5 Budgeting Tools To Sort Your Finances

If you want something for tracking your spending and savings over time, a spreadsheet or a budgeting...

Christine Jensen

29 April 2022

27 September 2021

First home ownership is an important milestone for many Kiwis. We’re going to hazard a guess that the goal of buying a home has either been on your list of goals in the past, is currently on it, or might be in the future. And hey, we’d be lying if we said it hadn’t been on ours. After all, it’s hard to beat the satisfaction of being able to say you own your own home, plus renovate it whenever, and however, you like.

But in today’s environment, how are we to afford our first home? Are traditional methods – earning an income then saving up a lump sum in the bank for the deposit – working for us now? Or is it becoming harder to get on the property ladder? Read on to find out…

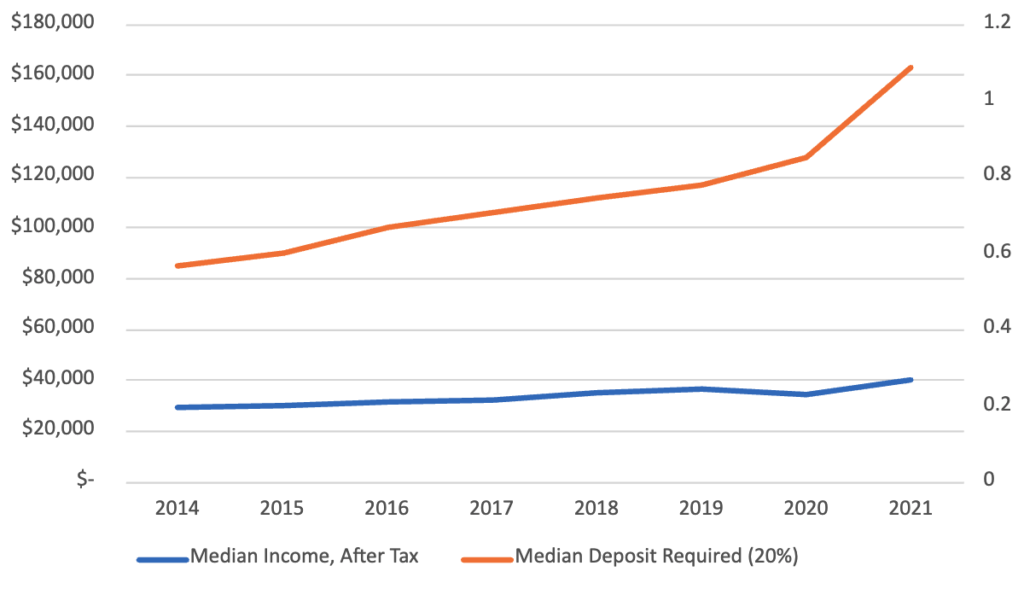

Many of you will know that house prices have been rising over the last decade. In fact, this week for the first time, the NZ national average property value hit $1M. Even if you exclude the posh city suburbs and mansions dragging the average up, the median price for residential property in NZ hit $815,000 (as at June 2021); up from $450,000 in 2015. That’s an increase of 81% in just 6 years!

Interestingly, during the same period the median annual income has increased by only 34% from $30,295 in 2015 to $40,510 in 2021.

Incomes are clearly getting left behind, which effectively makes it harder to save for a first home deposit in today’s environment.

While these stats can be confronting, it’s not all doom and gloom. There are things – like investing – you can do to help you get to the first home deposit you’re working so hard for.

For the purpose of this article, and to not overwhelm, we’re going to hone into one key concept, rent-vesting.

Rent-vesting is a term that is not commonly known in NZ, but one that is well-known overseas. It’s the idea that you’ll rent accommodation while investing in the share markets or a property that isn’t the one you live in (likely outside the city).

This is a practice many people have used to get them onto the property ladder sooner. It’s also commonly done to avoid giving up your current lifestyle and moving to a cheaper region where the houses may be more within your budget.

Now, it sounds great in theory but what about in practice? Here’s an example to give you some context…

Let’s say a single person, or couple, living in central Auckland region is paying the median rent of $600 for a 2-bedroom townhouse.

Let’s assume they earn the median wage of $40,510, and for a couple we assume both are on the median wage for a total of $81,020 per year.

Looking at the current housing market, they have their eyes on their own 2-bedroom home in Auckland, currently worth $950,000. The deposit alone would be $190,000 (20%).

Now, if the couple were saving 30% of their salary (after tax) – $81,020 – they would be able to save $24,306 per year. That’s roughly $2,025 per month, or $467 per week.

Applying the concept of rent-vesting, if this couple invested this $467 per week assuming house price growth settles to the long-term historic return of 6% and investing provides a long-term historic return of 8%, they would be able to afford a deposit for their dream home in 8 years, over 3 years faster than if they left it in the bank.

Want to put in your own numbers? Try it out using our home deposit calculator.

As you can see from the calculator, it’s important now more than ever to be ensuring you’re maximising your income and your savings are working for you rather than standing still while you work towards buying your first home. Doing so would mean that long periods of time would tilt you towards investing over leaving it in the bank.

The biggest challenge is that the future of any investment growth is not linear. But if your horizon (the timeline for when you want to buy your house) is flexible, the largest fluctuation in the share markets is more likely to result in reaching your goal faster.

While the calculations above have been made assuming an individual or couple may be starting from zero, this is of course not the case in many instances. You might be starting to rent-vest your way to your home deposit with an existing lump sum of money.

There is of course also your ability to use your KiwiSaver to contribute towards your first home purchase, plus there are opportunities to apply for a first home grant if your household income and desired home are under a certain threshold. Check out Kāinga Ora’s handy tool here to see what support you can get.

To reiterate, we’re not saying it’s harder to own a home once you’re on the property ladder. In fact, in today’s low interest environment the difference between owning a home or renting isn’t huge.

Looking at the previous example, if a couple was to buy a $950,000 2 bedroom home in Auckland (20% deposit is $190,000), a 30-year mortgage fixed at the current 1 year rate of 2.60% p.a. would result in weekly repayments of $697.

With the median rent of the same property type in Auckland being roughly $600, the difference between paying a mortgage and renting can be as little as $97 per week. Bearing in mind this is not factoring in rates payments, insurance, repairs, renovation expenses and more. Don’t forget about these!

If you’ve tried the calculator and are sitting here wondering how you can get on the property ladder sooner, don’t worry you’ve got a couple of options here.

The first option is that you could buy a house outside of Auckland (or any major city you live in) as an investment property, then rent this out. Typically houses in smaller regions tend to be less expensive and therefore require a smaller deposit, hence they’re more affordable.

That said, by the property being in a different location there’s the possibility they may not grow in the same way as your local area. Don’t fall into the trap of thinking property only goes up, there can also be specific and general events that mean the value of your house falls. While New Zealand has yet to broadly experience this in the way other countries have, it doesn’t mean it can’t happen.

You’ll need to note of course that investment properties typically require a 40% deposit and any rental income made no longer has interest deductibility. In other words, any income made from tenants you’ll be taxed on.

Easier said than done, we know, but finding new ways to upskill so you can negotiate a salary raise or generate a side income will help you save up a deposit faster. Of course, this has downsides too – being loss of time and potential costs to upskills – but there can be ways around this, through upskilling in areas that add value to a company (and in turn getting them to pay for it!).

Lastly, you could find a way to decrease your expenses to increase the amount you invest towards your deposit. We’re not talking about cutting out a takeaway coffee here and there, we’re talking about reducing your rent by 30% each week or cutting out your fortnightly massage.

If you’re just starting out investing in the share markets, don’t be put off by the idea that it’s hard and you need to spend hours on end researching and picking individual stocks. The reality is that picking stocks doesn’t actually work in your favour, and regularly investing in to well-diversified, low cost index funds usually works out better in the long run.

Everyone is on their own timelines, working towards their own investment goals. Just because your friend is on the property ladder, doesn’t mean you need to race to be too.

Who knows, perhaps if you’re flexible with your property purchase timeline, you might just end up rent-vesting your way to a larger home deposit and therefore nicer house!

5 Budgeting Tools To Sort Your Finances

If you want something for tracking your spending and savings over time, a spreadsheet or a budgeting...

Christine Jensen

29 April 2022

Are you deciding between paying off your debt or investing for the future? Our no-nonsense guide exp...

Catherine Emerson

18 August 2019

Starting to Invest – 5 Things All Investors Need to Know

Are you thinking about starting to invest? You don’t need to know as much as you might think. Here a...

Catherine Emerson

18 November 2024

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices