How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

make (something bad) worse; intensify the negative aspects of.

Geez, that sounds great doesn’t it. Would you believe me then, if I were to tell you that as an investor, compounding is actually your best friend?

Yep, it’s true. You better believe it. Einstein even said “compound interest is the eight wonder of the world”.

In the investment world, compounding is the process whereby an asset’s income are reinvested so that subsequent returns grow exponentially. Basically, it’s a process where the money you have made also makes money.

Sounds good right – yep, we think so too.

Automatic reinvestment is key. With reinvestment, instead of receiving a distribution or dividend in cash, you will own more units in the fund or shares in a company. Therefore, returns on your assets will now have the opportunity to earn further returns. Voila – your investments are compounding.

Not all investments offer the benefit of compounding, so it’s important to know what to look for. Many bonds and shares pay out interest and dividends but don’t offer the ability to automatically reinvest, which then costs you time and money to invest again.

Two factors come into play with successful compounding – the higher your account balance and the longer your money is invested. You don’t need to start with a huge balance, but you do need to leave your balance alone, so that it grows.

You also need the most time possible. Every day you wait is a day you miss out on the opportunity to start compounding.

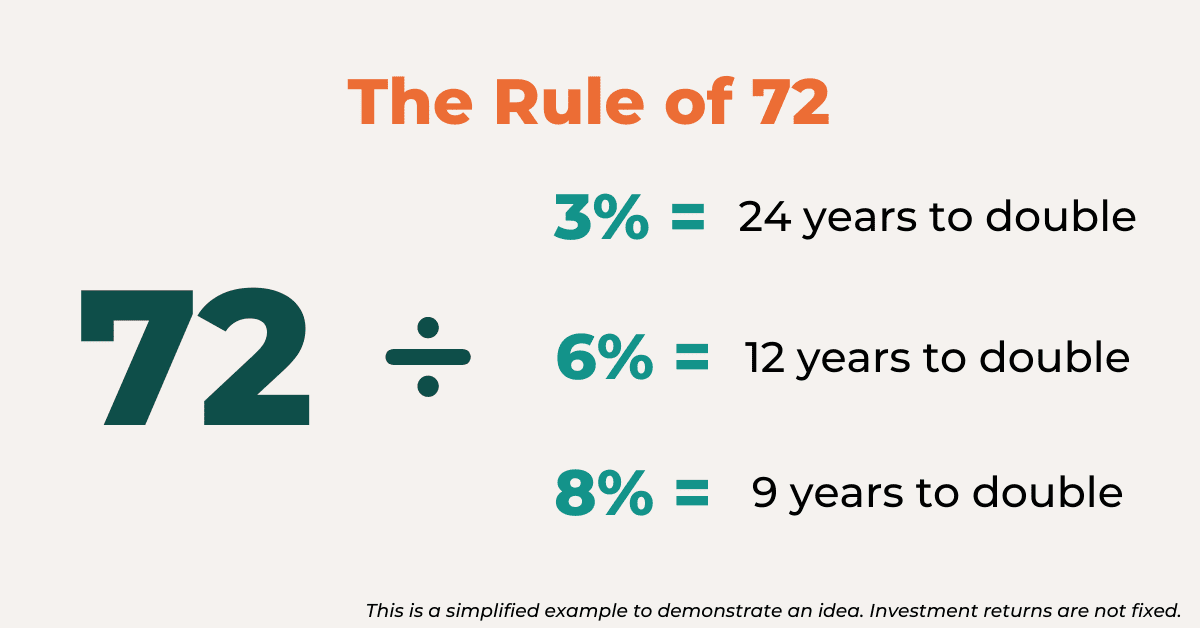

You might have heard the idea that compounding can double your money. Well, it is true, but you need time (and some good returns will help). To calculate roughly how long it will take for your investment to double, with the impact of compounding, use the “Rule of 72.”

Take the number 72 and divide it by the percentage annual return you think you will achieve. The result is the approximate number of years it will take for your investment to double, assuming you don’t make any additional lump sum investments.

See for yourself how much your portfolio could be worth using this simple calculator.

What are you waiting for? When it comes to compounding, there’s no time to waste!

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

When and How Should I Be Rebalancing My Investment Portfolio?

Making changes to your investment portfolio should be driven by a change in circumstance or the econ...

Raj Gooptu

10 January 2022

What is diversification & how does it help me?

I'm sure you’ve heard the eggs in one basket analogy – drop the basket and all eggs will crack. This...

Catherine Emerson

6 October 2019

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices