Investing in International Shares: Location or Tax?

Tax can have a huge impact on your overall portfolio returns - in some cases by up to 2% p.a! We've ...

Stephen Upton

29 November 2020

There’s no denying that the popularity of index funds is continuing to grow both in New Zealand and overseas as investors shift their strategy from stock picking to indexing. In fact, according to Ernst & Young, the market share of index funds of the global equity market rose from 14% in 2011 to 31% in 2020. So, it’s no surprise that we find many investors asking which fund is most suitable to invest in.

Recommended by Warren Buffett, many US-based investors turn to S&P 500 index funds. This is perhaps why it’s the most popular type of index fund in the US.

What many New Zealand-based investors often wonder is whether an index fund which proxies the US stock market such as an S&P 500 index fund or a more geographically-diversified index fund such as the S&P Global 100 index fund is a more suitable investment option. Read on to find out more.

The Standard & Poor’s 500 Index, or simply S&P 500, is a capitalization-weighted stock index tracking the performance of roughly 500 large-cap U.S. companies. The S&P 500 is often referred to as the best gauge of the US economy since its constituents make up 80% of the US equity market cap and span across all market sectors.

There is a common perception among investors that the US market is the safe harbour with long-term growth potential. So, if you would like your portfolio to grow with the US economy and only companies listed on US stock exchanges, you should invest in this broad well-diversified index fund offered by many providers, including us.

Since its inception in 1957, the S&P 500 index has faced countless downturns and market crashes. However, given enough time, it has always been able to recover, earning an average return of around 10% per year over most long-term periods. Both retail investors and investment experts marvel at this robust performance.

In fact, Warren Buffett repeatedly claims, including during the 2020 Berkshire Hathaway shareholder’s meeting, that “for most investors, the best thing to do is to own an S&P 500 low-cost index fund”. No wonder why S&P 500 index funds are so loved by investors when the Oracle of Omaha recommends it!

Undoubtedly, consistently buying a Vanguard S&P 500 ETF or iShares Core S&P 500 ETF through thick and thin can be a good option for investors who want greater exposure to US large-cap equities to complement their existing portfolios.

And for that reason, in April 2022, we started offering the Kernel S&P 500 Fund for those who are seeking additional US exposure for their current investment. Our key distinction is the removal of most of the currency impact of the USD/NZD exchange rate, through currency hedging.

If you’re just getting started with investing and are still unsure if S&P 500 index fund is the right choice, the following dimensions of diversification should be taken into account.

One of the reasons why people want to invest in S&P 500 index funds is that its size of over 500 companies is believed to offer good diversification. Diversification means that different stocks in different sectors and industries respond differently to market factors. This ensures that all stocks do not go down in value at the same time and thereby reduces the probability of severe losses during recessions or crises.

However, we should bear in mind that the more companies we add to our holdings, the more underlying costs and administrative record keeping is required. Many sound better, but with lots of very small holdings in widely diversified funds (i.e. each less than 10%, many less than 0.01%), how much diversification do we really need? Research says not more than 100.

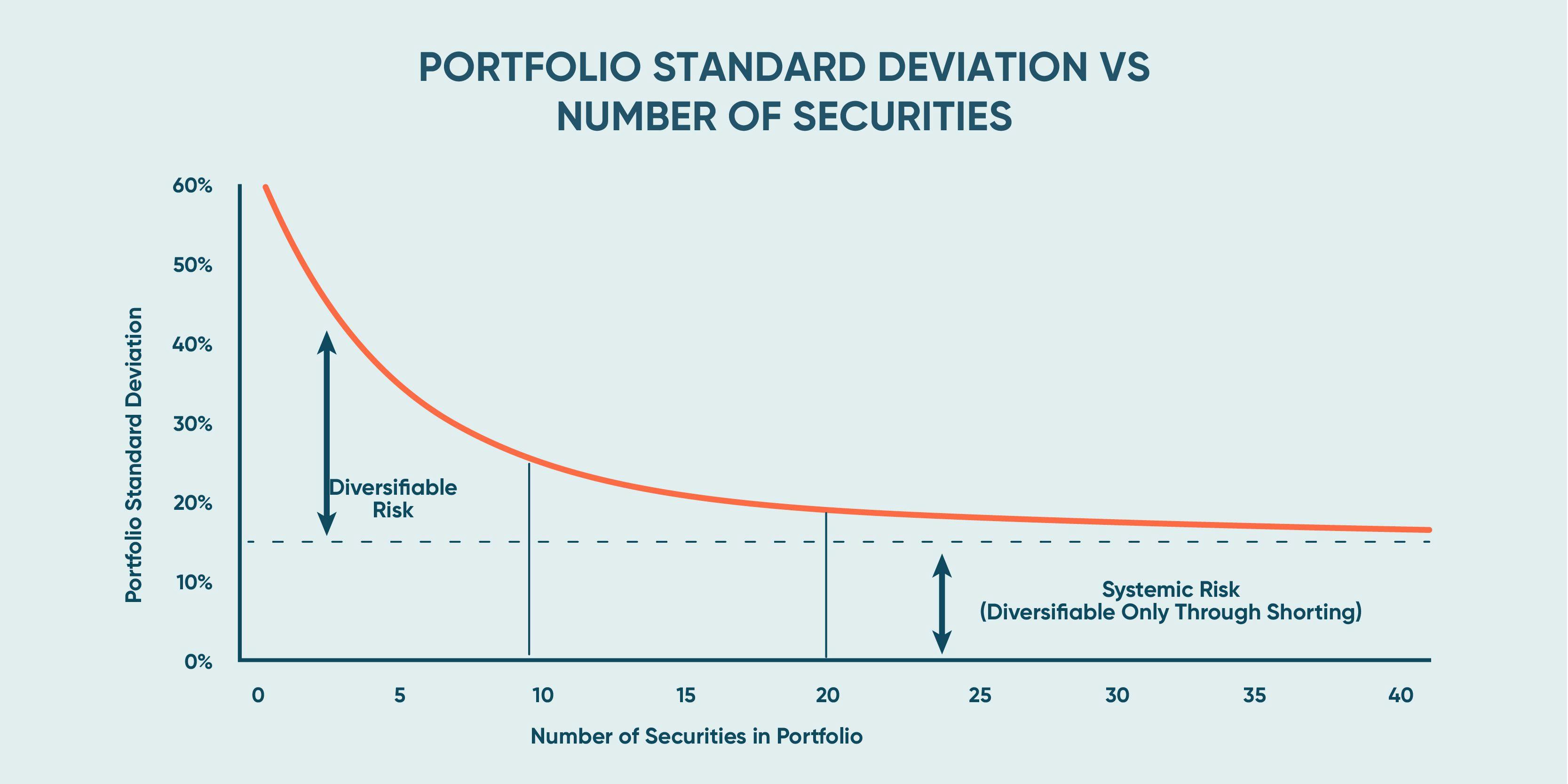

Research on the ideal number of stocks to make a diversified portfolio has been extensively done over the past three decades. While results have not yet been settled, one common thing is that these studies often focus on the minimum -not the optimal- size needed for a well-diversified portfolio. Depending on which markets and time periods are examined, this minimum can vary from 20 to 100 stocks.

For instance, one of the most recent studies on the subject found that over the period from 1975 to 2011, the number of stocks needed to reduce 90% of the diversifiable risk, on average, is about 55 for the US market. In times of financial distress, the figure can increase to 100 stocks.

For the U.K., Japanese, Canadian and Australian markets, other research suggested it can be as high as 86, 97, 39 and 81 stocks, respectively. Nevertheless, the results only cover domestic equity investment, leaving the international diversification untouched.

As the chart below illustrates, there are diminishing returns to the addition of stocks to a portfolio, so while the first 20 reduce that risk, once holding over 40 (assuming they are across country, sector and style) the benefit is much smaller.

Source: “Risk, market sensitivity, and diversification”. Financial Analysts Journal, 51(1), 84-88.

So, beyond the sweet spot where investors can reduce 90% of diversifiable risk, adding stocks to your portfolio does not help mitigate portfolio volatility in any significant way.

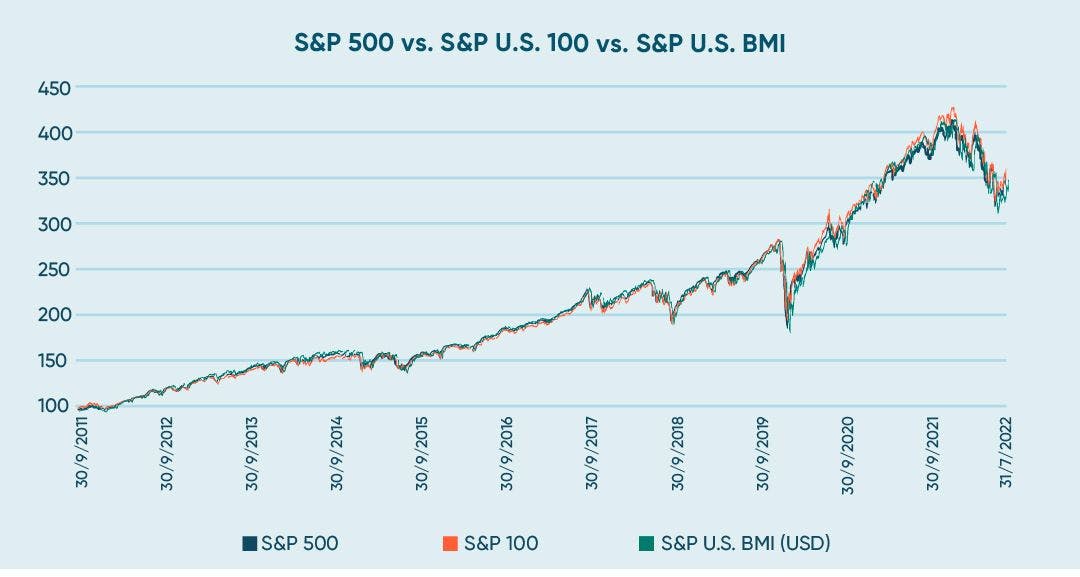

This can be demonstrated by the correlation of returns between the Top 100 stocks of the S&P500, the S&P500 itself and the S&P United States BMI, (all 3,293 listed United States Companies) is 99.9%. As evidence of this, Chubb being 101st largest company, represents only 0.20% of the S&P500.

Often investors read that a fund has a certain number of stocks and immediately think it equals more diversification. That more is better, however, this isn’t the case. That diversification may be concentrated in a country, sector or style (e.g. early stage, value, thematic) and even in total world indices, you don’t get everything.

Looking at a couple of indices examples that offer exposure to multiple large and mid-cap companies across various markets, we can see that there are 1,561 in the MSCI World Index and 11,801 in the S&P Global Broad Market Index (BMI).

Whilst it can be tempted to want to own every stock in the share market with the intention of maximum diversification, the reality is that even the largest, broadest indices don’t capture every listed company in the world and have various criteria such as sufficient liquidity, minimum size and which exchange listed on as some smaller stock markets are excluded.

Given almost all broad indices are market capitalisation (cap) weighted, the size of the company within any given fund is likely to influence the performance of that fund. Stocks with a larger market cap have a higher weighting and any movement in their share prices will have a larger impact on the index performance.

On the other hand, many smaller companies that are just a fraction of the size of larger companies hardly effect the overall performance of the fund, even if they grow significantly. The graph above illustrated the difference in index performance between the US100, S&P500 and the US BMI of all 3293 US-listed companies. Basically the same.

This leads us to one of the main reasons we chose to offer and track the S&P Global 100 index as one of our first global funds.

Often considered less, diversification across markets is just as important as diversification across stocks. Certainly many large US companies have global operations, but there are also great companies not listed in New York. Nestle, Samsung, Toyota, and Unilever to name just a few.

All holdings in the S&P500 are US-listed companies, whereas the Global 100 Index can offer exposure to companies not listed in the United States. The S&P Global 100 offers roughly 73% exposure to US-listed companies, plus an 18% allocation to Europe, 7% to United Kingdom and 2% to Asia/Australia (as of 30 September 2021).

These large, global companies and mega brands together make up an index of USD 14 trillion in market cap. In fact, to be included in the S&P Global 100 index, companies must have operations in Asia, Europe and the Americas, and have their assets and revenue streams spread around the world. This globalisation requirement is an additional dimension of diversification.

The point is: if your existing portfolio is already diversified across different markets and your investment objective is to increase the US market exposure, then the S&P 500 index fund could be a good option for you.

However, if that’s not the case, just concentrating your portfolio in US listed companies by investing in an S&P 500 index fund means you can miss taking advantage of gaining exposure to various macroeconomic policies. That’s why many (including us!) continue to love the global diversification that the Kernel Global 100 Fund provides.

In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.

For more on diversification between markets and sectors, read our blog on diversification or check out our recent webinar.

Besides diversification, fees also matter in investing.

One critical fact or to consider when choosing index funds is the fees that we must pay for. In NZ, an unlisted index fund and a passively managed Exchange Traded Fund (ETF) are not the same thing.

ETFs are funds in which you can buy and sell units on the share market. Hence, besides the management fees paid to fund managers, there will be other trading costs incurred. For example brokerage/trade fees, bid/ask spreads, and foreign exchange fees, when buying or selling ETF units.

By comparison, with unlisted index funds, you purchase units directly with zero transaction fees. You receive the full value of a unit, not a premium when buying or discount when selling to a market maker as the usual facilitator. Overall, the difference between our fees of 0.25% p.a. and the management fee of the Vanguard fund at 0.03% can be more than outweighed by other costs.

Moreover, listed investments are not always as tax efficient as some unlisted investments. Thanks to unclaimed tax benefits, higher dividend tax rates and dividend drag, NZ ETFs can often cost NZ investors more than they think. More on this here.

Currently in NZ, if you want to invest in S&P 500 index funds, three options are either New Zealand Stock Exchange (NZX) listed ETF, ETFs listed overseas or our Kernel S&P 500 Fund – a cost-effective unlisted index fund that was launched on 11 April 2022. The distinction of the Kernel version is that it is hedged to the New Zealand dollar. This means most of the currency impact of the USD/NZD exchange rate is removed, through currency hedging.

In other words, if you invest in our Kernel S&P 500 Fund, your performance will be similar to that of Vanguard 500 Index Fund ETF (in USD) for a US investor.

However, if you want to track the S&P Global 100 index, you can invest in Kernel’s unlisted index fund. The Kernel S&P Global 100 was launched on 15 July 2020. With our product design, there are no brokerage, buy-sell spreads, or foreign exchange fees. For those contributing regularly to a portfolio, these can often make a large difference in the total cost of ownership.

Now that you’re armed with knowledge around a few key differences between the S&P Global 100 and S&P 500, we’ll leave you to make the decision.

The bottom line is that with Kernel’s S&P Global 100 fund, your portfolio is well-diversified across both sectors and countries. But if you only want to increase the US market exposure in your current portfolio, or are focused on removal of the exchange rate fluctuations, our Kernel S&P 500 Fund is also a cost-effective option compared to other listed ETFs.

Investing in International Shares: Location or Tax?

Tax can have a huge impact on your overall portfolio returns - in some cases by up to 2% p.a! We've ...

Stephen Upton

29 November 2020

Why ETFs Are Unsuitable for New Zealand Investors

ETFs and index funds are not the same thing and if you're a passive investor in New Zealand, you rea...

Dean Anderson

28 October 2022

Majority of Actively Managed Funds Continue to Underperform

Time and time again the data shows that actively managed funds result in underperformance compared t...

Dean Anderson

23 June 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices