S&P 500 vs S&P Global 100: Which Should I Invest In?

Often the S&P 500 index or ETF can be a go-to for many NZ investors, but is it the most suitable inv...

Chi Nguyen

October 19, 2021

First things first, why invest globally at all? Especially when the NZ market has regularly out-performed most global markets. Plus it can be more tax efficient for NZ investors and is simply easier to access.

You’ve heard the advice: Don’t put all of your eggs in one basket. It’s been repeated ad nauseam that a well-diversified portfolio is the only “free lunch” in investing. Put simply, by diversifying across countries, asset types and sectors, you can lower the total risk of your investment, whilst getting equal or greater returns. See – free lunch.

You may already have a diverse investment portfolio of NZ shares and possibly hold direct property. If so, you’re off to an excellent start for growing your wealth towards whatever your financial goals may be. But you may be missing out if you haven’t yet considered adding in global assets.

By diversifying globally, you have a chance to spread your nest egg into baskets across the world. Giving you access to opportunities and industries that don’t exist in NZ.

Whilst the NZ market is dominated by large blue-chip utility, tel-co and infrastructure companies, by going global you can add in thriving growth sectors like tech or add a large stable dividend payer. This helps improve diversification in your portfolio and get you one step closer to your investment goals.

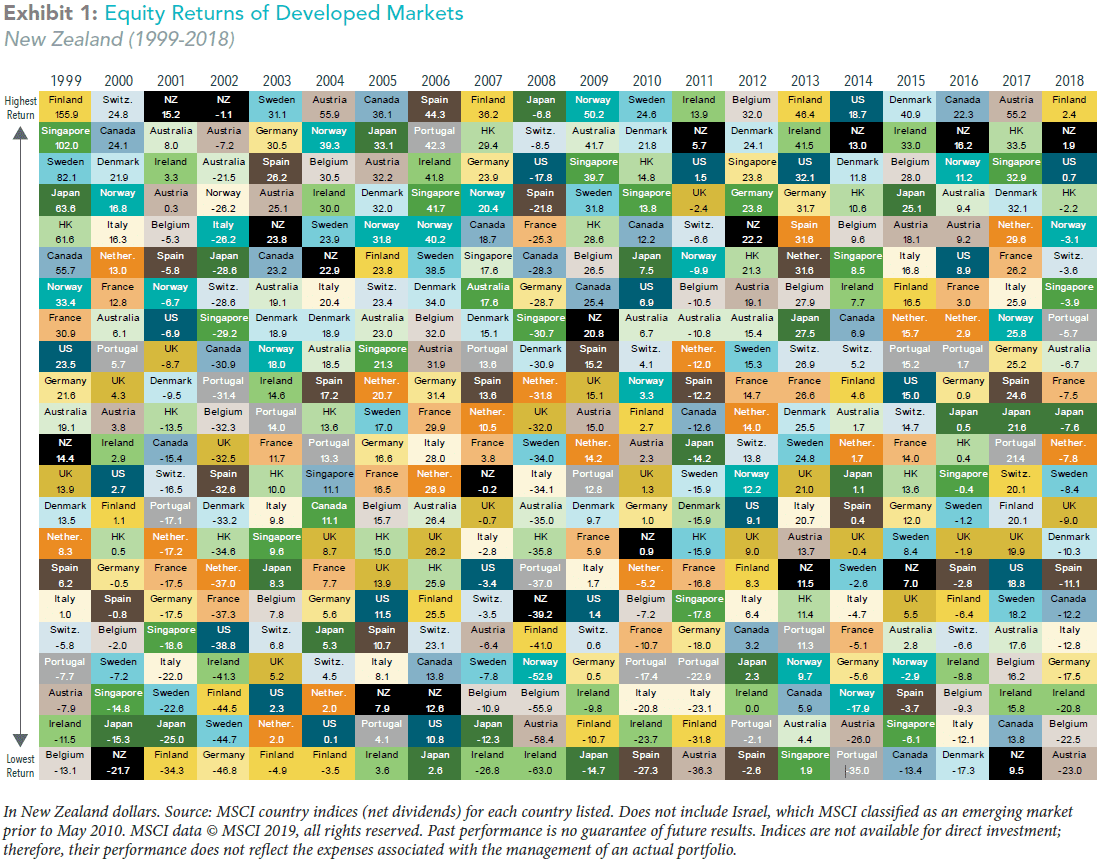

Yes, we went there. As we were painfully reminded in Japan last year, the All Blacks won’t always take home gold. As much as we expect them to win every game! While the NZ share market has been a strong and consistent performer of recent years, a wise investor will realize that NZ may not be the top winner year after year. This shows what we mean (you may need to zoom in!).

This highlights the importance of diversification. Diversification smooths out the ups and downs. Something you would otherwise experience by just investing in one market. It’s similar to using low cost index funds rather than risking everything on one stock pick.

So we’ve outlined the benefits of including global investments in your portfolio, how do you go about implementing this?

Global investing can be more difficult for a number of reasons. There are thousands upon thousands of companies, dozens of markets and tens of thousands of funds to choose from. Where to start?! You could go via online broker platforms and pick individual stocks, opt to invest in a range of funds or pay a financial adviser to manage your portfolio. All of this can become quite overwhelming. So let’s take a step back and break down the best approach to getting started.

The objective of investing globally is to reduce the overall risk of your portfolio and to get you to your investment goal. To do this, you need to be broadly diversified and own part of the markets in the table above. We know that stock picking and high-fee actively managed funds have proven to consistently underperform index funds. That helps cut down your options. So now you can focus on finding the right index fund for your investment objectives.

When looking at your various index options, there are some easy check points to assess your options against. Remember to keep an eye out for the basics; tracking error of the manager and index features (not all indices are created equal). You should be assessing index options on more than just headline fee – that’s easy. A serious DIY investor can do much better with a little further investigation.

There are two key things to consider when adding global assets to your portfolio; your investment horizon and your investment objective.

If you have a long investment horizon, you typically don’t need access to your investments for 10 years or longer. If this was the case, then you would typically have the majority of your investment portfolio in shares.

As index investing has grown in popularity, the number of index funds available has increased. You can now find index funds that give you access to specific sectors (such as technology), countries, or even investment styles (like high dividend strategies). This is where you need to be clear on your investment objective. Work out what your goal is and then research index fund options that fit with that.

You are saving for retirement and investing for long term growth. You want a portfolio that is well-diversified and simple to manage. Look for diversified, low cost index funds, that invest across a number of companies, sectors and countries, such as a Global 100 fund or a Total World index fund. This can be used to compliment a NZ index investment option.

You would like to receive some income from your investments over time, but want to leave your investments in place for the long term. Here you need a particular style or theme, in this case it would be index funds that have an income or dividend focus. This could be something from the Dividend Aristocrats family, which is made up of companies with stable and increasing dividends.

Remember, you don’t need to overcomplicate your investment strategy with too many funds or investment options. If you are getting started and have a long investment horizon, initially you may only need two or three funds (NZ equities + Global equities).

If you are an experienced investor, closer to your investment objective or have a larger portfolio then you can start to take strategic views and add in specific sectors and asset classes. This could incorporate specific holdings in bonds, emerging markets, infrastructure or property.

NZ investors are fortunate to now have access to a range of NZ based index funds that can provide access to global markets. Alternatively, investors could use one of the many investment platforms to access global managers located offshore.

By using an investment platform to access offshore managers, you will have access to a huge array of index funds that vary from the highly speculative and niche, through to broad traditional all market options. This range of choice may suit some investors who want to implement certain strategies or want to invest in a specific sector.

Given the size of these offshore markets, the management fees on these funds can sometimes be lower than those available through NZ-based managers. However, there are hidden costs to be aware of.

You will need to consider what brokerage fees you are paying through your platform of choice. This can eat into investor returns, especially if you are wanting to regularly contribute to your portfolio. Some platforms also have fees for holding your investments, known as custody charges. Others may be taking a large margin when they convert your NZD to foreign currency. So while some things may look low cost up front, it is always total costs that eat into your returns.

All investing involves tax considerations. You always want to make sure you pay the tax that you are legally liable for. You don’t want to pay more tax simply because the way you invested was inefficient. When you invest into funds or shares overseas, you are exposed to a range of tax implications. In short – there is Foreign Investment Fund tax, withholding tax and tax treaty benefits to consider. If you go DIY into offshore markets you will need to manage this yourself. In some scenarios (when the return on your investment is negative in a year or you have a balance below $50,000), there may be times when investing directly into offshore assets is beneficial.

However, if you want to avoid this complexity and/or the cost of a tax accountant, you can invest in a NZ-based Global PIE Fund. An NZ based fund will calculate and pay all the tax on your behalf. For a large portion of investors this can have some material tax benefits in a given year!

If you’re the type of DIY investor that likes to build complex portfolios, invest in niche funds or solely trade direct shares – then an online broking platform may be best for you.

However, if you are after a long term investment portfolio that efficiently gets you to your desired outcome, you may find NZ based PIE funds is the answer.

Investing in global assets also carries other risks that are unique to overseas investments. These include:

Foreign investments are usually held in the currency of the country of origin. Income, capital gains or losses must be converted into New Zealand dollars (NZD), which means you are exposed to changes in exchange rates. If the value of the NZD rises against a particular currency, the value of investments held in that currency will fall.

Conversely, a fall in the NZD compared to the currency in which the investments are held will increase the value of your foreign investments. If you don’t want currency risk you can look for NZD-hedged funds, as this will typically remove the majority of the currency movement. However, having some exposure to currency can be beneficial. For example, when the global share markets fell during the COVID-19 crisis, the NZD fell against the USD. This helped boost the return on the global investments for a NZ based investor, offsetting some of those paper losses.

International investments are subject to country-specific risks such as political, economic and regulatory changes. You may also need to understand the specific laws and regulations relating to foreign investments in another country. Risks will differ depending on whether you are investing in well-regulated developed markets or in emerging markets that may carry heightened risks.

Diversifying your investments to include global assets can have significant benefits for your portfolio. Take some time to work through your objectives, look at the options available that align with your goals and your values, then start diversifying.

Remember, there isn’t a “magic” number for the percentage you should allocate to any investment. Because everyone has unique needs and goals. It is a smart idea to base this on your appetite for risk and your investor behaviour. Don’t forget to consider the likelihood that you’ll actually stick to your investment plan when international equities are thrown into the mix too.

Happy investing!

S&P 500 vs S&P Global 100: Which Should I Invest In?

Often the S&P 500 index or ETF can be a go-to for many NZ investors, but is it the most suitable inv...

Chi Nguyen

October 19, 2021

Investing in Global Infrastructure – Why, What & How

As the backbone of modern society, investing in a Global Infrastructure Fund can provide many benefi...

Catherine Emerson

July 15, 2020

Investing for Income - Global Dividend Aristocrats

Investing for income can be a challenge in this low interest rate environment. That's where Global D...

Catherine Emerson

July 12, 2020

For market updates and the latest news from Kernel, subscribe to our newsletter. Guaranteed goodness, straight to your inbox.

Indices provided by: S&P Dow Jones Indices