Investing for Kids: A Guide on How to Save and Invest For Your Children

Wondering how to save or invest for your child's future? In this blog we highlight a few key concept...

Stephen Upton

26 November 2021

Every parent wants what is best for their child and this usually includes a future that is financially secure. In an age of eye-watering house prices and accelerating inflation, there has never been a more important time to start planning and investing for your children’s financial future.

With any investment strategy, it’s important to define what you are trying to achieve i.e., your goal. Is it to help your child get onto the property ladder? Save for their education? Or simply to cover potential unexpected costs of parenting?

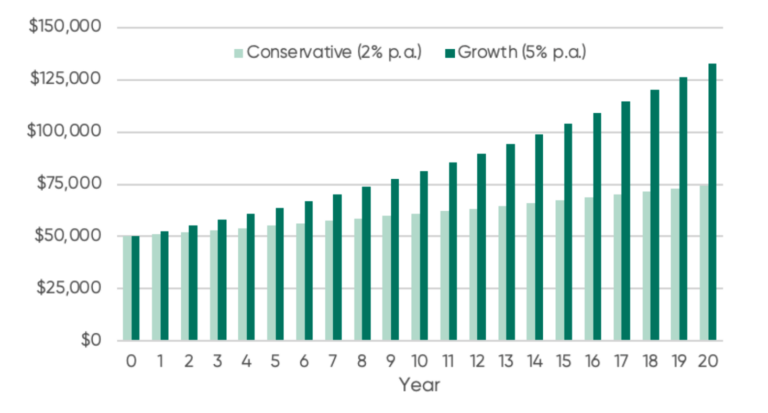

Defining the goal will help you understand how long you are going to invest for, and therefore what type of investments you should use. The longer the time frame, the more you can invest in growth investments such as shares, and the higher your return is likely to be, which equates to a greater level of financial support you can provide your children.

The answer to this question is very specific to your goals but using the Sorted Calculator can give you a good idea of how much you need to set aside to achieve a specific amount. The Financial Markets Authority (FMA) provides estimates of investment returns for different investment types which can be used in the Sorted Savings Calculator.

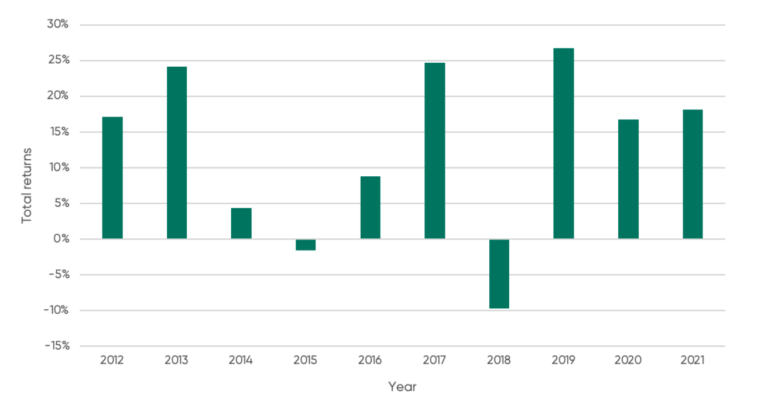

The graph below illustrates this idea, taking a look back at the past 10 calendar year total returns of the Global Broad Market Index. As you can see, while the index returned 10.27% p.a. over a 10 year period, the yearly return wasn’t linear or consistent. Understanding that there can be great years and not-so-great years in the markets is also an important message to be teaching kids.

Beyond the decisions of how much to save, and how to invest, you should also consider whose name the investments should be made in. The main considerations include:

Below are three common ways of investing for your children’s future and some pros and cons of each option.

The simplest way to put aside money for your children is to open up a separate savings or investment account in your own name. Or, even easier, just add to your current investment portfolio and plan to use some of these funds to help your children in the future.

The advantage of this option is that you will retain a significant degree of control and flexibility over the investment. Some parents find that their teenager or young adult may not be mature enough to use the funds wisely at 18 or 25, so prefer to have discretion on when the money is given. You will also still be able to draw on these funds to meet any unforeseen expenses if your own personal circumstances change.

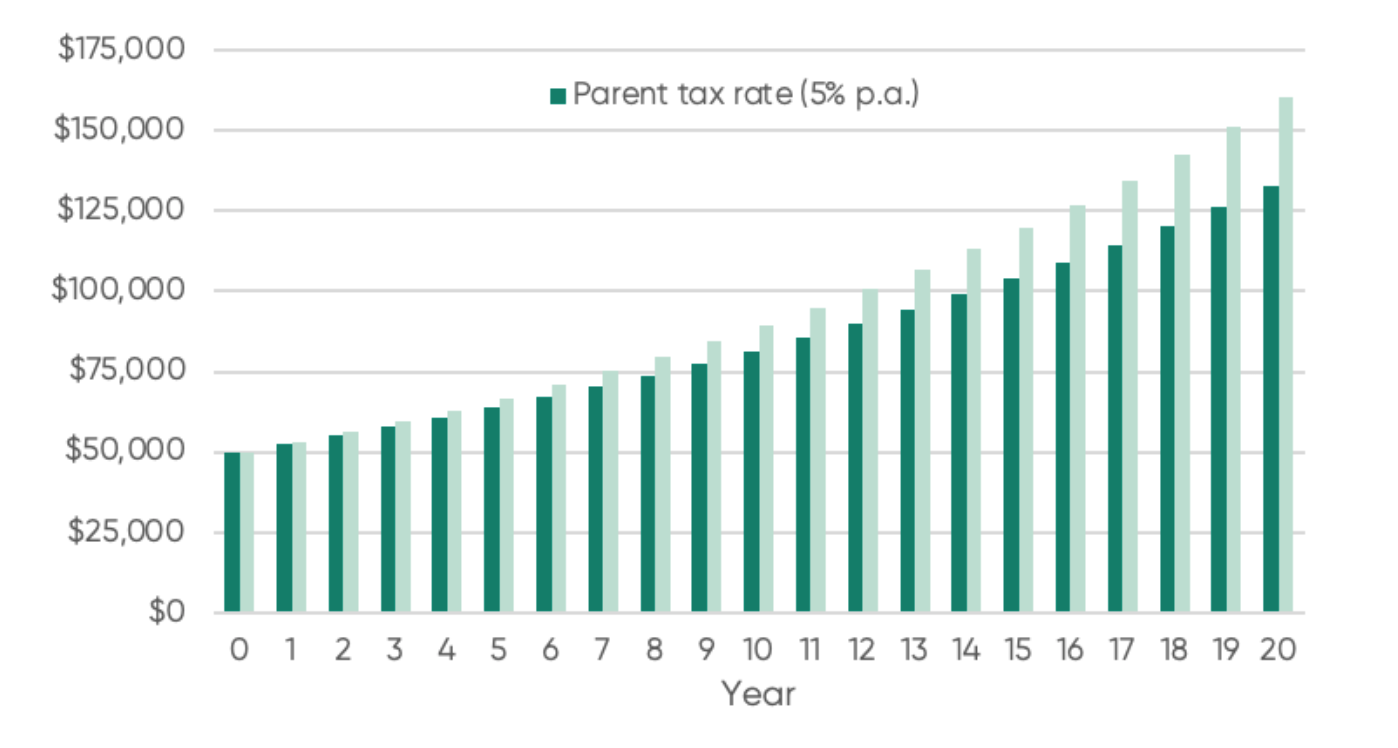

However, there are also disadvantages with this approach. Any investment funds held in your own name will be treated as your personal assets. You will have to pay income tax on any earnings based on your own tax rate, which is based on your income level. Additionally, the investment funds could be lost if you are made bankrupt, face a relationship property claim following separation with your spouse or partner, or any other claims were successful against you in your personal capacity.

Pros: Ease; Control for the parent on when and how much to give it to their children

Cons: Likely not as tax efficient; Could be taken in the event of a relationship break-up or other events

There are many investment providers out there who now offer investment accounts for children. These have become a very popular option as more parents are wanting to teach their children about good saving and investment habits from a young age. However, each provider will have its own specific terms and conditions which you should consider carefully before proceeding.

Generally speaking, when you set up an investment account in the name of your child, you are creating a relationship known as a bare trust.

A bare trust is a legal concept where the duty of the trustee (you) is to hold funds and act in the interest of the trust’s beneficiaries (your child). The parent is merely the trustee and must administer the account for the child’s sole benefit.

All money received in the account is treated as a non-reversible gift to the beneficiary, meaning that the parent cannot access the investment funds for any reason personal to themselves.

The investment fund provider will typically stipulate when and how the investment funds will transfer to the beneficiary, generally between the age 18 and 25. Once the funds are transferred to the child beneficiary, the parent ceases to have any control over them. This means that the child now owns the funds outright and can do with them as they please.

An advantage of setting up an investment account in your child’s own name is that it is generally more tax efficient. This tax difference can add up over time, potentially adding more than 20% to the value of the investment over a 20-year period. It is also less likely to be attacked by creditors in the event that you go bankrupt.

You should be aware that if the child’s investment earnings exceed $500 during any given tax year, these will likely be treated as part of your income when assessing eligibility for certain state benefits, such as Working for Families.

Pros: Tax efficient; Generally safe from parties claiming on parent’s assets

Cons: Minimal control on when your child receives the fund and what they do with it

A variant on this option is to open a KiwiSaver account in your child’s name. This option provides the same benefits as a standard children’s account but has different implications in relation to when the child can access the funds. The two main ways to access KiwiSaver assets are when they look to purchase a first home, and in retirement.

While this appears an attractive option for helping your child purchase their first home, we would highlight that your child may not want to buy property or may prefer to use these funds in another way such as their education or starting a business. Also, there is no guarantee that this first home withdrawal will be available in the future. Most other countries do not allow the withdrawal of retirement savings to help purchase a first home and there is a small risk in the future that New Zealand could withdraw this option.

A discretionary family trust can be an important tool for succession planning and asset protection. In general, here’s how a trust works.

An advantage of a discretionary family trust is that it provides flexibility. Discretionary beneficiaries have no particular right to the trust funds. They merely have a right to be considered for a distribution. The trustees’ discretion allows them to exercise a significant degree of control over how and when the trust funds are distributed to beneficiaries.

Another key aspect is that trust funds are better protected against business risk, creditors risk and spousal claims and do not form part of the settlor’s or trustee’s personal estate. When your children are older and start their own relationships, the trust can be a useful mechanism to provide benefit to them while still protecting the assets against claims from their own partner or spouse.

The disadvantage of this strategy is that setting up and running a trust comes with a cost and time commitment. There are costs associated with setting up and running a trust. From the initial upfront costs of preparing a trust deed and transferring the assets to the trustees, to the ongoing costs of annual administration. Income generated from trust assets will either be treated as trust income taxed at 33%, or beneficiary income at the beneficiaries’ marginal tax rate (though the IRD has some specific tax rules in relation to income payments to children under 16).

Pros: Control on when the assets are distributed; Higher level of protection against claims from others including children’s partners in the future

Cons: Added cost and time commitment to set up and run

Setting aside some of your savings and starting to invest for your children is a great way to help them financially. As with all investing there are some common rules to follow to help achieve these goals: start as soon as you can, consistently contribute, and stick to your investment plan during the inevitable ups and downs of the market.

With children’s accounts, there are also some specific decisions to make in terms of whose name the investment should be made in. This decision involves considering the trade-offs between the tax treatment, security, future control and administrative time and cost of the investment. There is no one answer to this question, and you should review your own specific situation, and seek advice if required.

Disclaimer: This article is general in nature and does not constitute financial, tax or legal advice in any way. Should you require such advice, please contact a suitably qualified professional.

Mike Ross

Founder & Investment Adviser | Evergreen Advice (in collaboration with Gavin Cairns & Joshua Pietras of TDSL Lawyers)

Share:

Investing for Kids: A Guide on How to Save and Invest For Your Children

Wondering how to save or invest for your child's future? In this blog we highlight a few key concept...

Stephen Upton

26 November 2021

Budgeting is Boring, But We’re Talking About it Anyway!

Spoiler alert: You don’t need to sacrifice everything now in order to dramatically change your finan...

Catherine Emerson

9 August 2020

3 reasons to invest your Christmas cash

Wondering whether to save or invest your Christmas cash? Read our blog to find out 3 reasons why inv...

Catherine Emerson

31 December 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices