Investing in Global Infrastructure – Why, What & How

As the backbone of modern society, investing in a Global Infrastructure Fund can provide many benefi...

Catherine Emerson

15 July 2020

Investing for income has been a challenge in the current interest rate environment. This is particularly the case if you are in a phase of life where you rely on your investment income. From day dot we have had requests for a dividend fund and even some specific requests for the Aristocrats family. Sounds fancy, eh?

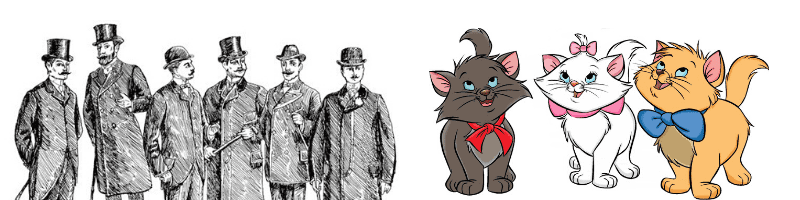

Olde World Aristocrats vs Aristocats

Dividend Aristocrats, not to be confused with the Disney Aristocats, are companies that have consistently maintained or increased dividends over a long period of time.

In the case of the Global Dividend Aristocrats, companies in the index must have increased or maintained their dividends over a minimum of 10 consecutive years. Reduce or suspend your dividend (like some have due to Covid-19) and you’ll be waiting another 10 years before you’re even considered for inclusion.

However this is an important part of the index design. It means investors can be assured the fund maintains a balance between high yield and dividend sustainability and growth. In basic terms, this is ensuring quality and low churn. A company that pays an unusually high dividend for a short time (which they may not be able to maintain) is not included in the index on a whim.

Two common strategies for dividend investing focus on high dividend yield or dividend growth. The Global Dividend Aristocrats Fund blends the two. Whilst this can result in a lower dividend yield, what you have is sustainable consistency. This is important for an investor who is relying on the income.

By having such thorough requirements to join this index, the companies are already recognised as proven winners. For one, they would not have been able to increase dividends for more than ten consecutive years if they didn’t have advantages over their competitors.

While long-term rising dividends isn’t the only reason for a company’s successful performance, it does indicate efficient capital management, strong cash flows and profit levels.

In addition, these companies have shown success over several economic cycles – as 10 years certainly captures this. An investor can take comfort that this fund is offering some of the most consistent yields available in the stock market. A company that can effectively get through the up-and-down cycles of the market and never cut or reduce dividends is clearly well-managed. These companies will provide dividend income, dividend growth, and asset appreciation.

Every investor should think about the potential downside of an investment before deciding. Traditionally, dividend funds have been able to offer downside protection because of the price stabilising effect of their expected dividends. This was evident through the tech bubble crash and GFC. However, we must note this was not the case during Covid-19. To be fair to Dividend Aristocrats, no traditional ‘defensive’ equity strategies provided downside protection during that time, due to the sectors most impacted by the pandemic. But in many other economic scenarios, they certainly can.

Without detailing the complexities of the New Zealand FIF rules for foreign investments, in most circumstances, investors must pay tax on 5% of their value regardless of the income received. Therefore, receiving income is positive both for the foreign tax credits and for the income to pay that tax. Further if the dividends received amount to more than 5%, the excess income is tax-free in New Zealand!

Dividend stocks are attractive in a low-interest rate world, but it must be noted that a company is not contractually bound to pay a dividend (unlike a bond). However through their history and commitment to paying dividends, their respective boards have a strong incentive and expectation to continue. Through diversification into around 80 companies and those companies’ long term growth prospects the effects are further mitigated. Finally, dividend companies tend to share mature characteristics. Compared to growth companies who believe they have strong prospects and ambitious expansion plans, so don’t payout dividends.

The must-knows about the Kernel S&P Global Dividend Aristocrats:

The must-knows about the Disney Aristocats:

Want to know more about the Kernel S&P Global Dividend Aristocrats Fund? Click the button below!

Investing in Global Infrastructure – Why, What & How

As the backbone of modern society, investing in a Global Infrastructure Fund can provide many benefi...

Catherine Emerson

15 July 2020

Home & Away – Investing in Global vs NZ Shares

What proportion of your portfolio should you consider having in global vs NZ shares? We help you dec...

Stephen Upton

27 October 2023

How Can Kernel Funds Fit Together?

Whether you're new to investing or a seasoned pro, now you can build a portfolio of low-cost, well-d...

Stephen Upton

22 September 2023

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices