How to Prioritise Your Financial Goals

Want to improve your financial situation but not sure how where to start? Check out the Kernel guide...

Ben Tutty

6 October 2022

Are you new to investing with Kernel and looking at which funds to start with? Or perhaps you're a Kernel investor wanting to create a well-rounded portfolio of funds.

Whichever you might be, it’s important to understand how the funds can fit together. This is to ensure your investments are well-diversified and not over-concentrated in certain industries, markets, or companies.

But before we dig into how our funds can fit together, let’s take a step back…

Before understanding how Kernel funds can fit together, it’s a great idea to know why you’re investing, what your investment horizon is and if it’s flexible or not.

Another factor to consider is if you want to invest in companies that give you cash flow through paying out profits as dividends. Or invest in companies that focus on their own growth, therefore paying lower to no dividends.

Remember, understanding yourself, your goals and your reason for investing will help decide the most suitable fund to invest in.

Our diversified funds are a great starting point and can serve as a core part of your portfolio. If you’re new to Kernel or are looking for an overall well-diversified fund there are fund options to suit short, medium, and long-term timeframes.

Kernel High Growth Fund – Suitable for those working towards long-term goals 5+ years away. The fund holds 98%+ equities.

Kernel Balanced Fund – Suitable for those working towards medium-term goals 3+ years away. The fund targets an asset allocation of 60% equities and 40% cash and bonds.

Kernel Cash Plus Fund - Suitable for those working towards short-term goals within 3 years. The fund holds a mix of cash, bonds, fixed-income assets and other cash equivalents.

Depending on your own personal preference, one of these funds can be all you need.

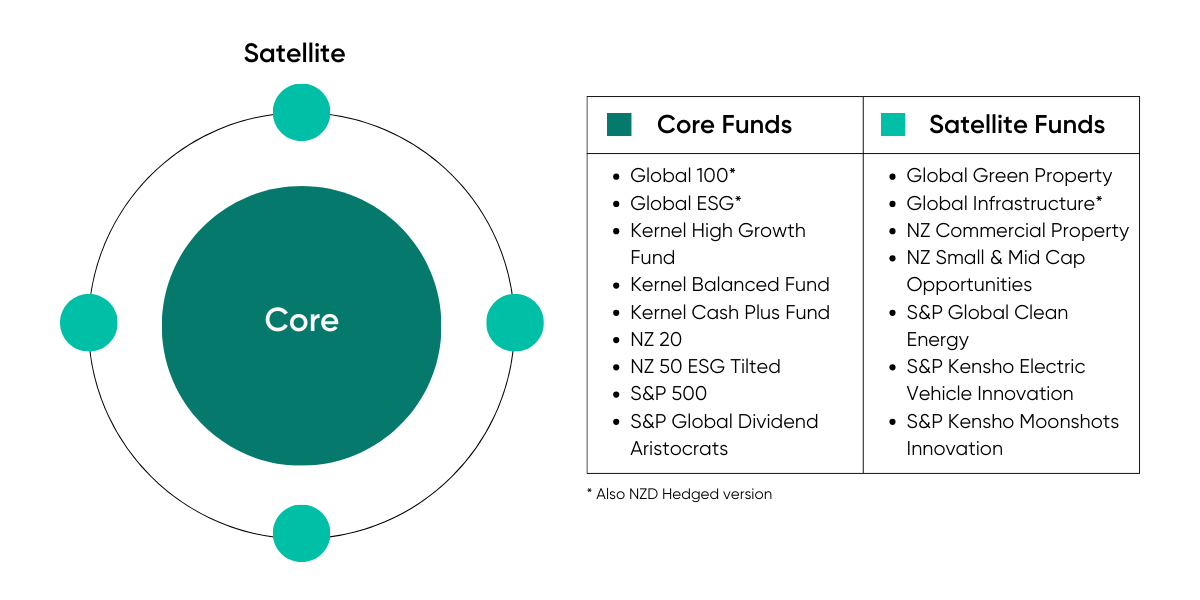

If you’ve read a few of our blogs already, you’ll know that we’re big advocates for a core-satellite investing approach.

In fact, we base our investment approach at Kernel around it.

It’s where 80-90% of your portfolio is invested in broadly diversified low-cost index funds – the “core”. While the other 10-20% is invested in “satellites” which can be more speculative investments, such as individual stocks, thematic funds, sector funds and more.

Sounds great in theory, but what about in practice?

Let’s take a look at how you might split the Kernel funds more specifically according to a core-satellite strategy…

Investments that are considered core are generally weighted by size (largest listed companies getting the most weight) and are well diversified across industries.

While there are no hard rules, 20 is about the minimum number of companies needed in a core fund to be sufficiently diversified.

A core holding is expected to provide some exposure to most aspects of the economy, from defensive stable sectors like utilities and materials to more cyclical sectors like communication services and consumer discretionary.

Global Funds – The following Kernel funds invest in companies from around the world:

NZ Funds – The following Kernel funds invest in New Zealand-listed companies:

Diversified Funds – The following Kernel funds are designed for those with different time frames and risk profiles:

When deciding which funds, you would like to use as your core holding, having a mix of local and global investments is a key consideration.

Despite New Zealand only making up a fraction of the global economy and consequently a small percentage of many large or institutional investors’ portfolios, we believe there are advantages to having a home bias (Investing in New Zealand-based companies).

One of these advantages includes benefiting from local tax efficiencies including imputation credits.

Satellites within a core-satellite investing strategy can be made up of investments such as thematic funds, sector funds, individual companies, cryptocurrencies and private equity.

Sector Funds - The following Kernel funds invest in one type of industry or segment:

Thematic Funds – The following Kernel funds invest in companies that are related to a specific theme or trend:

Alternately or additionally, you might also choose to hold a few of your favourite individual companies or other investments that you have an interest in.

Ultimately, the amount of you choose to allocate your portfolio to your satellite holdings is a personal choice.

We’ve found some investors like to follow the more traditional core-satellite approach of allocating often 10% but up to 20% of their overall portfolio to satellites, to tilt towards a belief in particular themes or hypotheses they might have.

Choosing between these three funds can be a little more difficult as they have a lot in common – being all broadly diversified equity funds. There is also an overlap between the funds’ underlying holdings when looking at each fund’s allocation to US-listed holdings:

S&P 500 | Global ESG | Global 100 | |

|---|---|---|---|

Allocation | 100% | 67.3% | 74.5% |

(As at 31 August 2023)

Not sure of the key differences between the three? Here’s a quick overview of each:

S&P 500 – Contains 500 companies that are all U.S. listed but have roughly 40% combined revenues generated outside of the U.S.

Global ESG – Holds over 700+ global companies that collectively align with the 2016 Paris Agreement, rewarding companies with strategies and outcomes aligned to keep global warming to 1.5° Celsius.

Global 100 – Holds 100 of the biggest multinationals across the globe.

Regardless of which fund you choose, they are all great examples of core funds, and ultimately it depends on your personal preference.

While the Global Dividend Aristocrats Fund isn’t weighted by the company size like most core funds, it is weighted by the dividend yield. It also has country and sector concentration limits to keep diversified.

As at 31 August 2023, the Global Dividend Aristocrats Fund has its top three sectors concentrated in Financials (25.7%), Real Estate (17.7%) and Industrials (14.8%). This isn’t surprising given the mature and yielding nature of these sectors.

For an investor with a higher demand for yield (normally older, looking for a passive income), the Global Dividend Aristocrats Fund may be a suitable core investment for the equity portion of their investment portfolio.

If you are an investor looking to generate returns without the complication of the strength of the New Zealand Dollar (NZD) compared to major global currencies, an NZD-hedged fund may be good to consider.

Here’s a list of Kernel funds that are hedged to the NZD.

But be aware that there are pros and cons when choosing between hedged and unhedged funds - mostly centred around the risks that can come from the fluctuations of currency.

If you’re unfamiliar with what ‘hedging’ is or would like to learn more about the impact of currency hedging on your investments, check out our latest blog.

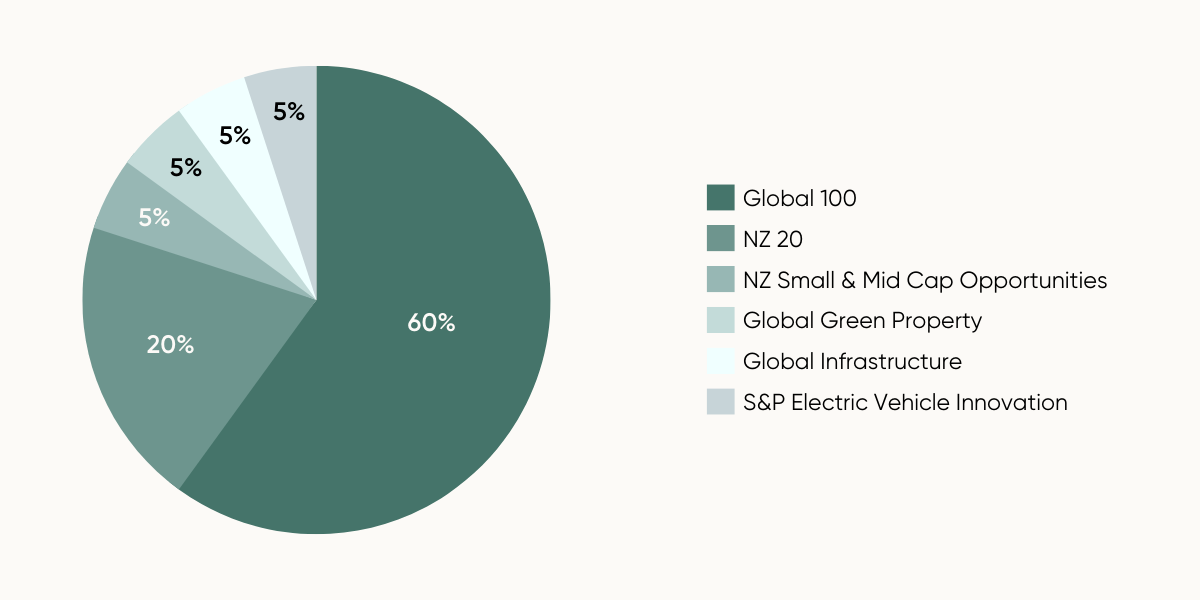

A reasonable equity portfolio for a 35-year-old following an 80/20 core-satellite strategy, with no expected short-term need to withdraw money might look like this:

Noting the assumption that there is no expected short-term need to withdraw money.

While these examples aren’t set in stone, they hopefully give you a good idea of how you might invest in one or many of the Kernel funds alongside each other.

A core-satellite strategy is a simple yet effective way to group your investments, that enables you to have a little bit of everything, without betting the bulk of your portfolio on a speculative investment.

By investing in low-cost, well-diversified index funds you can take advantage of the benefits passive investing offers while combining this with active funds you might not yet be able to part way with, or those individual stocks you’re not quite ready to sell.

The appeal of this strategy is that it shields a significant part of the total portfolio in index investments (the core) with lower volatility. All while enabling investors to add more direct shares or sector funds (satellites), which they believe to have great prospects in the future.

This article is not intended as financial advice; it just contains some ideas and investment strategies for illustrative purposes and it does not consider the suitability to your personal situation.

How to Prioritise Your Financial Goals

Want to improve your financial situation but not sure how where to start? Check out the Kernel guide...

Ben Tutty

6 October 2022

How to Start Investing: Part One

Successful investing isn’t as hard as you think. In this blog we walk you through key concepts and h...

Dean Anderson

13 August 2020

How Do I Choose the Right Investment Strategy for Me?

Without an investment strategy, how do you know whether you'll meet your short, medium and long term...

Chi Nguyen

19 January 2022

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices