The future of investing is sustainable

Today more investors are adopting sustainable investing, looking at both the financial outcome and i...

Dean Anderson

11 May 2021

17 June 2021

In case you missed it, we recently announced three sustainable funds: Kernel NZ 50 ESG Tilted, Kernel Global Green Property, Kernel S&P Global Clean Energy.

Having previously been somewhat of a niche area, growing demand for sustainable investing has seen ESG (Environmental, Social, Governance) funds globally grow 10-fold since 2018.

The use of ESG factors to steer investment decisions is now becoming much more widely adopted. In fact, a recent survey by the Responsible Investment Association of Australasia found two thirds of the public intend to invest ethically within the next five years, most of those within the next year (42%).

Are you in that 42%? If yes, read on to find out everything you need to know about investing in ESG and sustainable funds.

There’s a lot of misuse of the adjectives: sustainable, ESG, impact, ethical and socially responsible (SR). In part this is due to a lack of global standards in terminology. While ESG and SR investing are both values driven, there are a couple of differences to be conscious of.

Historically, SR investments have used an exclusions strategy; excluding ownership of “sin stocks” like those in the business of tobacco or gambling. ESG investing often has these same exclusions, but it might also use a scoring system across the E, S, and G factors of each company to increase allocation to companies that are calculated to be creating a positive impact and vice versa.

Ethics is a broader term that we prefer to not associate directly with an investment product. Ethics are closely aligned to individual personal values, faith and what one person considers suitable, another finds repulsive.

Given many of these terms are used interchangeably, despite doing very different things, it’s important to look at the methodology of the investment strategy to ensure it aligns with your values and objectives. As an index manager, we follow a systematic and transparent methodology. An example methodology of the S&P Global Clean Energy Index can be found here.

What most won’t realise is that the shift towards ESG index strategies is fairly new. While socially responsible, exclusions and thematic strategies have been around for a while, index strategies that incorporate ESG scoring are only a few years old, with S&P Dow Jones Indices launching their first S&P 500 ESG index in 2019.

What we have seen recently is:

This has fuelled the expansion of ESG indices and lead to the launch in 2021 of the first ESG equity index for New Zealand.

The factors used to measure ESG performance can vary, but typically include things such as:

Source: S&P Global

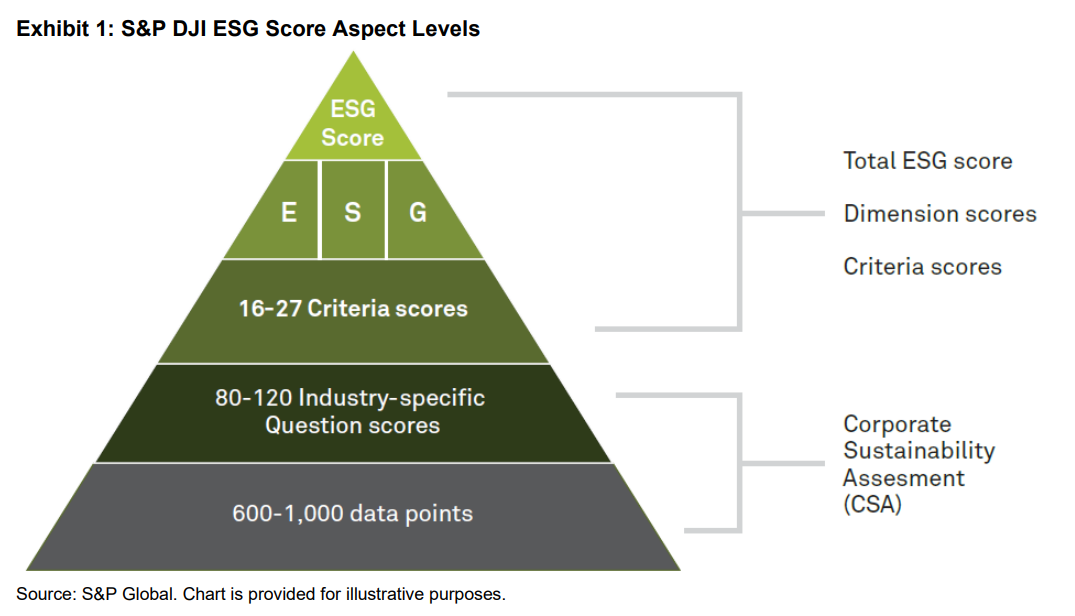

Often multiple data sources and providers are used in the calculations, including Trucost (carbon), Sustainalytics, Carbon Disclosure Project, Corporate Sustainability Assessment, and in the case of real estate, GRESB.

Each company is assessed against ESG criteria which are industry specific. This is so that for example industrial companies are not unfairly compared against retail companies or using criteria which are inappropriate or inapplicable.

Each company’s ESG dimension score (e.g., a company’s “E” score) is the weighted average of all criteria scores and weights within that dimension and combined for the total ESG score.

Total ESG scores range from 0-100, with 100 representing best performance. These scores are then used to upweight and downweight companies within a sector, with the ESG index retaining the same sector weights as the original base index.

We’re seeing a significant global shift of assets into sustainable and ESG strategies. More investors are considering the impact their investment has in shaping the world they live. We see this demand across the spectrum, from retail investment through to the world’s largest pension schemes driven by sentiment and regulatory requirements.

Investment into listed ESG funds in the U.S. in 2020 reached $51.1 billion, which was more than double 2019 levels and a nearly 10-fold increase from flows into ESG funds in 2018, according to Morningstar Inc.

Further, investment in listed ESG funds have grown 10-fold since 2018, passing $230 billion and becoming one of the fastest-growing categories. The shift to sustainable strategies will persist, as social and climatic issues continue to rise. In addition, there are regulatory changes driving investment towards companies better prepared to tackle climate risk, as countries transition to a renewable, low carbon future.

Aside from concerns about environmental and social issues, investors are also looking at sustainable investing as a way to make longer term strategic investment decisions.

When ESG was first coined as a term in 2005 (in a study titled “Who Cares Wins”), it was considered novel and perceived as coming at the expense of better returns.

However, numerous studies have shown that companies which have adopted environmental, social and governance policies have outperformed those that don’t. The logic being companies that are thinking decades into the future and considering their impact on the world may be better positioned to adapt to change and therefore deliver greater long-term returns. Conversely, companies that don’t are penalised in what investors are willing to pay for a share.

There are two approaches you can take when thinking about how sustainable funds can fit into an investment portfolio.

The first is if a fund is thematic, then it can make up a small portion of your portfolio – a “satellite” in a core-satellite investing strategy. An example of a thematic, sustainable fund is Kernel’s S&P Global Clean Energy Fund which provides a ‘tilt’ to those companies’ delivering renewables.

Alternatively, you might like to let investing in sustainable funds guide your overarching investing strategy. Some investors choose to invest in ESG and sustainable funds for strategic purposes, as companies ahead of the curve adapting to new or potential legislation and demand, therefore shifting their business practises accordingly. This may or may not prove to lead to higher performance depending on whether this eventuates into greater profitability and forward expectations.

Interested to know more about Kernel’s sustainable funds? Read more via the link below.

The future of investing is sustainable

Today more investors are adopting sustainable investing, looking at both the financial outcome and i...

Dean Anderson

11 May 2021

Three Forces Accelerating Sustainable Investing

Since 2018, sustainable investing has been on the rise both locally and globally. But what's driving...

Dean Anderson

20 December 2021

Getting to know Kernel’s Sustainable Funds

With growing demand for ESG funds both in NZ and globally, we're proud to introduce Kernel's sustain...

Christine Jensen

28 July 2021

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices