Today, Nov 21st 2019, is the inaugural Buy NZ Made Day, encouraging Kiwis to purchase locally produced products. What better day to share why we think investing in NZ companies is a great idea.

NZ companies are pretty great

Why, you ask, did we start with three NZ share funds and not other asset classes or a global focus? Part of the reason is that we understand the New Zealand market well and are deeply patriotic people, but there are actually structural reasons and benefits to investing at home. In fact, it surprises us how much foreign investment bias there is in some of our competitors.

The first and most significant is tax. We know many of you won’t want to start you day off reading about investment tax, so for those that want to skip this section and just believe us now is your warning. For the rest of you, here are the details.

Investing locally

When investing in NZ listed companies, most investors won’t have to pay Capital Gains tax and will only be liable for tax on the dividends from the companies they invest in. If you have invested directly in those shares, the tax will be paid at your Resident Withholding Tax (RWT) rate, up to 33%. If you invest via Portfolio Investment Entities (PIEs) fund, like all of Kernel’s funds, the tax on those distributions is calculated using your ‘Prescribed Investor Rate’ (PIR), capped at 28%. Whoop – not only do you get easy access to diversification with Kernel, you may also be paying less tax!

The other big benefit local investors get to take advantage of is ‘imputation credits’. Imputation credits, according to the Inland Revenue website, “lets shareholders receive tax credits with the dividends they receive, by allowing the company to pass on credits for the income tax it has already paid”.

So for NZ companies paying out dividends from NZ earned profits, the company has already paid the tax for you.

Investing globally

An extra warning here – as soon as you start investing globally, tax unsurprisingly becomes complicated. There are a multitude of different tax treatments and obligations and they all depend on your own circumstances. So make sure you get your own specific tax advice as required (that’s another disincentive itself!) but we will highlight some of the typical tax implications and therefore why we think ‘Buying Kiwi Made’ is a great way to go.

When you invest offshore, you will have to consider the Foreign Investment Fund (FIF) tax obligations. Under the FIF tax rules, if you invest overseas (excluding most Australian shares), you will usually be liable for a ‘Fair Dividend Rate’ (FDR) tax, simplistically a tax on 5% of your total returns in NZD. Creating a tax payment of up to 1.65%*, which is the top marginal RWT tax rate of 33% multiplied by 5%.

As total return is taxed, and the dividends are usually below 5%, it’s part capital gains tax. Alternatively you can, or pay an accountant to, calculate your tax obligations using the ‘Comparative Value’ (CV) method, broadly speaking tax of actual gains or losses.

To complicate things further, if you have investments worth less than $50,000 in FIF global shares then you’ll pay tax differently, as just the dividends are taxed. You can find out more in guides from the IRD.

Then there is a second tax to consider; withholding tax. For example; if you invest into the US market you will be subject to a 30% US withholding tax on the dividends/distributions paid from the investment. So if the investment has a 3% dividend, then 0.90% would be held back as a tax.

Using double tax treaties the New Zealand investor can attempt to claim back half of this tax, but unsurprisingly despite trade agreements, the full amount is rarely achievable, and fund managers investing offshore are rarely questioned on their efficiency here, because there is not much in it for them.

Those who wanted to avoid the tax talk, jump back in here.

To summarise, when investing locally the tax obligations are simple, easy to calculate, and you can take advantage of the corporate tax the company has already paid. When it comes to investing offshore, it gets complicated! It may directly cost more in tax and often involves a lot more work or cost for the investor in terms of managing the tax obligations.

NZ companies like high dividends

Traditionally our companies pay a large proportion of their profits as dividends rather than retain them for their own expansion. There’s a number of reasons for this: partly for tax, partly for historic investor demand and partly because of the nature of many of our largest companies. This is why in New Zealand it is always important to look at total return, not just the increase in share prices.

Total return = dividend yield + the growth in share price

High dividend pay-outs should give a strong boost to total returns, even when the share price is sideways or negative.

This also gives you the flexibility to invest to suit your own goals. After a passive income stream? Great, keep the dividends as cash. Want to grow your investments over the long term? Easy, reinvest the dividends and enjoy the benefits of compounding.

At Kernel, all of our funds pay quarterly distributions, and we give you the choice to take it as cash or reinvest, without any brokerage!

But isn’t NZ too small?

Some detractors say that the size and liquidity of the New Zealand market is too small. Which would make sense if you are investing the billions of the NZ Super Fund (who by the way, still invests $2B in the NZ share market and have another $5B in unlisted assets), but not for those investing smaller amounts in our $160 Billion market.

Similarly, there is the New Zealand is the “drop in ocean” argument; that we represent just 0.25% of the world’s GDP, so investors should invest accordingly. Now maybe this is a personal bias, but we would rather see New Zealand’s place in the world grow, than try to track a global return (see tax above too), because as Kiwis, we are more interested in New Zealand’s growth and opportunity.

Then there is cost.

Accessing international markets is full of additional costs; foreign exchange fees, higher brokerage and international custody charges. Even if the sticker price of a low management fee or discounted brokerage are enticing, be careful as there can often be hidden costs that aren’t transparent and could be costing you more than you thought!

NZ actually performs really well!

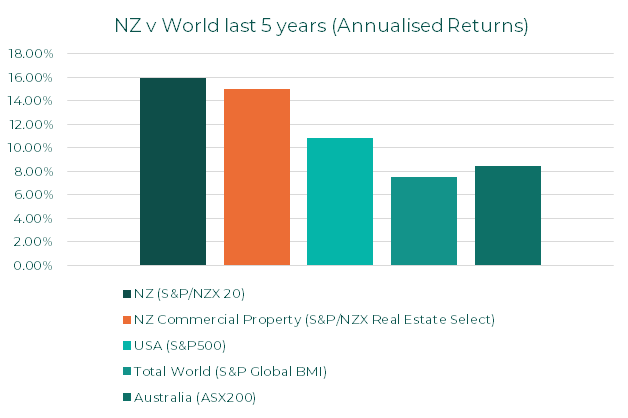

Finally, the best for last, we have done well in the past, our economy is shaped and positioned as well as many others for the future and there is little reason to believe that should change. The graph below shows we have outperformed on a gross basis (i.e. before considering the fees and taxes) the US, Australian and Global broad market indices in the majority of the last five years.

While we are not saying no to investing overseas, we will continue to fly the flag for New Zealand even when others won’t.