering their cost to do business, and encouraged spending, lending and borrowing. While this was a good outcome for those hit hardest during this crisis, your savings account would have been an unfortunate casualty.

Source: S&P Dow Jones Indices

When we talk about “interest rates” we’re referring to the official cash rate (OCR). OCR is an interest rate set by the Reserve Bank of New Zealand which defines the wholesale price of borrowed money. This is the rate the Reserve Bank (wholesale bank) charges other banks to borrow money for one day. In turn, this directly affects every other interest rate a bank will offer or pay their customers.

For example, mortgages, loans, credit cards and what they will pay for term deposits and savings accounts. The Reserve Bank reviews the OCR eight times a year.

Central banks are mandated by the government to manage the rate of inflation and increasingly other economic measures such as employment.

By making changes to the OCR they try to regulate the economy and directly affect the money supply. If a central bank cuts the rate, it will be cheaper to borrow money. There will be more money available, at a lower price, which tends to make some people spend more.

On the flip side, when the central bank raises the rate, it gets more expensive to borrow. This means there will be less money circulating, the price to borrow will be higher and people tend to save more.

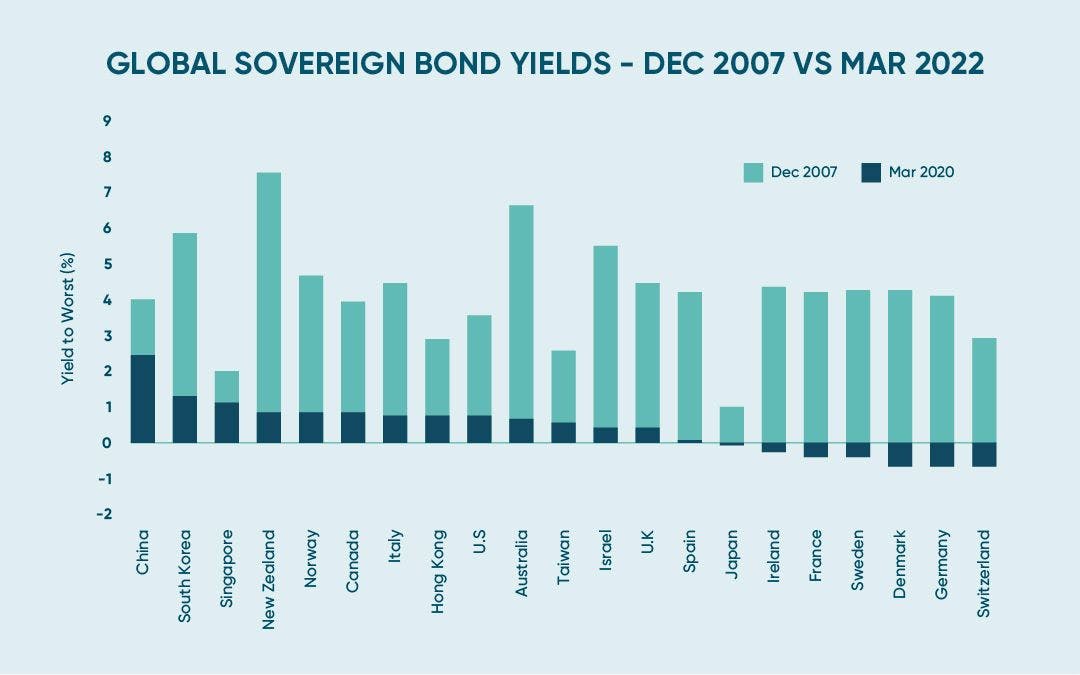

The biggest challenge that was faced by central banks was that interest rates had fallen so far that they were at zero and in some countries negative!

Ongoing cuts to interest rates are unlikely, as further cuts have a diminishing impact on stimulating growth. Instead, we can expect to see governments revert to other means to drive economic growth and prosperity. This is called fiscal stimulus. Most often it involves activities such as infrastructure spending programs in order to create jobs and stimulate the economy.

Everything in investing starts with assessing what your goals are. If it’s money you can’t afford to lose in the short term, a savings account is still a great idea.

Of course, the realities of saving versus investing cannot be oversimplified. There are many personal factors to consider, like whether you have an emergency fund or a near-term big-ticket purchase, like a home or new car.

There are many good reasons for favouring greater savings in the present, even if it means earning less. However, savings at the exclusion of investing can prove problematic over the long term.

The relationship between interest rates and financial markets is complicated and not always predictable. First, there are three key asset classes to consider: cash, bonds and shares.

Cash (like savings accounts and term deposits) have the least risk and therefore the lowest returns. Shares have the highest risk of the three, so they need to offer the highest returns to be attractive. Bonds need to provide returns above cash, with less risk than shares.

Investing in shares isn’t as risky as many perceive, as long as you have a diversified portfolio across a range of companies, sectors and have time on your side.

When interest rates for savings accounts are low, saving becomes much less attractive. Your real returns are negative and no longer provide the income investors require. This means you need to consider investing over saving.

This can result in the price of these assets increasing, as there is more demand. If the price of shares increases without their fundamentals (i.e. the expected profits of a company) changing, the returns you can expect are lower.

So low interest rates are a bit of a double-edged sword. When interest rates are cut, the share markets will get an immediate boost. However, lower interest rates also make your expected rate of return lower in the long run.

We know diversification is a key investing strategy and the 2020 pandemic actually amplified its importance.

However, the low-interest rate environment (and the increasing chances of an interest rate rise), means investing in bonds may no longer provide the return benefits that investors expect.

Bonds in an investment portfolio aren’t generally viewed as return enhancers but rather seen as volatility dampeners. If your investment time horizon is short, where you plan to spend that money soon at a fixed point in time, then it makes sense to use bonds.

If you’re investing for a long-term goal (10+ years) you shouldn’t be too concerned about market volatility because you’ve got the time to ride it out. This is why, when we hear from people in their 30s saving for their retirement (25+ years), having exposure to bonds just doesn’t make logical sense.

The health crisis also demonstrated that a lot of governments and governmental systems around the world are under strain, even in places we thought were stable.

At the same time, not all sectors have been impacted equally. While tourism and hospitality have been hit hard, technology companies have boomed. Making sure your portfolio is globally diversified became more important than it’s ever been.

Not quite. Hearing that you’ll lose money long term in cash, that bonds aren’t providing the diversification we need and that the share markets aren’t providing as high returns as we’ve seen is not great news. While it’s tempting to chase quick returns and invest in hot tips from friends or the internet, our general financial guidance hasn’t wavered

That means putting the majority of your money in riskier assets (i.e. investing over saving) and allowing compounding to get to work for you. Investing in a low cost portfolio of shares, ideally through an index fund, can offer attractive returns over cash.

You can consider bonds and cash for those short term money needs, but may want to think twice about having too large of an investment in these asset classes in this environment.

If you do want to gamble with speculative investments, make sure it is with a small fraction of your portfolio that you are happy to lose if it goes to zero.

Finally, there’s the basics that is probably more important than any investment decision you make. Whether interest rates are 0% or 5%, remember…

Save more than you spend. Minimize the amount that you pay in fees and taxes. Try not to check your investments too regularly - A simple set and forget strategy is the most successful approach to investing!

How to Set Up an Emergency Fund

We never know what life can throw at us financially, so we need to be prepared when big expenses hit...

Dean Anderson

4 August 2025

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices