NZ companies are pretty great and there many reasons you should want to invest in Kiwi made brands, ...

Catherine Emerson

21 November 2019

For the majority of my adulthood, we have nicknamed my mum the Grinch of Christmas because she would never let us have a real Christmas tree (apparently it’s the smell and the pine needles). Coming into this Christmas season, however, I’ve been starting to think whether I am in fact the Grinch of Christmas. Why, you ask?

I am the aunty that gifts a three, five and seven year old a deposit in their investment account.

I am the wife that encourages us to spend less, so we can save more for the next year.

I am the friend that asks if you’ve saved anything for your future in the lead-up to December.

I am also the person that will return an unwanted gift and use the money towards something that I truly want instead; achieving our financial goals.

These are unpopular acts. Money in an investment account is way less fun than a Harry Potter Lego set (I also agree with this having built a Quidditch field with the five year old last year).

It’s also much harder to talk about with friends and family; asking for money can often feel a little ruthless and selfish, particularly when loved ones enjoy the gift-giving process. Giving money for the purpose of long-term reward is also a challenge because there is nothing to show, touch or admire right now. Let alone wrap and put under a tree!

So this year I have recognised that yes, I am a little grinchy, but I’m also okay with it. I am happy to find a balance between Christmas giving and long-term rewards. If you find yourself questioning the Christmas status quo this year, here are a couple of reasons why you should be okay with it too:

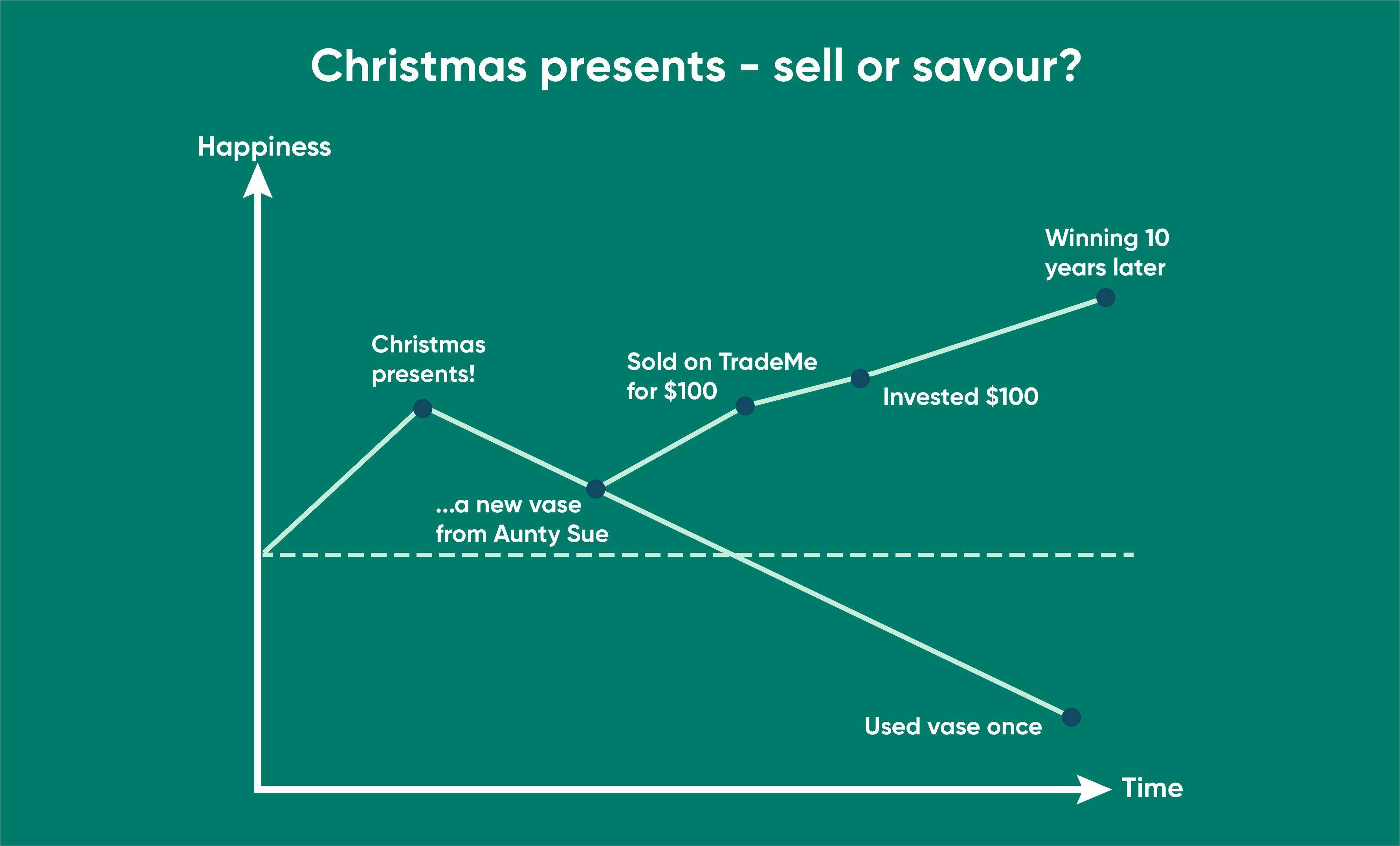

This is the age-old challenge. We buy new things, have an instant endorphin hit, feel great and look amazing and then slowly ride the high of the new thing until it fades into normality. Comparing this to the longer-term results of investing; whereby you gain nothing instantly (or even for a while) but eventually you gain much, much more: financial freedom.

Now, this is not to say that all short-term purchases or presents are like this and you should choose future you over current you every single time. There is a balance and some gifts are too damn awesome to ever lose their value. It is, however, a good idea to invest towards your future – whether that be three, five or 10 years from now.

Keen to see where investing will get you? Check out this calculator.

If you have been lucky enough to receive some Christmas cash this year beware: there’s an opportunity cost with everything.

If the money you’ve been given is for a goal 5+ years away, the best thing you can do is start putting it to work immediately. What does that look like?

Firstly, assess your goals and time frame to ensure you select an appropriate investment. You can read up on that here.

Secondly, get started straight away. You’re probably still on holiday right now and signing up to invest online takes 10 minutes – you can even do it whilst you’re on the beach.

Thirdly, depending on the size of your gift, you may want to think about investing it over a period of time (called dollar cost averaging) to smooth out the ride and make it a little less daunting.

One of the great things about growing up is that you get to create your own traditions. This year my husband and I got a real Christmas tree for the first time ever. It brings me so much joy (sorry mum).

Two years ago, we started the investing-gifts for our nephews and niece. This is a Christmas tradition we plan to continue for their entire childhood.

So what if saving and investing a little for your future goals could become part of your Christmas traditions? Whether it be something you do for yourself, as a family or for your children, traditions are kind of like investing. One day they start, often rather innocently, and then five…seven…ten years later they’re still going. The best part is, the longer they run for, the better the end result! (thanks compounding).

Save and invest for your future today with Kernel – get started online in 5 minutes. It’s a good excuse to get out of the post-Christmas clean-up.😉

NZ companies are pretty great and there many reasons you should want to invest in Kiwi made brands, ...

Catherine Emerson

21 November 2019

Starting to Invest – 5 Things All Investors Need to Know

Are you thinking about starting to invest? You don’t need to know as much as you might think. Here a...

Catherine Emerson

18 November 2024

Small, Mid & Large Caps explained – which is best to invest in?

Knowing what small, mid and large caps are is important when choosing how to invest within your port...

Dean Anderson

29 September 2020

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices