When getting started with investing, it's best to use an index investing approach. What exactly does...

Catherine Emerson

8 August 2019

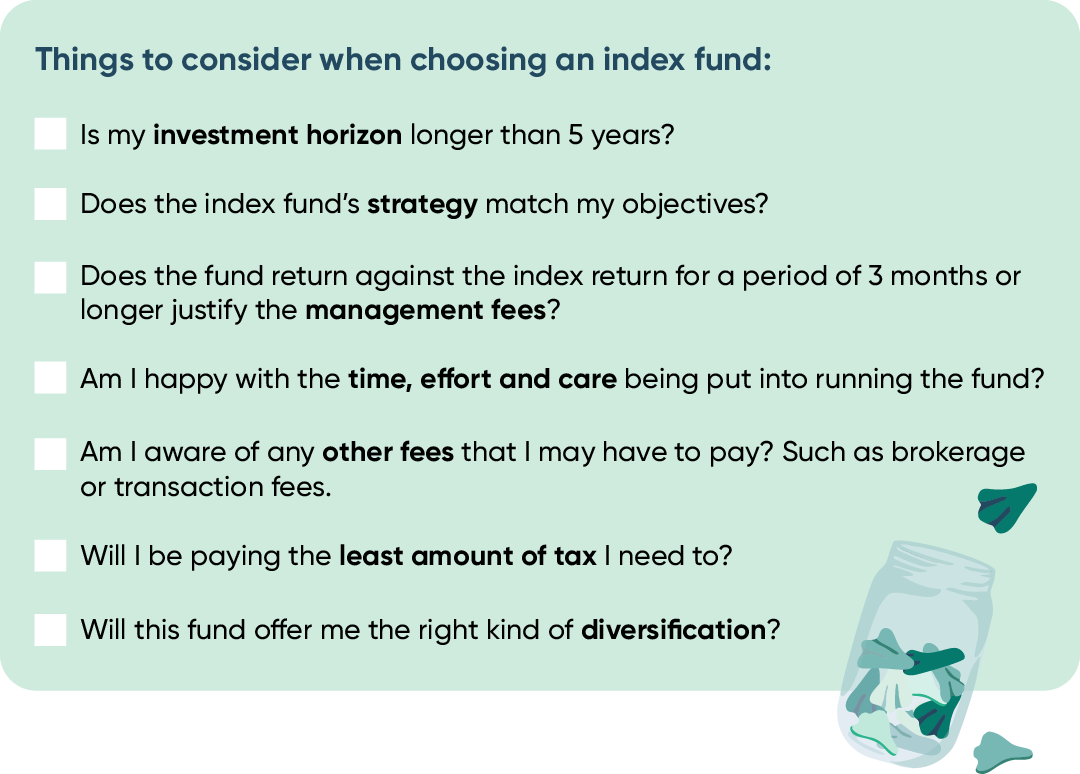

When it comes to choosing an index fund, there are hundreds of indices and many different funds available. As with any investment, it's important to start with research so you can select the right index fund with confidence.

Here are our top tips of things to look for when deciding on an index fund.

Everyone's investment goals are different. Your portfolio should be made up of funds that fit your investment horizon, goals and risk tolerance.

If you are seeking long-term growth without needing to access the money in the short term (i.e. you plan to leave your investment untouched for at least 5 years), then you'll want an index fund that invests in shares.

If you need more stability or access to the money in the short term, you will want to include bonds.

With that in mind, the first step is to work on how you want to split your investment between growth and defensive portions.

If you need help determining your investor profile, check out the Sorted Kickstarter tool or talk to a financial adviser. You can then filter your investment options down within each category, making it easier to find the right fund for you.

Next, consider the exposure to both NZ and global assets. New Zealand investments have the benefits of tax credits to reduce the tax payable, no complications with foreign exchange and cost less to gain access to. However, many investors want the large, broad and multiple economic options of foreign investments.

One of the benefits of index funds is transparency. As an investor, you can see all of the companies each index fund is investing into at any time. This is not the case with actively managed funds.

But not all index funds are the same, so it’s important that you understand what the index invests in, how it invests and where it may sit within your portfolio. Take time to understand the specific index the fund tracks and select a strategy that fits your goals.

No matter how you invest, there are going to be fees to facilitate or manage your investment portfolio. One of the benefits of index funds is their low management fees. This means more of the returns remain in your pocket, rather than with the fund manager.

Management fees will vary depending on what the fund invests in, the size of the fund and the operations of the fund manager.

There is little point in choosing a fund based on the cheapest fee if the manager is unable to effectively track the index and produces a worse return than the index.

When comparing, it’s a good idea to look at fund return against the index return for a period of 3 months or more as shorter periods can be impacted by timing differences.

The job of an index fund manager is to give their investors the return of the index, less fees and taxes. For example, if you invested in a fund that tracks the S&P/NZX 50 index and the index went up 10% for the year, if the management fee on the fund was 0.50% you could expect to receive 9.50% return, before tax.

However, there are things that can cause an index fund manager to perform worse than just market return minus fees. For example, if they hold too much cash, their tax structure is inefficient or they make operational errors.

All of these things can eat into the investor returns, meaning that instead of 9.50% you may only receive 9%. This doesn’t sound significant, however the difference can be substantial when compounded out over several years.

Equally, there are things index fund managers can do to improve on how well they track the performance of an index. Often these are technical nuances, like reinvesting the underlying dividends between distribution dates, securities lending or how they trade the underlying stocks at an index rebalance.

As an investor, you want to invest with an index fund manager that puts time, effort and care into how they run the fund. Individually these often make very little difference, but when added together they can have a material impact on your returns.

Any time the return of the index fund deviates from the return of the index, either positive or negative, it is called tracking difference. As the name implies, it is a simple measure of how well the fund manager is tracking the index. One of the first things you want to look at when choosing the right index fund, is the tracking difference.

Generally speaking, you want to be investing in funds with no or low transaction fees.

While we’ve already talked about the management fees a fund charges, there are a number of other fees that may be hidden or less obvious and they can eat into your returns. Total fees do matter when choosing the right index fund.

Investors can access an index investment through Exchange-Traded Funds (ETF) or unlisted funds. Units in an ETF can be bought and sold, like a share, on a stock exchange. Whereas with an unlisted index fund you will be buying and selling directly with the fund manager.

With an ETF there will usually be a brokerage fee every time you buy or sell, and the price that you pay on the market may not be reflective of the true value of the units.

If you are going to regularly contribute to your investment portfolio, then an unlisted index fund may be the best structure for you as there are often low or no transaction fees.

Brokerage/transaction fees. These are fees paid every time you buy or sell an investment listed on a stock exchange, such as units in an ETF or a direct share and can range from 0.10% to over 1%! You can avoid brokerage fees by investing in unlisted index funds.

Buy & sell fee. Similar to transaction fees, this is a portion that the fund manager takes each time you buy or sell into a fund. These can range from 0.05% to 0.30% and can fluctuate at any time, so it's important to keep an eye out. There are a number of unlisted index fund managers who don’t charge these fees.

Spread. When you purchase units in an ETF, there is a difference between the price you pay on the stock exchange (driven by buy and sell demand), and the actual true value of those units. This is known as a spread and normally it should be small, around 0.05% or less. However, it can become quite large and is another fee that eats into your returns.

Reading the Product Disclosure Statement (PDS), or investment documents, is the best way to confirm if there are transaction/brokerage or buy & sell fees.

In countries other than New Zealand, the ETF structure can provide tax benefits as they may avoid capital gains taxes.

However in NZ, an investment fund is typically structured as a Portfolio Investment Entity (PIE). PIE funds calculate tax using your PIR (prescribed investor rate) on the interest/dividends received, which is capped at 28% rather than the top marginal rate of 33%.

ETFs listed in NZ are taxed as ‘listed PIEs’ with a flat interest rate of 28%. If you are on a lower PIR rate (likely if you are retired, investing for a child, a charity or through a trust) then you may be paying too much tax if you are investing via an ETF.

At the end of the financial year, you can file a tax return to claim this back, but only if you have other taxable income to offset against.

Unfortunately, when it comes to getting the best tax treatment, there isn’t one fund structure or scenario that all investors could follow. If your income situation is complicated or unstable, you may need to do further research or seek tax advice.

Here is a snapshot of potential tax implications if investing in local assets and international assets:

NZ tax. In NZ, you typically only pay tax on the income (dividends) from the companies. This is calculated using your marginal tax rate, up to 33%. However, if you invest in a NZ-based PIE fund, then the tax is paid on your behalf at your PIR. If you invest in an ETF, it defaults to 28%.

International tax. When you invest into funds or shares overseas, you are exposed to a range of tax implications. In short – there is Foreign Investment Fund tax, withholding tax and tax treaty benefits to consider. If you want to avoid this complexity and/or the cost of a tax accountant, but still want exposure to international markets, you can invest in a NZ-based PIE fund that invests into international markets and will calculate and pay the tax on your behalf.

Some investors think that picking a large number of funds creates a well-diversified portfolio. In reality, doing exactly this might have the opposite effect as many of the funds may hold the same or similar investments.

As a result, the investments can become concentrated rather than spreading the risk between asset classes and markets. On the flipside, spreading $10,000 across 1,000 individually purchased companies will create a lot of transaction costs.

Diversification is primarily about asset classes, industry and country. The published fund holdings and current for an index fund will help you to compare how your money is invested.

When getting started with investing, it's best to use an index investing approach. What exactly does...

Catherine Emerson

8 August 2019

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

S&P 500 vs S&P Global 100: Which Should I Invest In?

Often the S&P 500 index or ETF can be a go-to for many NZ investors, but is it the most suitable inv...

Chi Nguyen

19 October 2021

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices