How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

Building wealth can be an incredibly rewarding experience and it doesn't have to be complicated. With just a press of a button, investors can now buy and own a slice of the share markets around the world.

But with everyone's needs and goals being unique, how should you approach building your investment portfolio for long-term success? If you're feeling overwhelmed by all the investment funds in NZ or are unsure of where to start, don't worry. You're not alone.

We understand that DIY investing can feel intimidating. That's why we're here to help you navigate the process.

One of the biggest challenges in creating an investment plan can be deciding which funds to include. The more funds you have, the more complicated it can be to manage. But here's the thing: creating your investment portfolio is personal, and there are countless reasonable methods to reach your financial goals.

Our suggestion? Don't get too caught up in finding the absolute perfect mix.

What matters is that you choose an investment approach that you feel comfortable with, can stick to and that you can manage effectively. The truth is no one can predict which portfolio will perform the best in the future.

While you can adjust factors like diversification and risk levels, it's essential to consider fees, taxes, and your reaction to share market movements (i.e., will you stick to course when things are down?). Even a complex portfolio may not provide significant advantages when these factors come into play.

In the spirit of Bogleheads (fans of Jack Bogle, the person who created the first index fund) and JL Collins' author of "A Simple Path to Wealth," we're here to show you how low-fee index funds can set you up for the future. So, how can you start?

You can begin by narrowing down a few funds that appeal to you and that align with your goals. For example:

Feeling overwhelmed by all the fund options? Try looking at them categorically - are you interested in local, global, sustainable or future-focused funds?

Looking at them categorically can help narrow down your options based on preferences and values. After you’ve narrowed down a few funds, select a portfolio that resonates with you and that you can stick with for the long term. Over time, different investment portfolios will have their moments of success.

Be sure to avoid constantly changing your portfolio in response to short-term market fluctuations. This approach is like driving while constantly looking in the rearview mirror—it's not a winning strategy.

With that in mind, let's explore some examples of index fund portfolios that you can use as inspiration to build long-term wealth.

The one-fund portfolio is a popular investment approach for many.

Since we can't predict which companies will perform best in the future, why not own a fund that has a diverse range of companies from various parts of the world?

For long-term investors, consider keeping it simple with the Kernel High Growth Fund. This fund invests in 1000+ companies from around the globe across many industries.

We’ve also recently added the Global ESG Fund, which is our second-largest fund by number of holdings. As with the name, it also ticks the box of being a sustainable investment too.

Whilst it’s not a pure index fund, the Kernel Balanced Fund is also an option to consider if you’re wanting to introduce cash and bonds into your portfolio.

Whichever options you opt for, all are examples of funds that you can use to keep your portfolio simple, low-cost, and diversified—what more could an investor ask for?

You might’ve heard the term ‘home bias’, where an investor makes a higher investment into their local home market in comparison to global markets. Home bias is common and logical; it makes sense to want to back the economy we know the best and hear about the most.

As is the case in New Zealand, there is often a tax and cost advantage to investing locally. By adding a local NZ fund alongside a global fund to your portfolio, you can introduce a home bias and benefit from local tax efficiencies and imputation credits.

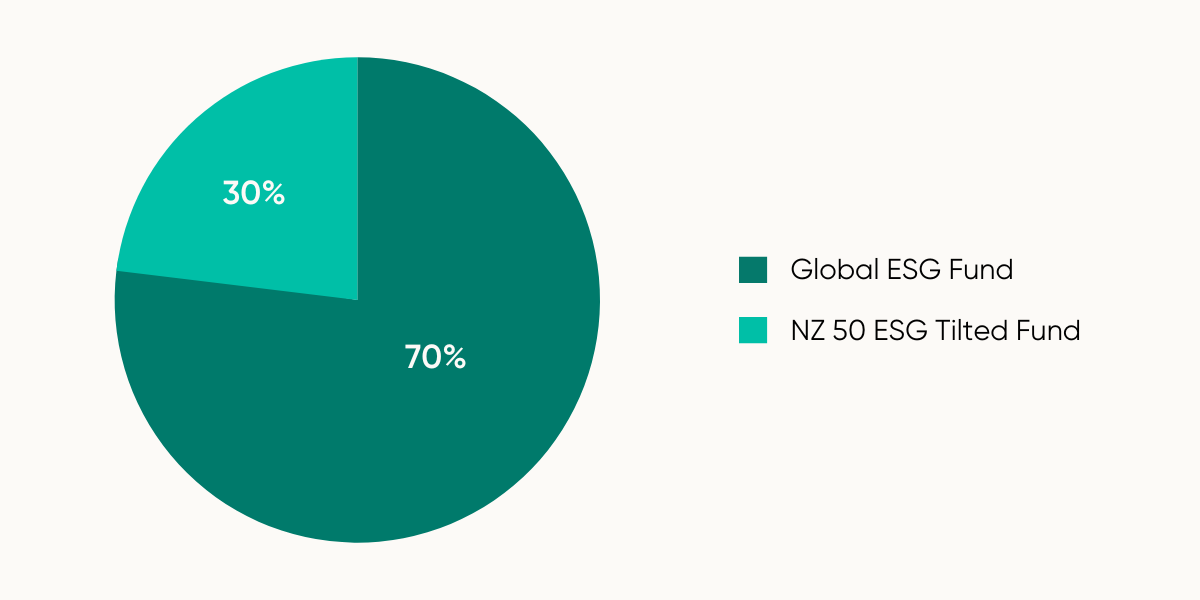

Two diversified, index fund options can include the Global 100 Fund and the NZ 50 ESG Tilted Fund. As to what the ‘magic number’ is between investing in a global fund and a local NZ fund – that’s the million-dollar question and is ultimately up to you.

Here, we offer a couple of different angles.

One option is to follow the core-satellite investing approach.

This approach suggests having 80-90% of your portfolio invested in broadly diversified low-cost index funds – the core. Whilst the remaining 10-20% is invested in “satellites” which can be more speculative investments like individual stocks, thematic funds, sector funds or more.

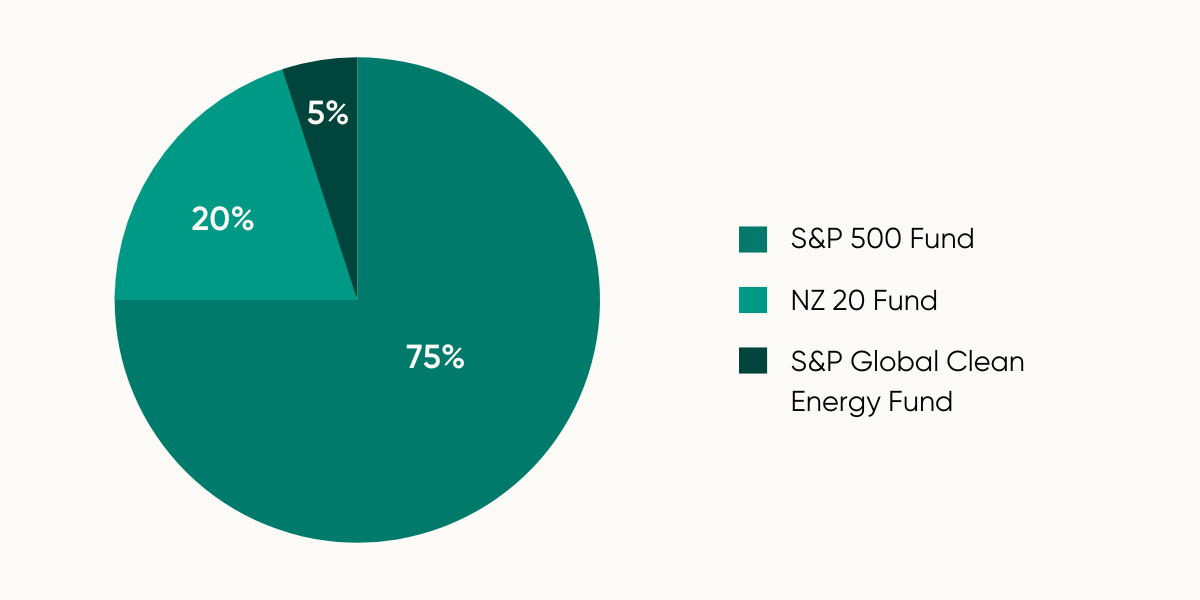

An example of a core-satellite approach can be to have the S&P 500 Fund and the NZ 20 Fund as your core funds, while the S&P Global Clean Energy Fund can be used as the satellite holding.

Another option is to diversify further across asset classes and include additional assets like cash or infrastructure. This can reduce the fluctuations in your portfolio but can also reduce the overall growth.

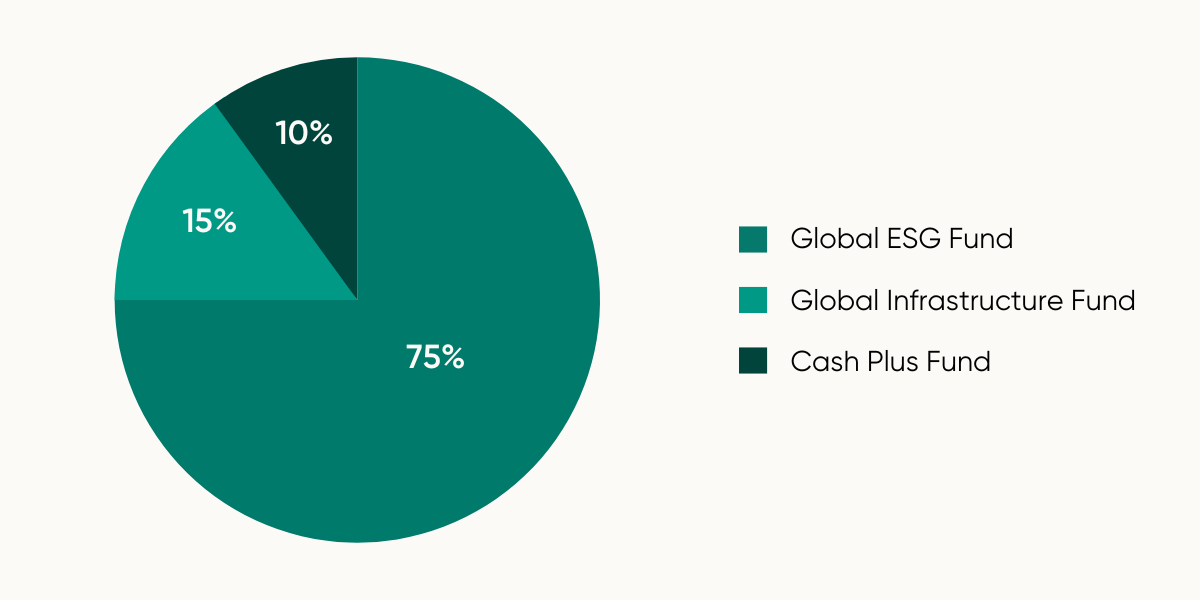

Which asset type(s) you choose depends on personal preference, plus alignment to your investment goals and risk tolerance. An example of this can be to invest in a combination of the Kernel Global ESG Fund, Global Infrastructure Fund and the Cash Plus Fund.

Note: The Cash Plus Fund is an actively managed fund and does not follow a passive investment strategy.

There are countless ways you can build your investment portfolio. What matters the most is finding a strategy that works for you, and that you can stick to. The key benefit of index funds is that you have access to tens, hundreds or even thousands of companies in just one fund.

If your preference is to keep it nice and simple with a broadly diversified one-fund portfolio, that is perfectly reasonable. If you prefer to mix and match by using a core-satellite strategy or diversify across asset classes, that can be an excellent choice as well.

Just be sure that your investment strategy aligns with your goals, timelines and risk appetite.

The scenarios above are suitable for long-term investors. Investors with lower risk profiles(e.g., defensive or conservative) or shorter investment horizons should consider other strategies and fund types. All investing involves risk, the scenarios mentioned are for guidance only, is not financial advice, and you will want to consider your own comfort levels with risk and volatility. Overall past performance is no indicator of future results.

How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

When getting started with investing, it's best to use an index investing approach. What exactly does...

Catherine Emerson

8 August 2019

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices